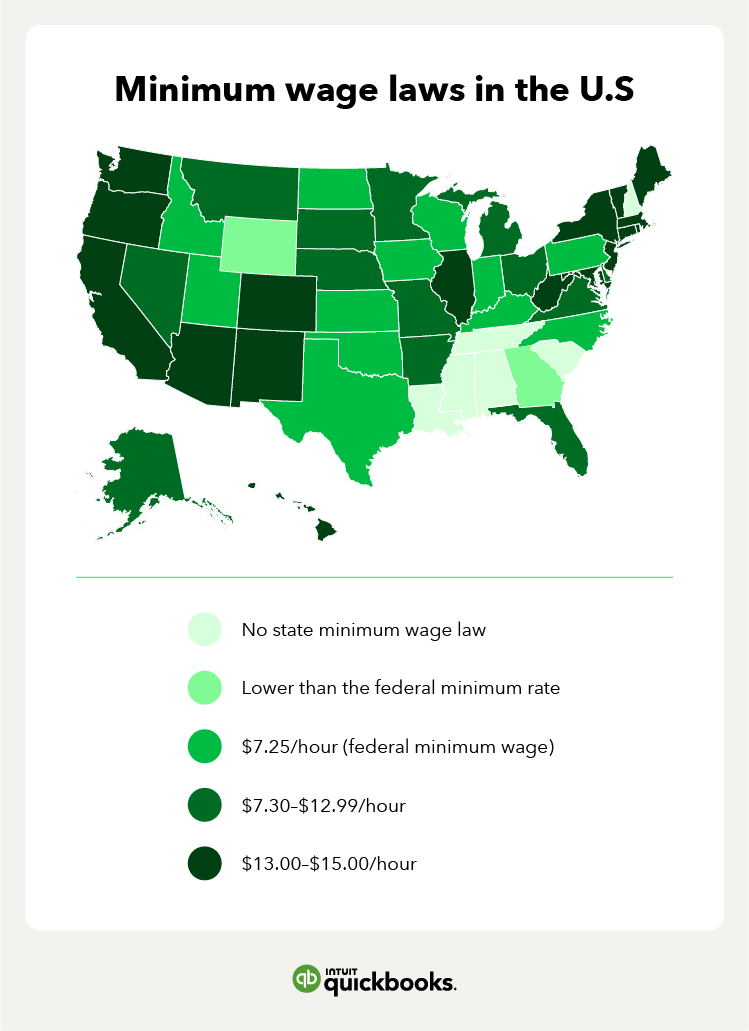

Navigating the complicated web of minimum wage laws and rates for your business can be confusing. Not only does the federal government establish a minimum wage that covers most US employers, but many states and local governments have also established their own minimum wage laws.

While some state and municipal governments passed groundbreaking increases to minimum wage rates in recent years, a few states have unfortunately passed legislation that prohibits state and local governments from enacting minimum wage rates that exceed the federal minimum wage rate.

To guide you through the ever changing world of minimum wages, we created a complete guide to minimum wage laws at the federal, state, and local levels.