Payroll isn’t just about cutting checks—it’s about staying compliant, earning employee trust, and keeping your finances accurate. That’s where a payroll audit comes in. Nearly 55% of the American workforce is affected by payroll problems, leading to compliance risks and costly mistakes.

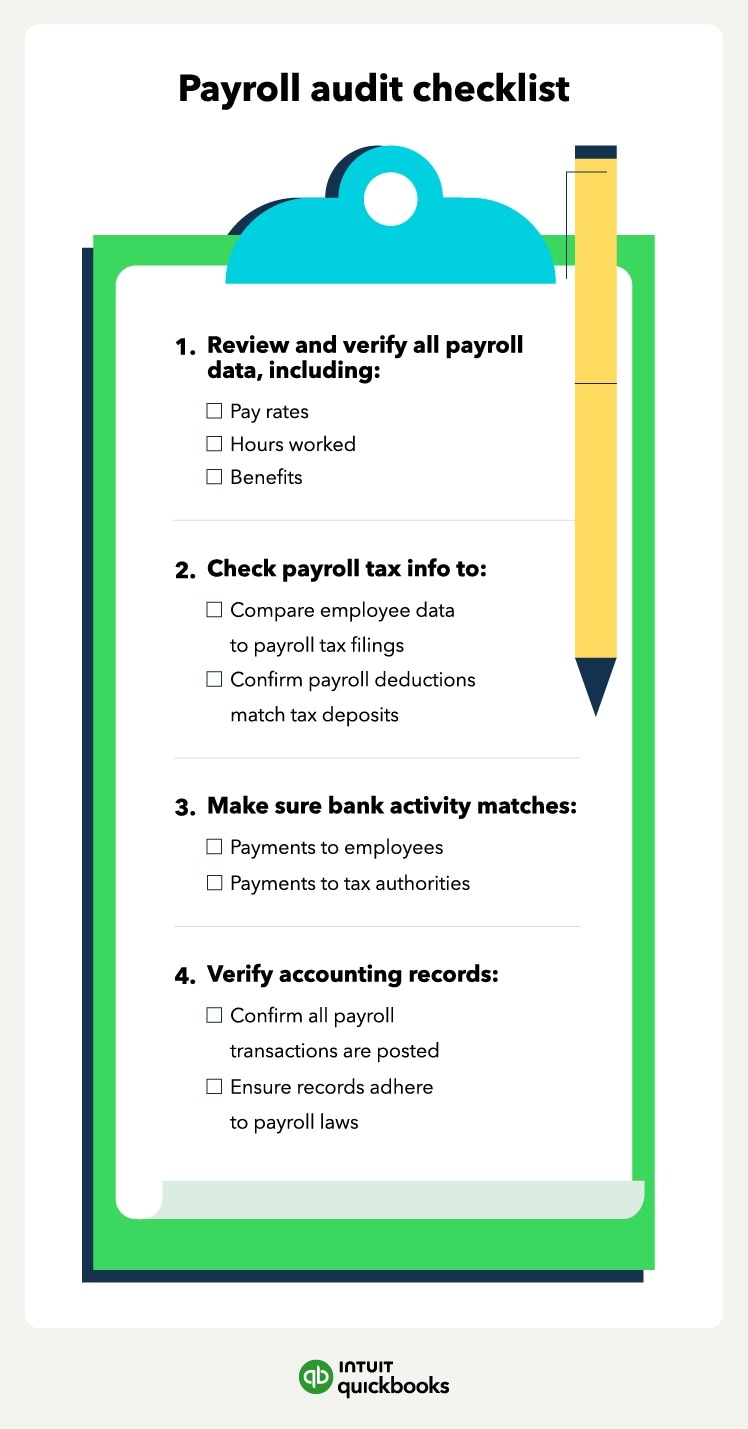

Whether you manage a small team or a growing workforce, regular payroll audits help you avoid costly errors and stay on top of tax requirements. In this guide, we’ll walk through what a payroll audit is, how it works, and why it’s worth your time. You’ll get practical tips, audit checklists, and tools we recommend to help you simplify the process, including software like QuickBooks Payroll.

Jump to:

Understanding how a payroll audit works

How to conduct a payroll audit

When and how often to conduct a payroll audit

Benefits of doing a payroll audit

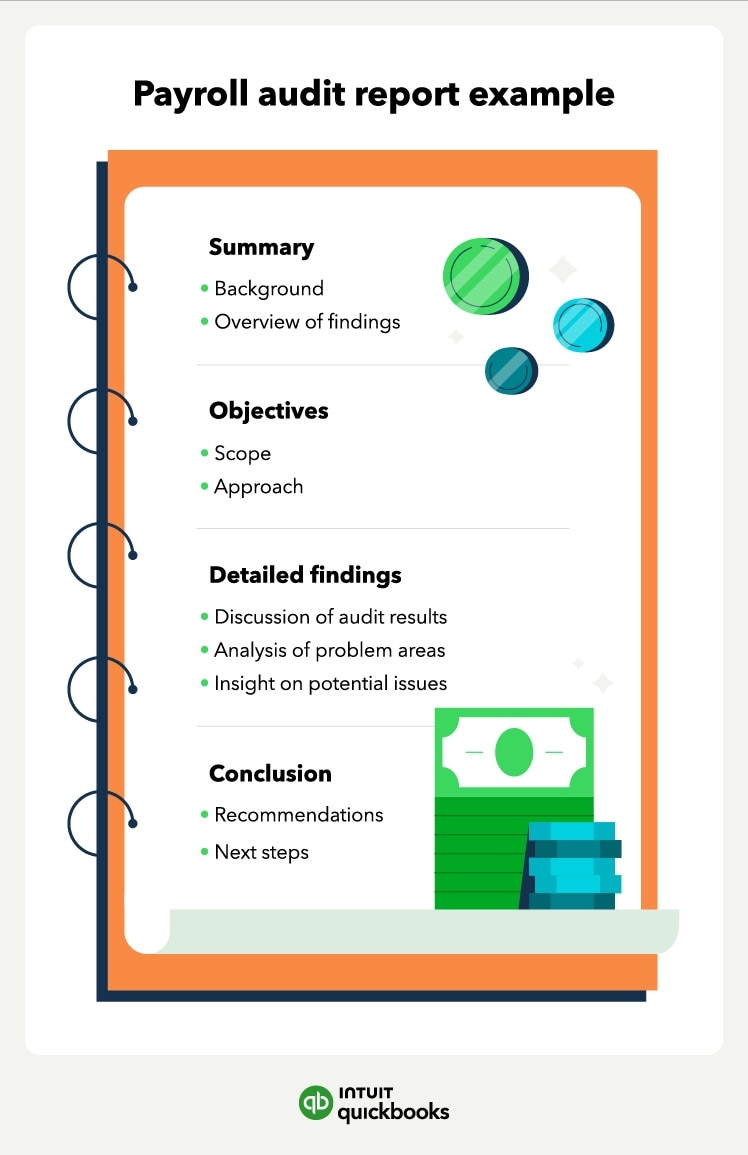

What to include in a payroll audit report