As a small business owner, you may find yourself striving to provide the best benefits to your employees. Health insurance stands out as one of the most crucial benefits, as it helps attract and retain top talent while demonstrating your commitment to employees’ well-being. However, navigating the health insurance landscape can be complex and costly, especially for those doing it for the first time. To simplify the process, QuickBooks has partnered with Allstate Health Solutions, allowing you to effortlessly provide health insurance to your employees directly from your QuickBooks Online Payroll account.

Why offer health insurance?

Here are three reasons why you should consider offering this important benefit:

- Attract and Retain Top Talent: In today's competitive job market, offering health insurance can help you stand out from other employers and attract skilled applicants. It also demonstrates your commitment to your employees’ well-being, which can be a strong incentive for them to stay with your company long-term.

- Improve Employee Health and Productivity: By providing health insurance, you enable your employees to access necessary medical care and preventive services. This can lead to happier and healthier employees who can bring their best selves to work.

- Cost Savings: By ensuring that your employees have access to preventive care, they can potentially avoid more expensive medical treatments for them down the line. Additionally, offering health insurance can help you save on taxes, as your contributions toward employee premiums are typically tax-deductible.

Our partnership with Allstate Health Solutions

QuickBooks Online Payroll has partnered with Allstate Health Solutions to make it easy for small business owners like you to provide health insurance to your employees. Here are just a few of the benefits of our integration.

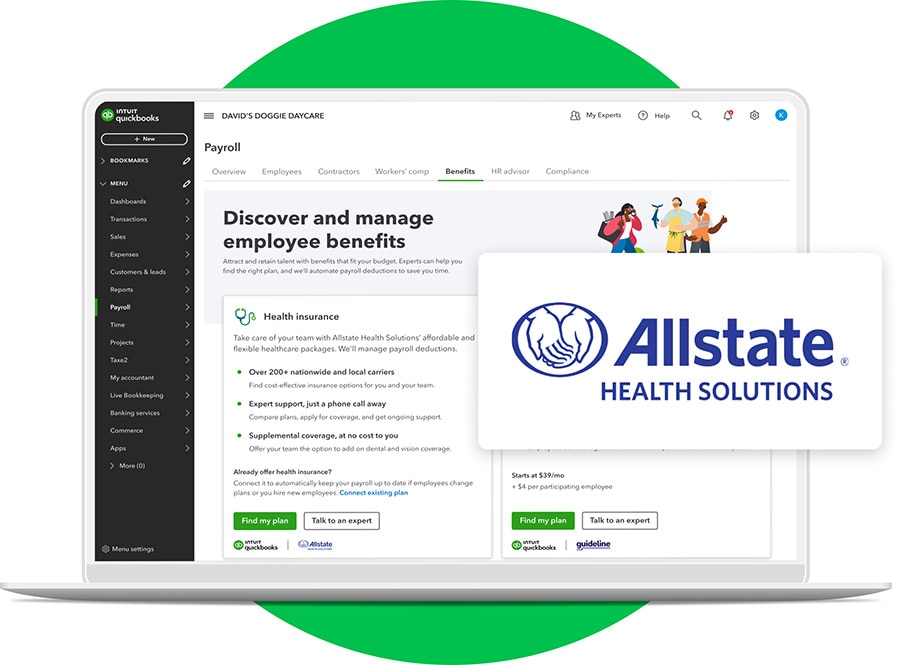

Seamless Integration: The integration between Allstate Health Solutions and QuickBooks is powered by direct APIs, allowing for an automated and streamlined experience. Once you purchase a plan and your employees enroll, all deductions will be automated within QuickBooks Online Payroll. This eliminates the need for manual updates and ensures accuracy in payroll management. We are continually working to enhance automation and improve our shared customer experience.

Wide Range of Coverage: Allstate Health Solutions gives you access to over 200 carriers, allowing you to browse and compare different group coverage options for your team. In addition to medical coverage, you can also explore options for health savings accounts (HSA), flexible spending accounts (FSA), and COBRA coverage. HSAs in particular can let employees set aside money on a pre-tax basis to pay for medical expenses, reducing their taxable income and providing them with potential savings on healthcare costs.

Expert Support: There is a dedicated team of Allstate Health Solutions agents who support QuickBooks customers. An agent can help you compare plans, explore health savings options, provide personalized recommendations, and apply for coverage. After you enroll, you'll continue to receive dedicated support in case you have any questions about your plan and to help make enrollment a breeze for the next year.

Supplemental Benefits: In addition to medical coverage, Allstate Health Solutions offers supplemental benefits such as dental, vision, short and long-term disability, and telehealth coverage.* These additional benefits can be added at no cost to you, providing comprehensive coverage for your employees.

How to purchase health insurance through QuickBooks

Purchasing benefits through QuickBooks Online Payroll is a simple and straightforward process. Here's how you can do it:

- Sign in to your QuickBooks Online account.

- Go to Payroll, then Benefits.

- If you're interested in a new group health insurance policy, select Find my plan. You can see various plans, and prices, speak to an agent, or get a quote for medical or supplemental coverage from Allstate Health Solutions.

- Once you have completed the application, Allstate Health Solutions will work with you to finalize the details and enroll your employees to access health benefits.