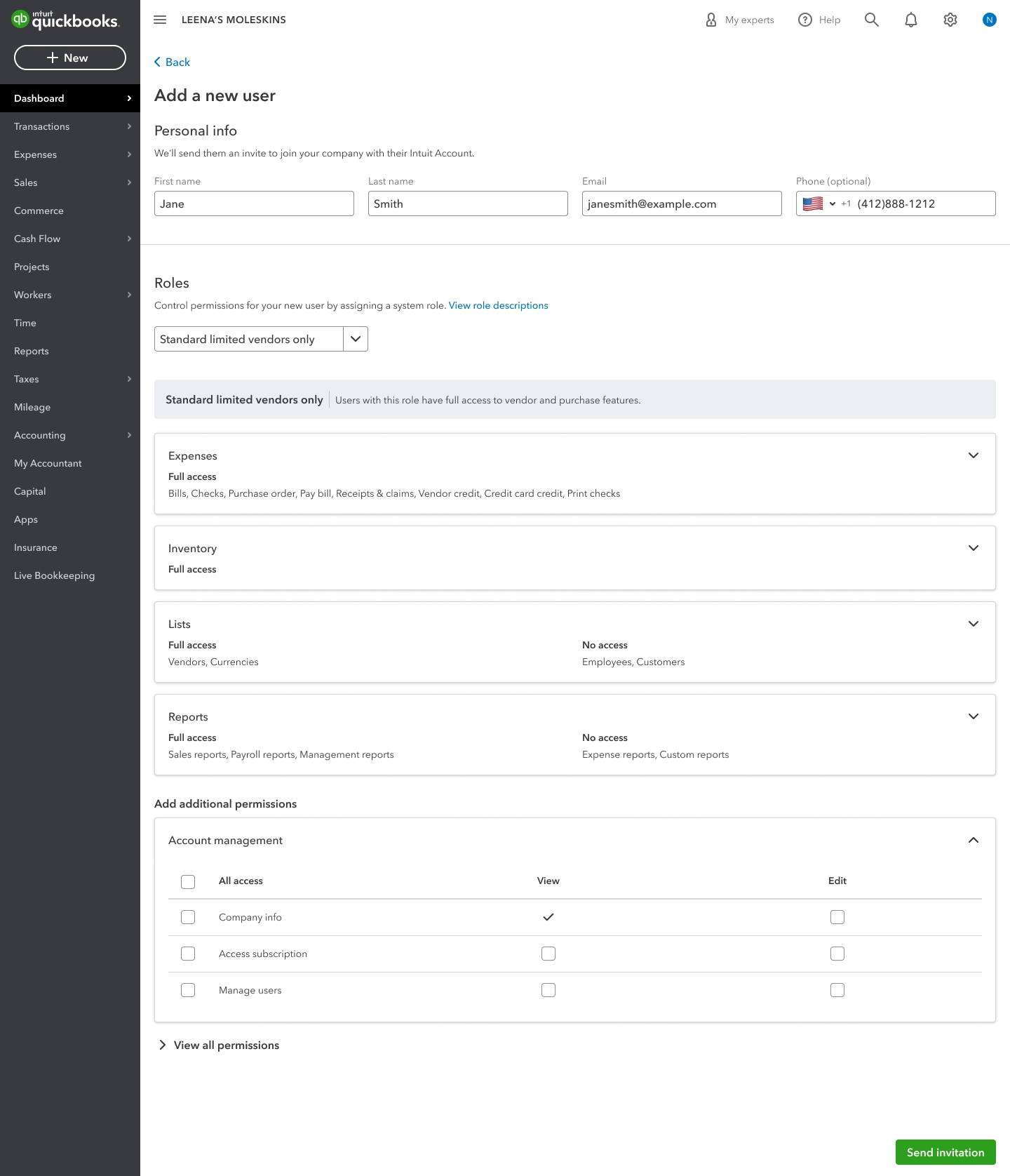

Manage users and roles from one page in QuickBooks Online

In a nutshell: When you need to add and assign roles to your team members, you can do so more clearly and simply, in a refreshed experience that will launch to all users by next month.

Rather than clicking through multiple steps to manage users, you’ll see everything you need on one page: A summary of what each role can access, with more in-depth detail on each level of access available as needed. With this, you can confidently add details for a new team member, pick and assign their role, and invite them to begin using QuickBooks—all from one page.

If you use QuickBooks Online Advanced, you’ll also be able to customize roles more efficiently by selecting features and level of access from a grid view.

Note: This updated experience will not change any of your existing roles or the features that each role has access to. All U.S.-based businesses using QuickBooks Online Advanced currently have the refreshed experience. Businesses that use QuickBooks Online Plus and Essentials, and those outside the United States that use Advanced, Plus, and Essentials, will see this new experience by the end of July 2023. Learn more

Learn how to add and manage custom roles in QuickBooks Online Advanced.

NOTE: Once a QuickBooks Online Advanced subscriber begins using the visual workflow builder, they will not be able to revert to the old interface.