We love November because it includes International Accounting Day on November 10 and Thanksgiving on the fourth Thursday. Accountants and bookkeepers help businesses thrive every day with their dedicated effort and support, and their work is certainly something to be grateful for. Be sure to thank the accounting professionals in your life for their continued partnership.

Here's what's new in QuickBooks Online for November 2024

If you aren’t already connected to an accounting professional in your locale, you can find one below:

Table of contents

Table of contents

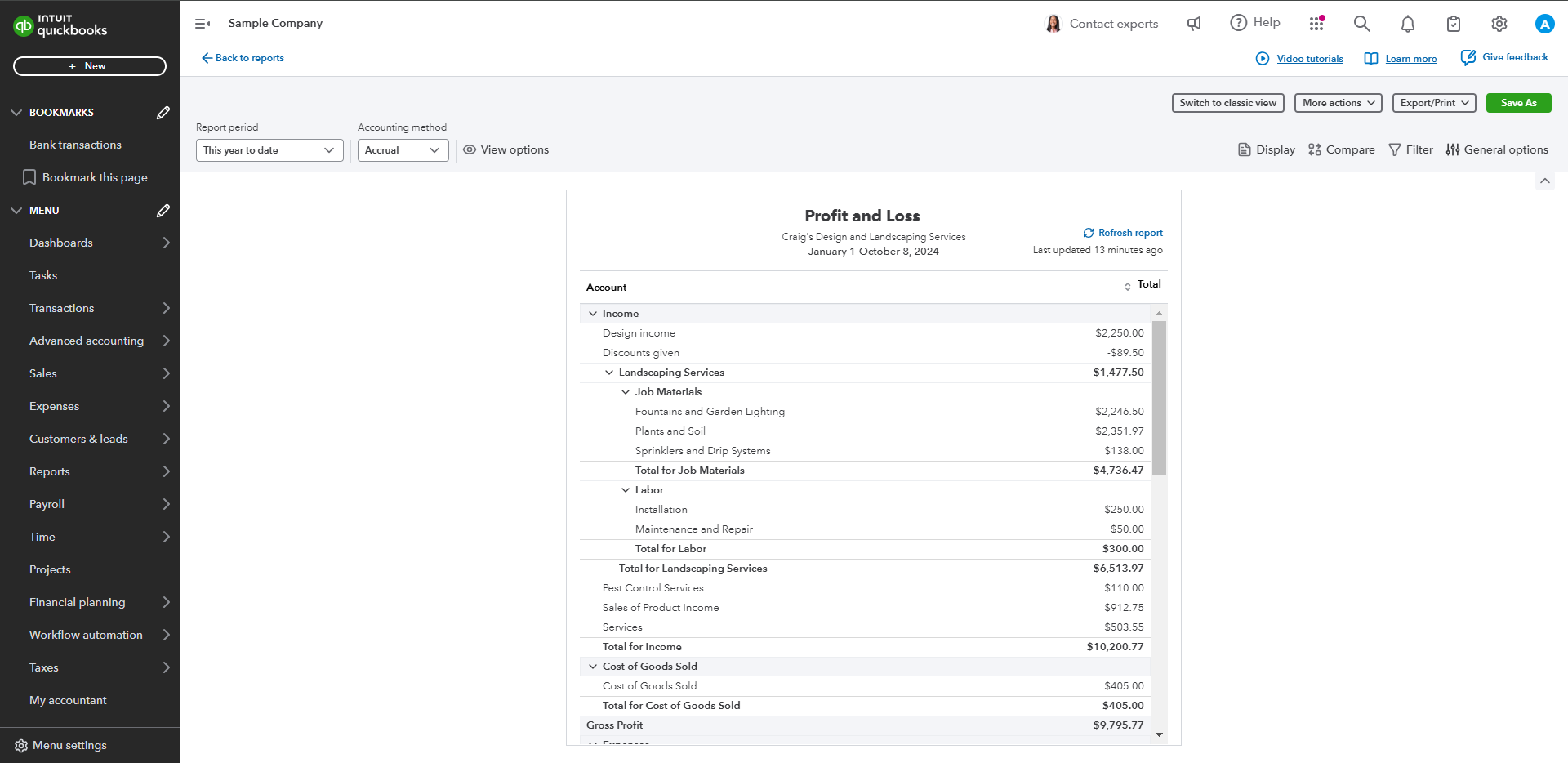

Modern view reports in QuickBooks Online

In a nutshell: More Standard Reports are now available in Modern view.

Since introducing this updated report experience earlier this year, we’ve expanded on it with more usability and functionality.

With Modern view reports, you get a more user-friendly interface, better functionality and load times, and you can generate new reports faster. Sort, filter, and group data, and apply advanced filters, data pivots, and charts consistently across all reports without having to export to spreadsheets.

When customizing reports, you’ll also have more fields to choose from and can preview customizations before saving the report.

As businesses grow in size and complexity, this updated experience will continue to perform smoothly at scale.

Note: Starting in December 2024, most of QuickBooks Online’s Standard Reports will be available in Modern view. You can choose whether to switch back to Classic view. Modern Reports will receive functionality updates and critical security updates, whereas Classic Reports will receive critical security updates until further notice.

Make unused pay items inactive in QuickBooks Online Payroll

In a nutshell: You can now clean up inactive payroll items from your workspace.

If you use QuickBooks Online Payroll, you can now turn off the pay types, deductions, and contributions you don’t need from the Edit payroll items tool.

To improve focus and efficiency, and reduce stress and the risk of error, businesses of all sizes should be able to minimize distractions. As payroll items fall out of relevance for your business, this updated functionality can help you declutter your screen.

To make a payroll item inactive, the item must have been created by a user and have no employees assigned to it. System-generated payroll items cannot be deactivated. For flexibility and peace of mind, you can reactivate your inactive payroll items as needed.

E-signatures in QuickBooks Online Payroll Elite

In a nutshell: E-signatures are now available in QuickBooks Online Payroll Elite.

Payroll admin users can now:

- upload documents

- position spaces for signatures, text, and dates on documents as needed

- request signatures from employees

Employees can then seamlessly complete and return their signed documents using Workforce on the web.

Rather than paying for a separate, disconnected e-signature service, take advantage of a seamless and secure e-signature process right in QuickBooks Payroll.

QuickBooks helps you comply with Beneficial Ownership Information (BOI) reporting obligations

In a nutshell: QuickBooks offers a simple solution for filing Beneficial Ownership Information (BOI) reports while safeguarding information, helping businesses enhance compliance with reporting requirements.

There have been many developments creating uncertainty around whether and when companies are required to provide reporting. On February 19, 2025, FinCEN issued guidance that the new deadline for most reporting companies is March 21, 2025. We will continue to monitor the situation in case it changes. Companies that were required to report on a date after March 21, 2025 should plan to report by the assigned deadline. Get the latest information.

Many corporations and limited liability companies are now required to file a BOI report with the US Treasury Financial Crimes Enforcement Network, in order to identify the beneficial owners of their entity and the company applicants of that entity. This process enhances government agencies’ ability to protect national security and financial systems from illicit use.

If you use QuickBooks Online Payroll, QuickBooks Online, or QuickBooks Desktop, you can now use these solutions to easily and safely file your BOI report, if required. You can also check in QuickBooks whether your business is exempt from filing a report.

For a one-time fee, you can follow a smooth, step-by-step experience to upload support documents and complete your form. You’ll be able to preview the form before final submission. After submission, you can track the status of your filing and safely store and protect your completed BOI report and information.

This service provides peace of mind with an easy and safe filing process for reporting your BOI.

Please note that BOI reporting deadlines vary by formation date:

- Existing businesses formed before 1/1/2024 must file before 1/1/2025.

- New businesses formed on or after 1/1/2024 must file within 90 days of business formation.

- New businesses formed on or after 1/1/2025 must file within 30 days of business formation.