If you’re dreading your tax bill this season, the deductions you choose to claim can make all the difference in how much you’ll owe (or save). When filing taxes for the year, all taxpayers must decide whether to use standard or itemized deductions—personal or “individual” expenses you can claim—to reduce your taxable income.

When you’re self-employed or a small business owner, sometimes the line between personal and business expenses can get blurry. Depending on your situation, itemizing your deductions may be the best choice to maximize your savings.

In this article, we’ll cover everything you need to know about itemized deductions, including the most common ones and what forms you’ll need to file.

How itemized deductions work

To claim your itemized deductions, you’ll use Schedule A (Form 1040) to list and calculate your eligible expenses. You’ll then subtract the total from your gross income. What remains is deemed your taxable income.

You can find detailed instructions for the eligible expenses on the IRS website. Make sure you keep receipts for all of your business-related expenses.

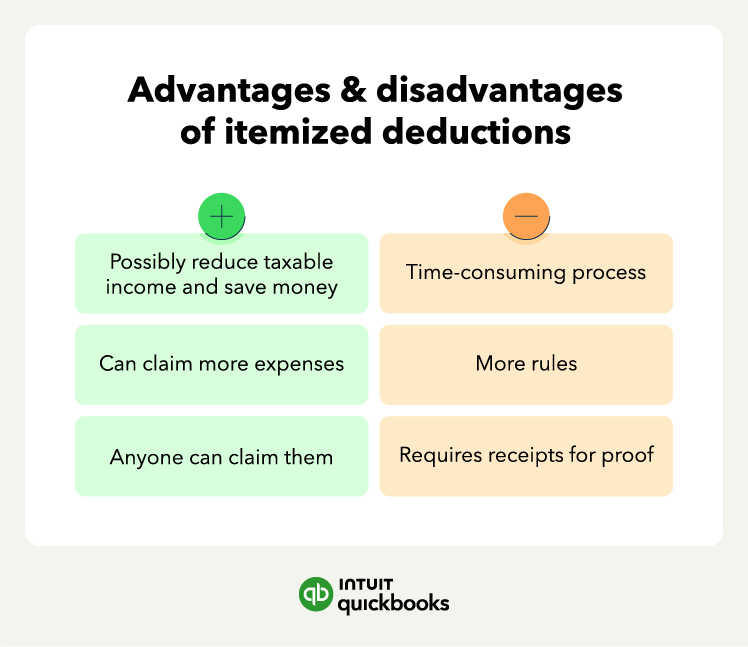

After adding up your eligible expenses, you can compare them to the standard deduction. You’ll only want to itemize deductions if the total amount is greater than the standard deduction. While it generally takes more time and effort to keep up with receipts throughout the year, it’s worth the bigger tax refund or smaller tax bill.

Itemized vs. standard deduction

While an itemized deduction is an individual expense you can claim, a standard deduction lowers your taxable income by a preset amount. These set amounts are based on your filing status.

Below are the standard deduction amounts for the 2024 tax year:

- Single or married filing separately: $14,600

- Married filing jointly: $29,200

- Head of household: $21,900

Most people are eligible for the standard deduction on their tax return, but it may not always get you the maximum tax deduction. Instead, it might be best to itemize your deductions.

Types of itemized deductions

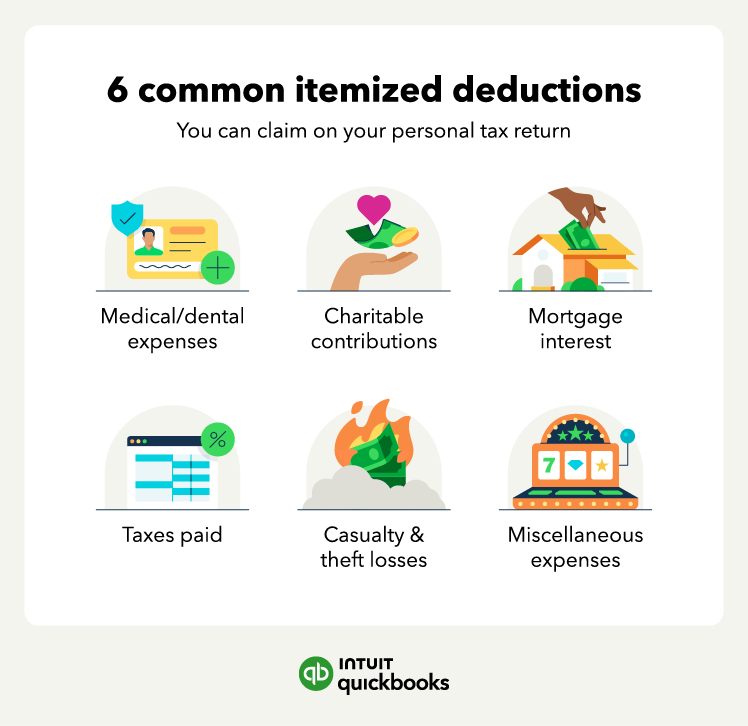

Itemized deductions can be a range of expenses from both personal and self-employed business transactions. Below are the most common expenses you can write off: