Running a business gives you access to various tax breaks, which are deductions that help lower the taxes you owe. Independent business owners should take advantage of all possible deductions.

As a sole proprietor, you can deduct various expenses for launching and running your business. You can deduct expenses that are necessary from your income. Here are some of the most common tax deductions available to sole proprietors:

Business expenses

Sole proprietors can deduct various expenses, such as office supplies, advertising expenses, and legal fees. For example, a graphic designer can deduct the costs of software subscriptions and marketing expenses.

Mileage

Vehicles are a must-use self-employed tax deduction that allows you to expense miles you drive for work. If you use your car for business, you can deduct 65.5 cents per mile for 2023. You’ll want to keep good records to keep your personal and business miles separate. You can use a mileage tracker to help with this.

QBI deduction

As a sole proprietor, you may also qualify for the 20% Qualified Business Income (QBI) deduction. This tax deduction allows taxpayers to deduct up to 20% of their qualified business income from their taxable income. The amount of the QBI deduction is your qualified business income times 20%.

Home office expenses

If you have a space in your home that you use just for your business, you may be able to deduct expenses for your home office. The home office deduction can include a portion of rent or mortgage interest, utilities, and even depreciation.

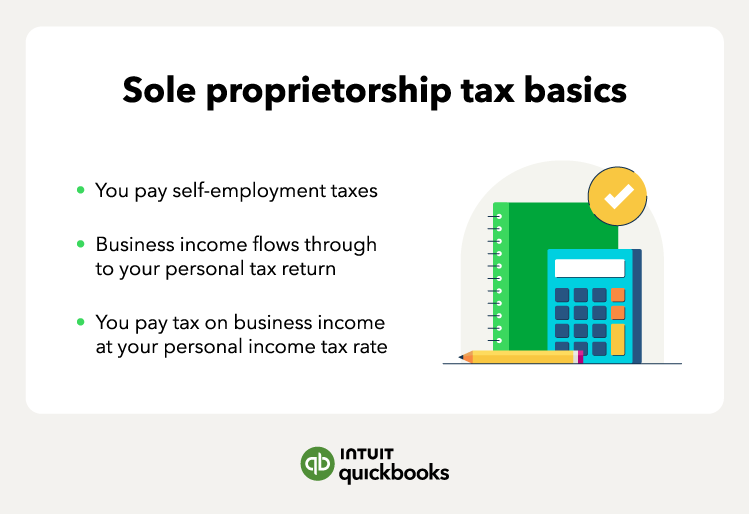

Self-employment taxes

You’ll need to pay quarterly self-employment taxes. This is the employer and employee portions of Social Security and Medicare taxes. However, you can deduct the employer portion from your tax liability.

Health insurance premiums

Sole proprietors who pay for their health insurance premiums may be eligible for a deduction. Deducting health insurance for self-employed individuals includes premiums for medical and dental. Keep in mind that there are certain criteria to qualify for this deduction.

Retirement contributions

Sole proprietors can contribute to retirement plans. There are various 401(k) plans, but the solo 401(k) is particularly great for sole proprietors. There are also other options like individual retirement accounts (IRAs). These retirement plans help you save for the future and provide tax advantages.

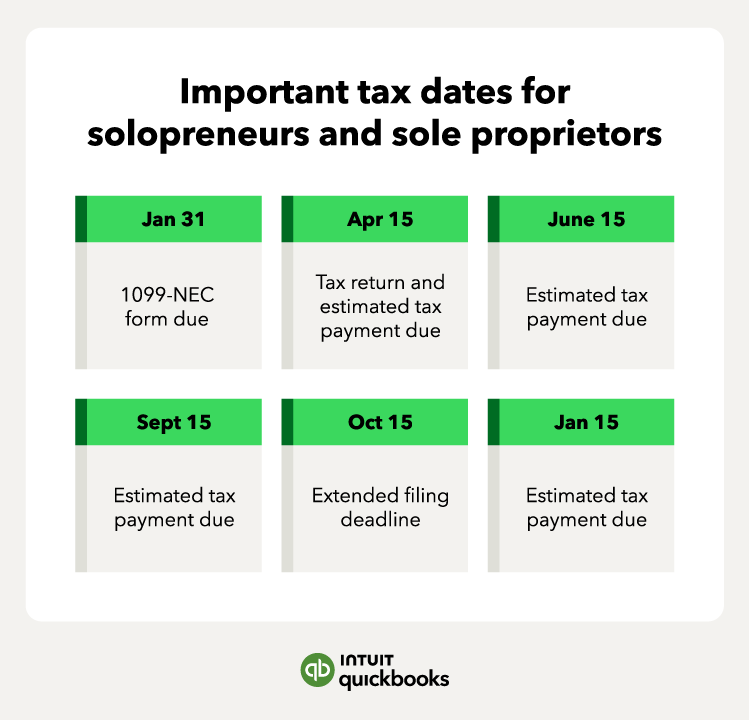

How to file taxes as a sole proprietorship