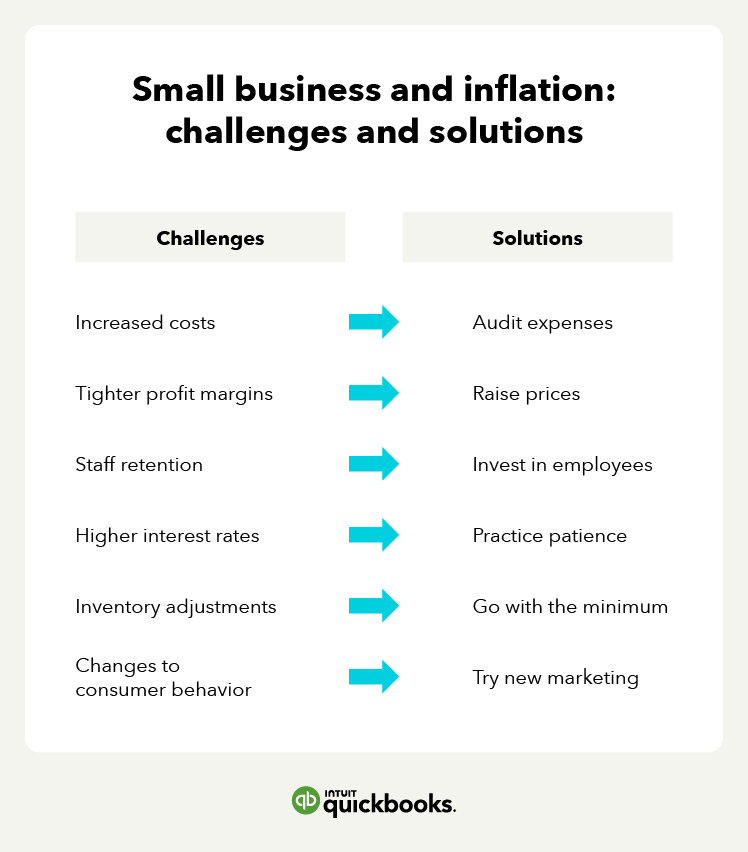

Increased costs

Almost all small business owners have been dealing with rising costs since the pandemic began. And with the inflation rate being higher in 2022 than in 2021, there’s uncertainty about when costs will lower to pre-pandemic levels.

Increased costs are the driver for the majority of challenges that come with high inflation. Higher prices make it more expensive to obtain the necessary resources that businesses require to stay profitable—leading to difficult decisions like raising prices and laying off employees.

How to fight back: Audit expenses

When you notice operating expenses creeping up, take a hard look at your expenses and see what nonessential costs you can cut. Other considerations in this audit could be diversifying your shipping sources for efficient costs, looking into a lower-cost office space, and categorizing costs into essential and nonessential.

If you have the resources, bringing in a financial advisor or an accountant can help in getting the best possible financial advice.

Tighter profit margins

With inflation rising at a steady rate, one of the biggest challenges that small businesses face is staying profitable. Small business owners must adjust pricing to stay competitive and profitable over the long term.

While the definition of “profitable” differs from industry to industry, the problem typically stems from a lack of purchasing power, which the majority of industries experience during high inflation.

How to fight back: Raise prices

According to the small business index, two out of three small businesses raised their prices over the last year to keep up with rising inflation. With expenses increasing from all directions, it’s increasingly difficult to find ways to stay profitable during periods of high inflation without raising prices. If you do decide to raise prices, be transparent with customers that it’s for the purpose of staying competitive during difficult times.

Staff retention

When inflation rises, it profoundly affects small business owners and their employees. In periods of high inflation, workers’ take-home pay is lower than it would be in more normal circumstances. As a result, many workers seek new jobs if their previous employer doesn’t raise their pay to align with rising costs. Data from our recent Pay and Benefits Survey found that 49% of small businesses expect it to get harder to retain employees due to the rise in inflation.

How to fight back: Invest in employees

In most small businesses, your people are an asset that you can’t cut. According to our Small Business Insights Survey, 49% of small business owners plan on increasing pay for employees. Additionally, 42% plan on increasing bonuses, a boost from 36% in December 2021.

Small businesses are also expanding employee benefits alongside larger than usual pay increases, in an effort to attract and retain workers and slow the pace of rising labor costs.

But, due to inflation, benefits are currently less attractive/important to employees than pay.

The evidence for this? Our data found that 72% of employers have had backlash from workers who would prefer to get even higher pay increases instead of these benefits.

Higher interest rates

To curb inflation in 2022, the Federal Reserve (the FED) increased interest rates in an effort to slow down the economy. While this makes sense in principle, it presents a new set of challenges for small businesses, as many take out loans to afford costly raw materials and finance growth.

With interest rates rising at the rate they are, it’s increasingly more difficult and expensive for small businesses to pay off outstanding loans—on top of affording the necessary operating expenses to keep the lights on.

How to fight back: Practice patience

If your small business relies on loans to finance growth plans, it may be best to wait until the market reaches a more normal state before putting those plans into action.

While startups and entrepreneurs can often fall back on venture capital and personal savings, small businesses typically don’t have that luxury and have to rely on grants or loans for growth. The best course of action for small businesses is to dock any growth plans until the market levels out.

Inventory shortages

Due to supply chain disruptions expedited by rising inflation, small businesses faced the challenge of receiving and affording the necessary raw materials to service customers. In some cases, this led to small businesses adjusting their inventory entirely, in turn causing them to create new internal processes as well.

How to fight back: Go with the minimum

Making inventory adjustments during periods of high inflation can actually be a positive opportunity for small businesses. When assessing current inventory costs, look for ways to save money by stripping down to the bare minimum. Sometimes, there’s also opportunity to source locally, rather than paying extreme shipping costs.

Changes to consumer behavior

While the rising cost of supplies presents an immediate threat to small businesses during periods of high inflation, getting people in the door can often be of equal concern.

Like we said, inflation dramatically affects businesses, but also people. And with most businesses raising their prices to stay competitive, consumers are more hesitant to spend liberally.

How to fight back: Try new marketing strategies

Innovative marketing strategies like loyalty programs and promotions can often be what it takes to get consumers back into the marketplace. While inflation deters consumers from spending, it can also be an opportunity to attract consumer segments you hadn’t previously seen—if you use the right strategies to get them in the door.

Other strategies to fight rising inflation

Rising inflation is a huge concern for small businesses; however, they can put different strategies into practice to soften the blow and sometimes come out more efficient and profitable. Here are a few strategies small business owners can put into practice in order to spin rising costs into more streamlined systems and greater profits.