How Single-member LLCs work

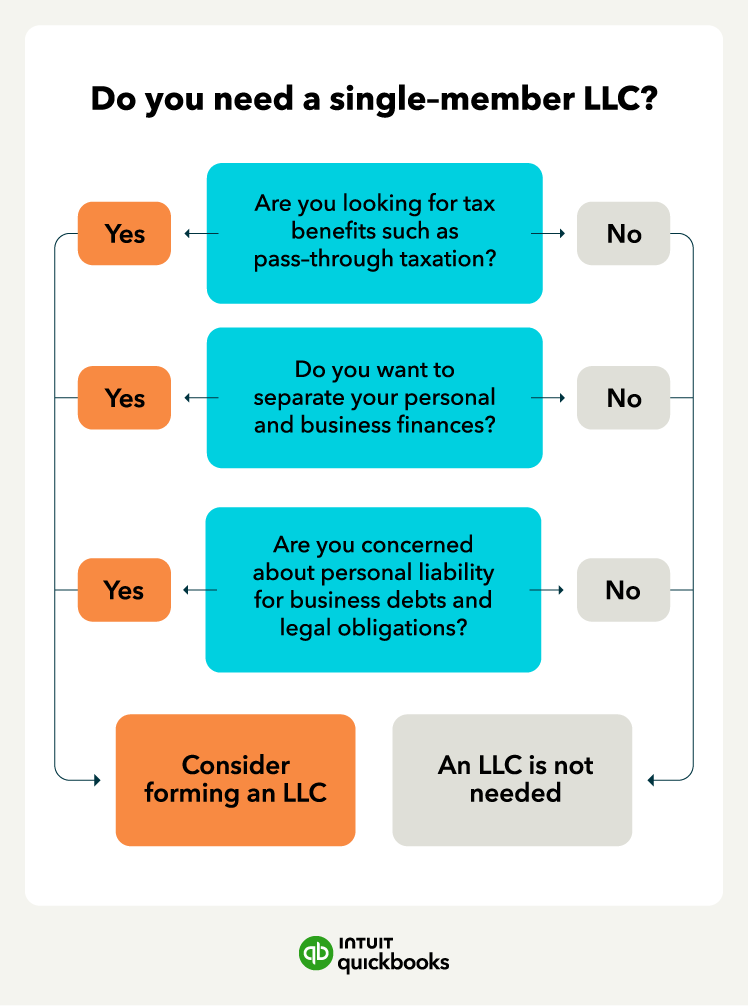

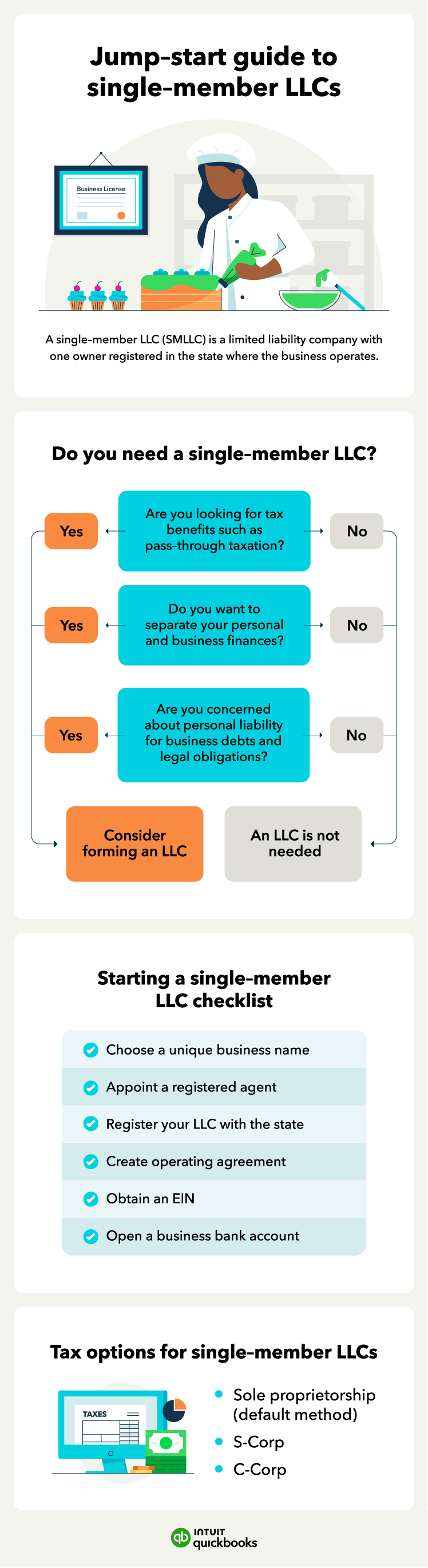

Single-member LLCs (SMLLCs) are LLCs with a single owner (hence the name), making them popular choices for solopreneurs and single-person businesses. A single-member LLC is a legal entity you register with your state, giving you limited liability for business debts and obligations.

The legal and liability protection an LLC offers is known as the corporate veil—an invisible curtain that protects your personal assets from the debts and obligations of your business. If you mix your personal and business assets, creditors can force you to use personal assets to pay business debts or settle lawsuits.

Pros and cons of single-member LLCs

Liability protection is just one of the benefits of forming an SMLLC. For example, you also have added credibility and tax advantages.

Other benefits of single-member LLCs include:

- Personal liability protection: One of the main reasons entrepreneurs choose to form an LLC is to protect their personal assets. In the event of legal actions or business debts, the LLC structure shields your personal assets.

- Credibility and professionalism: A single-member LLC offers credibility as a recognized business entity within the state it operates. It assures potential clients that they are dealing with a legitimate business.

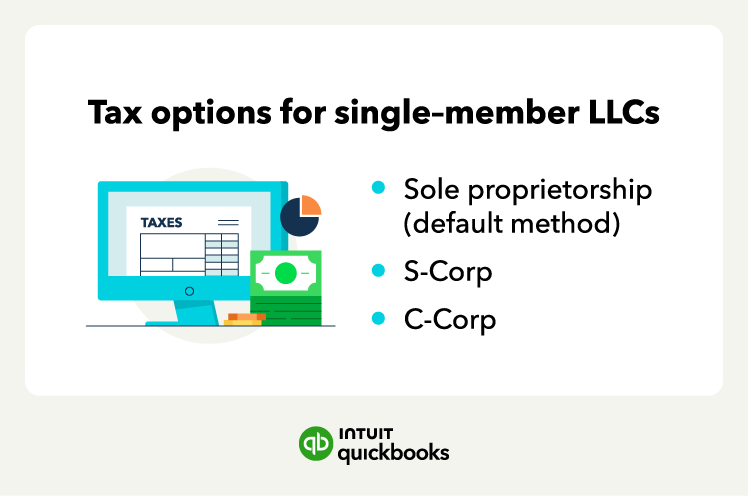

- Flexible tax options: LLC taxes have flexibility, where you can choose your tax classification, allowing the owner to opt for pass-through taxation or be taxed as a corporation. This flexibility can be advantageous when considering personal income tax returns.

If you do decide to create a legal entity like a single-member LLC, you’ll also need to consider:

- Paperwork: Unlike a sole proprietorship, a single-member LLC requires various paperwork, such as articles of organization and annual reports. The additional paperwork and ongoing tasks can be time-consuming.

- Fees and ongoing costs: Forming and maintaining a single-member LLC comes with associated fees. This usually includes a filing fee to register the LLC and annual fees.

- Compliance: Failure to meet the state's requirements and maintain compliance can result in penalties, like fines, loss of limited liability protection, or even dissolution of the LLC.

While a single-member LLC offers liability protection and other benefits, it’s essential to weigh the administrative burden—especially when you compare it to the simplicity of a sole proprietorship.

Single-member LLC vs. sole proprietorship