Feeling lost in the tax maze? Pass-through entities are business structures that help make taxes simpler.

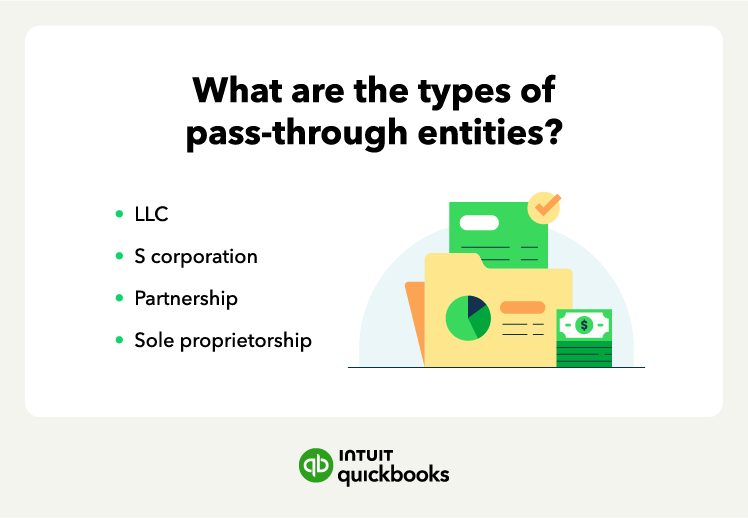

Company structure plays a major role in running a business, including the taxes you’ll pay. To understand the differences between business structures, consider how a particular structure impacts your taxes and the overall pros and cons.

A pass-through entity allows you to avoid double taxation on earnings—corporations pay income taxes on their profits, and shareholders pay taxes on dividends they receive.

No one likes to pay more taxes than necessary, and pass-through entities allow for more income to go into the business rather than going to taxes. Let’s look at how pass-through entities work and the different types you can pick from.

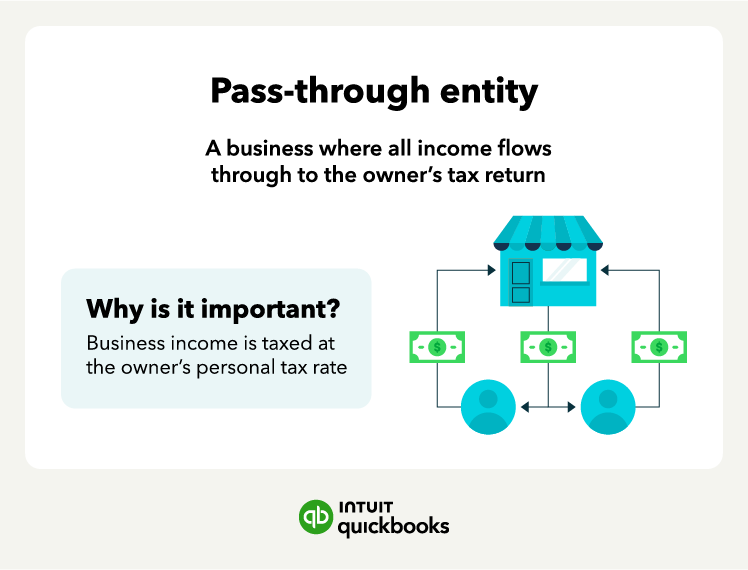

How do pass-through entities work?

Pass-through entities allow business income and tax liabilities to pass to the owner. You then pay taxes for income from pass-through entities at your personal tax rate. The business itself does not pay taxes. To better understand the process, here’s a breakdown of how taxation works for each.

For a nonpass-through entity, like a C-corp:

- The business pays corporate taxes on its income

- The business can pay shareholders through dividends

- But shareholders pay taxes on dividends

- And the dividends are not tax deductible for the corporation

In a pass-through entity, like a sole proprietorship:

- The business pays no corporate tax

- All income passes to the owner’s tax return

- Owners pay income taxes on the business income at their personal tax rate

There is no limit to how much you can earn within a pass-through entity, but there is a taxable income limit for the Qualified Business Income (QBI) deduction, which is $364,200 for those married filing jointly and $182,100 for all others.