Sales tax for brick-and-mortar businesses

Almost all retail sales may be subject to sales tax. This means that if you own a small business that sells clothing, any time you sell an article of clothing to a retail customer, that customer is responsible for paying the necessary sales tax amount on the total cost. As the business owner, you’re responsible for keeping track of the tax you collect so that you can report it to your local and state governments.

There are, of course, exceptions to this rule. Notably, sales tax is only applicable at the final point of sale from a business to a consumer. So sales tax can only be levied against the final retail sale of an item, not against a wholesale transaction.

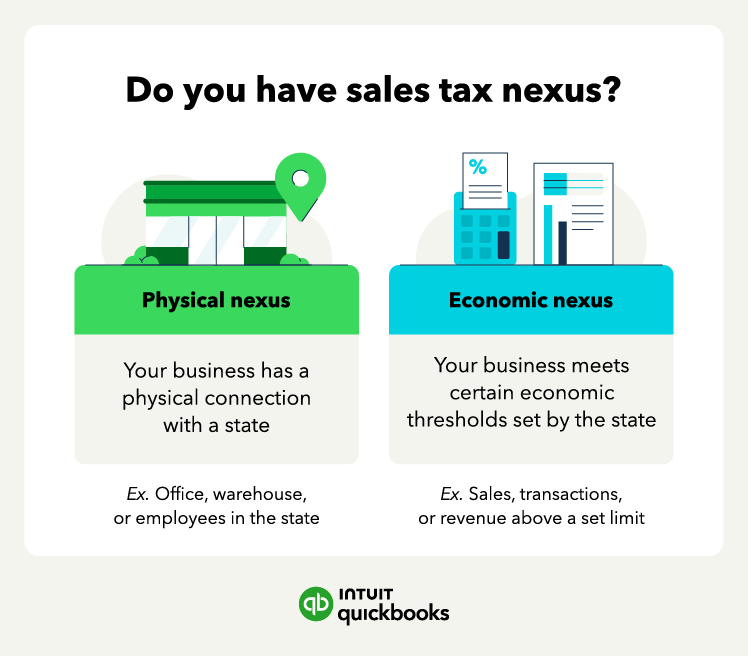

As a brick-and-mortar business, it’s also important to note where you’re responsible for paying sales tax. A state cannot demand that a company register to collect sales tax unless the business has a physical presence in that state. Having a physical presence in a state is known as a nexus, which is defined as:

- An office, store, or other facility located in the state

- A business where the business owner or their employees take orders, perform services, or otherwise do business within the state’s borders

If you have any physical presence in the state, an argument can be made that you have established a nexus and thus are subject to the state’s sales tax laws.