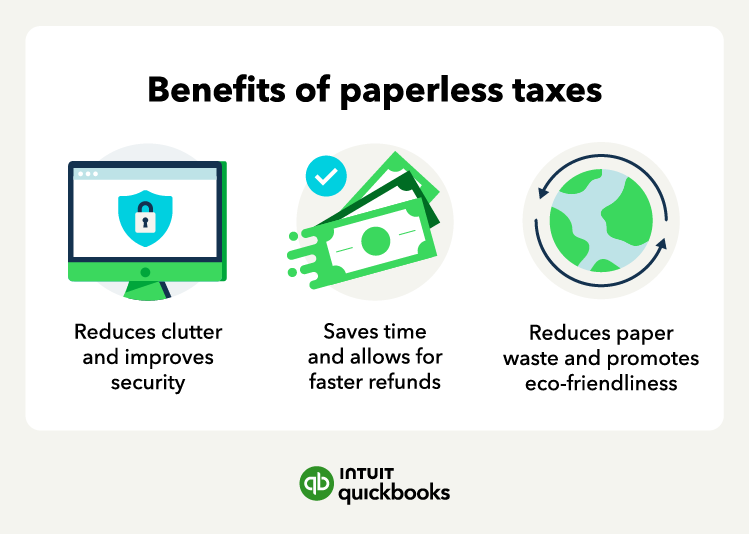

The IRS transitioned to paperless taxes with its paperless processing initiative. The transition speeds up tax return processing times, allows for quicker refunds, and helps reduce tax filers' carbon footprint.

Each year, the IRS receives over 200 million pieces of paper and spends $40 million to store 1 billion paper documents. Let’s look at how to go paperless this tax season, including the benefits and best practices:

Paperless tax basics: What you need to know

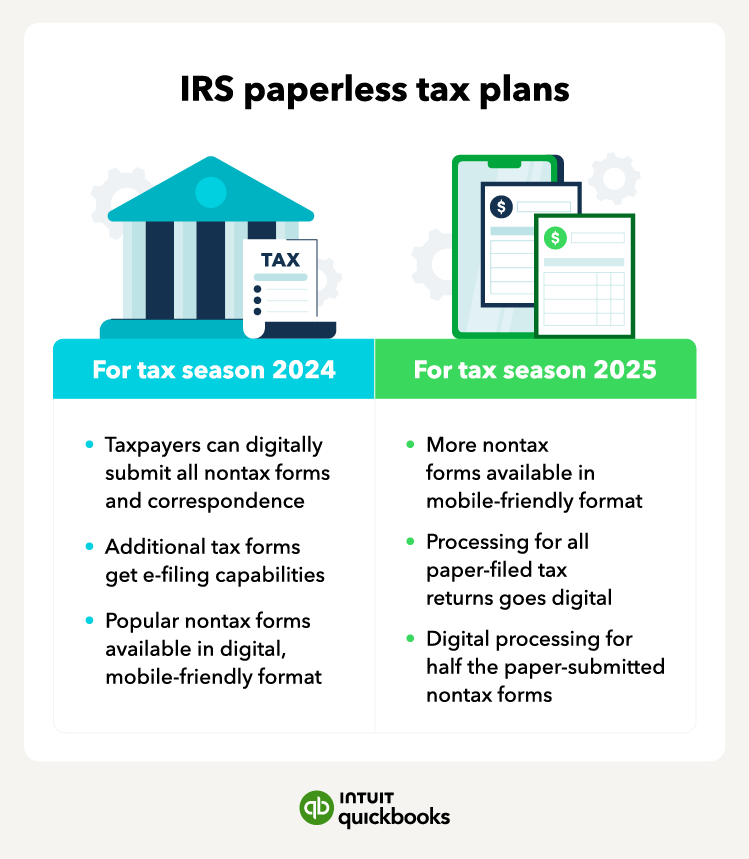

The IRS plans to digitize paper returns, allow for digital correspondences, and make popular nontax forms available digitally over the next couple of years. Here’s what to expect:

- For the 2024 tax filing season, taxpayers will be able to go paperless when filing nontax forms (such as annual filings), responding to notices, and submitting correspondence to the IRS. With this change, the IRS says that 94% of individual taxpayers will no longer need to send mail to the IRS.

- For the 2025 tax filing season, the IRS will start processing all paper tax returns digitally. This means that if you file via paper, the IRS will convert the form to a digital format. This will allow the IRS to process returns faster and speed up refunds. It also plans to process half of all paper-submitted nontax forms and correspondence digitally.