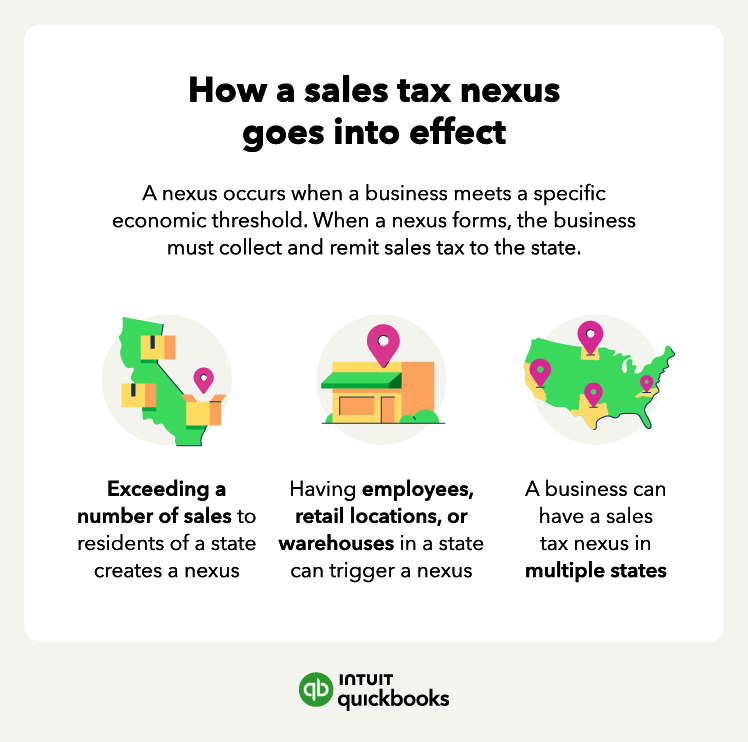

For years, online retailers didn’t have to charge sales tax outside their home state. That changed with the 2018 Supreme Court Wayfair ruling, which gave states the power to require sales tax collection based on economic nexus, not physical presence.

Today, 71% of business owners say they already operate online to some degree—selling, finding customers, or accepting payments digitally. That shift makes understanding and complying with online sales tax rules more important than ever.

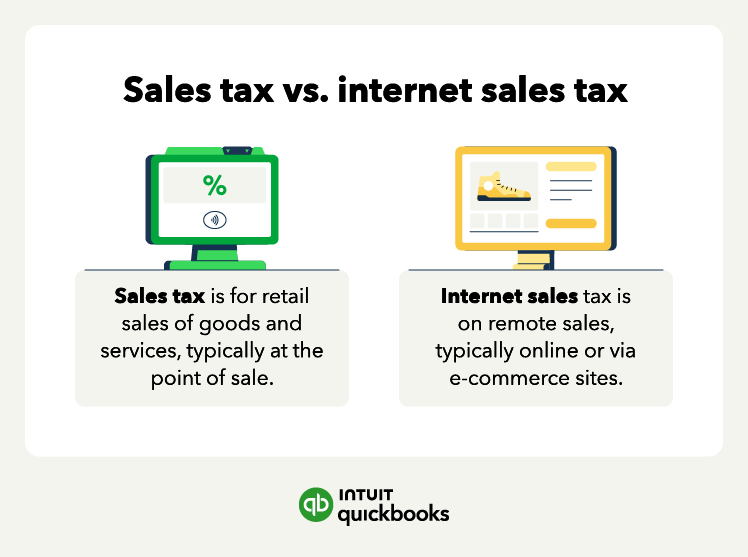

If you sell goods, whether in person or online, you’re generally required to collect sales tax. The difference is that e-commerce brings extra rules and thresholds you’ll need to follow. Let’s break down what that means for your business.

Jump to: