The hidden trap: Economic nexus in 2026

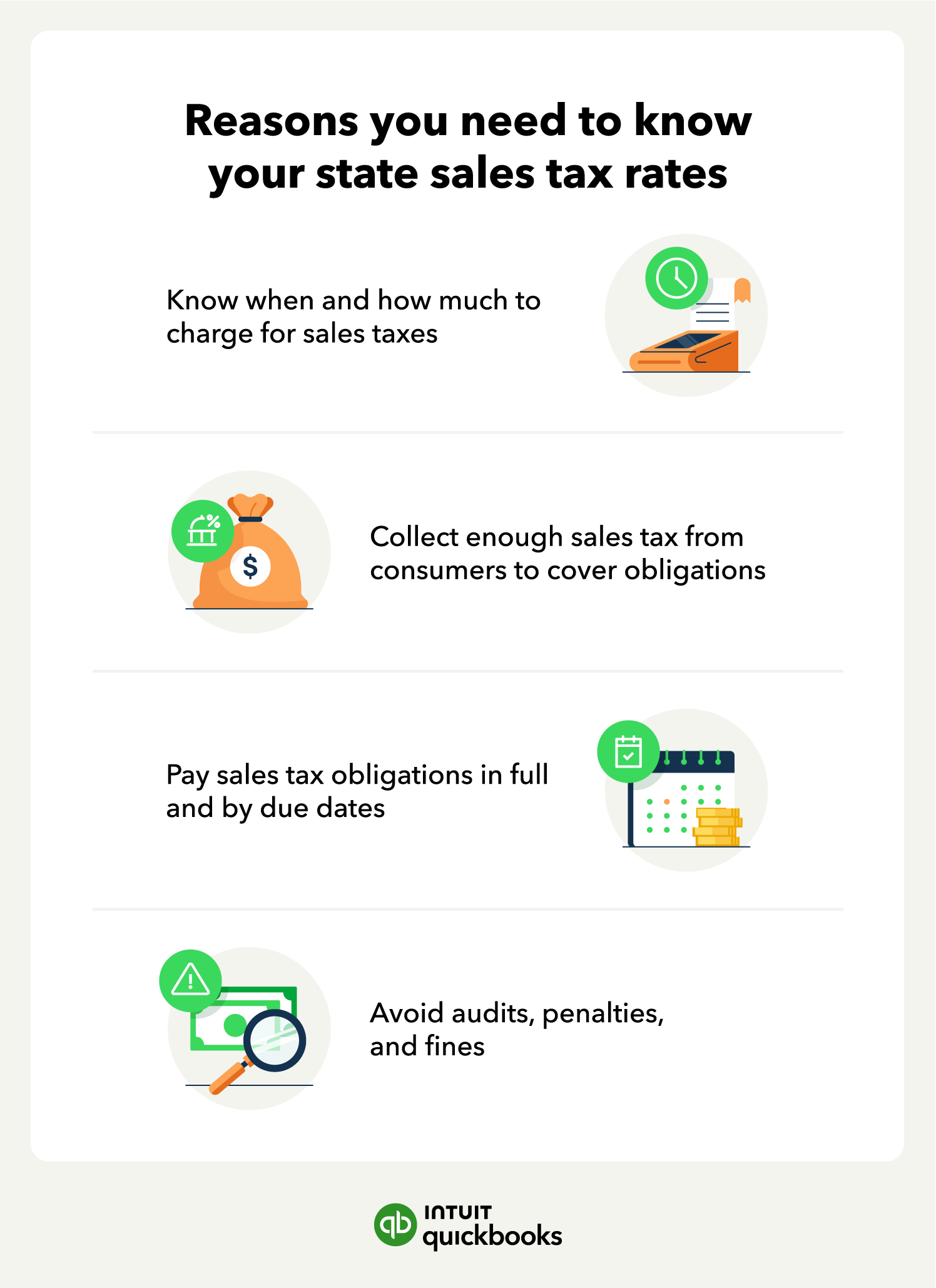

In 2026, every state that has a sales tax will also enforce economic nexus laws. This means that if your business sells to customers in other states through your website, social media, or phone, you may have to register, collect, and remit sales tax to those states once you reach certain sales milestones.

Why nomad businesses still pay sales tax

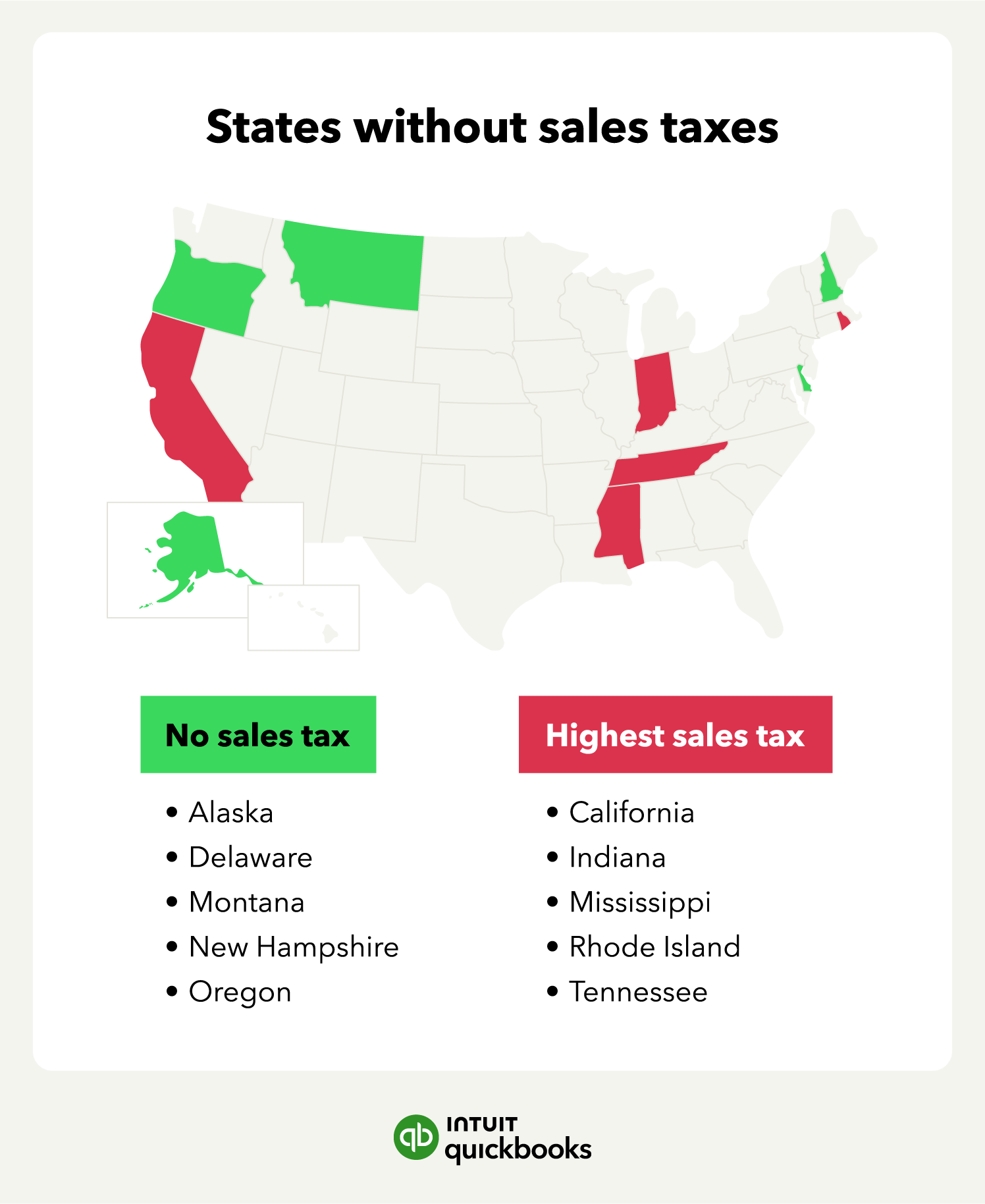

Operating from a tax-free home base like Oregon or Delaware doesn't exempt you from the laws of the states where your customers live. If you ship a product to a customer in California or Texas, you're using those states’ infrastructure to conduct business.

Under the 2018 Wayfair Supreme Court decision, states have the legal right to demand sales tax once you establish a nexus through your sales volume.

Common 2026 thresholds

Nexus laws are constantly shifting. For 2026, business owners should keep a close eye on these three categories of thresholds:

- The standard threshold: The most common benchmark is $100,000 in gross sales. States like Florida, Georgia, and Colorado require you to register for a sales tax permit once your sales to their residents exceed this amount in a calendar year.

- The shift away from transaction counts: Illinois officially removed its 200 transaction threshold on January 1, 2026, joining states like California, Indiana, and Maine that now focus solely on revenue.

- High volume thresholds: Some larger economies set the bar higher to protect very small sellers. In New York and California, for example, you generally do not trigger economic nexus until you exceed $500,000 in sales.

- Marketplace facilitators: If you sell exclusively through platforms like Amazon, Etsy, or Walmart, these facilitators usually collect and remit the tax for you. However, some states still require you to register and file zero tax returns once you cross their economic threshold.