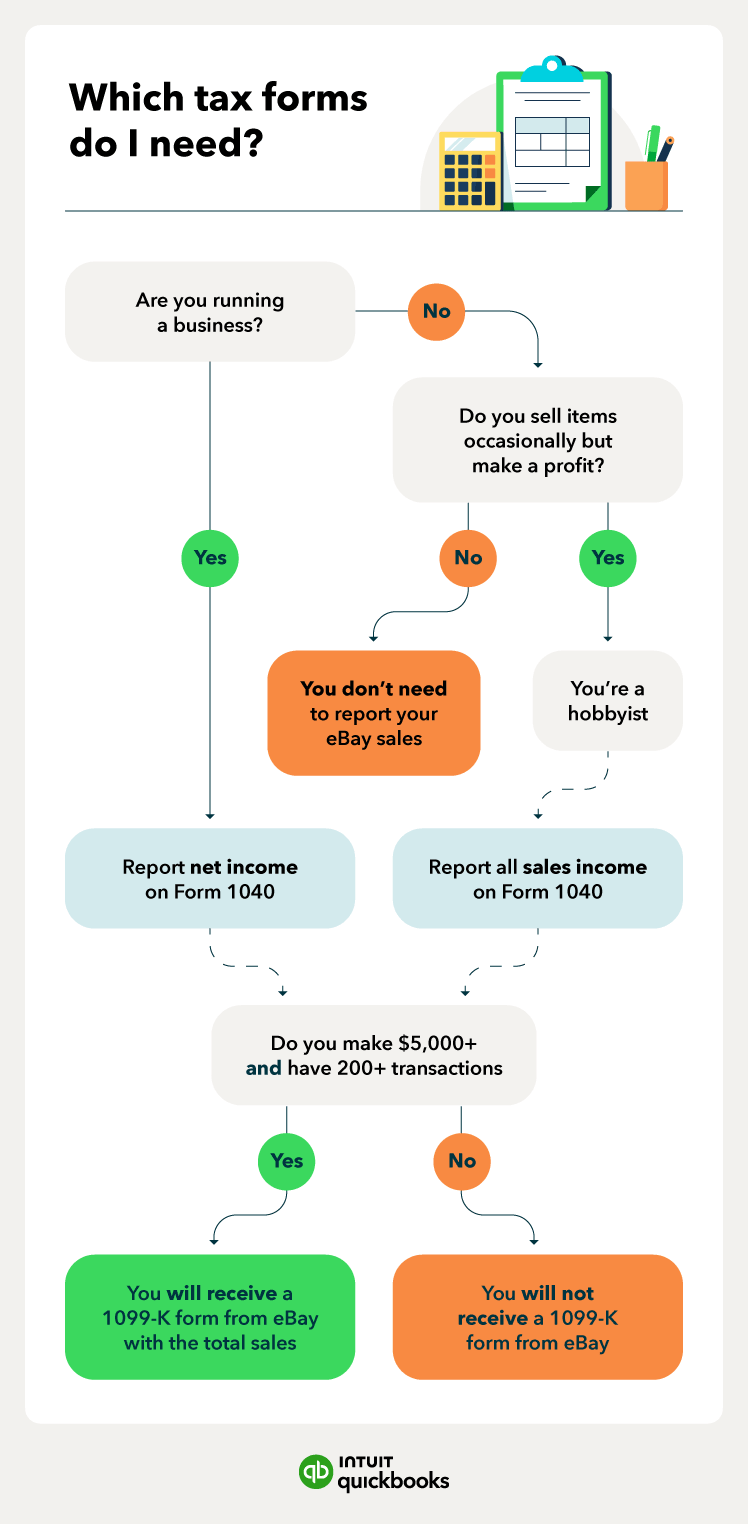

Selling on eBay can be a fun hobby or a serious business. It’s important for everyone—whether you’re a casual seller or a full-blown business owner—to know how to report eBay sales on taxes. In this post, you’ll find information on what forms you need, how to calculate income, and more to make tax season a little easier when you’re selling on this online marketplace.

Jump to:

- Understanding eBay Taxes

- What’s the difference between a hobby and a business?

- How to calculate your eBay sales

- Which eBay sales are subject to income tax?

- Tax deductions for eBay sellers

- What is a 1099-K?

- Will eBay send a 1099-K?

- How to fill out Form 1040 for eBay business sales

- Find peace of mind come tax time

- Frequently asked questions