How to fill out a Schedule C in 7 steps

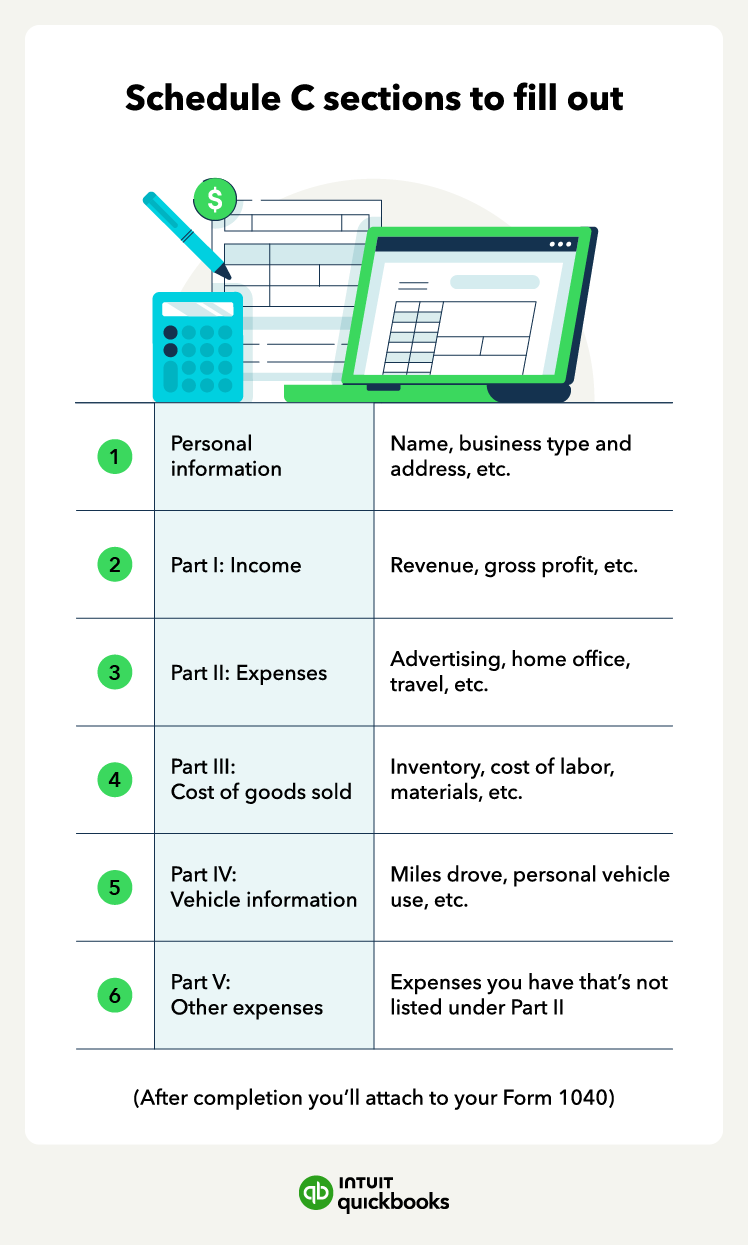

Schedule C, also known as a business expense form, has a personal information section and five parts you’ll need to fill out.

Schedule C will ask whether you use the cash or accrual accounting method. With accrual accounting, you’ll report expenses as you incur them and income as you earn it. Most large companies use the accrual method, but many small businesses use the cash method.

Here's a quick step-by-step guide on completing a Schedule C:

Step 1: Fill in personal information

Begin by filling out the top part of the form, including your name, Social Security number, and the type of business entity.

Step 2: Tally your business revenue in Part I

In Part I, report your gross receipts or sales. This is the total amount of money your business earned during the year. Include income from all sources, such as online sales, client payments, and any other business-related income. You'll also need to account for any returns or allowances.

Step 3: Deduct your business expenses in Part II

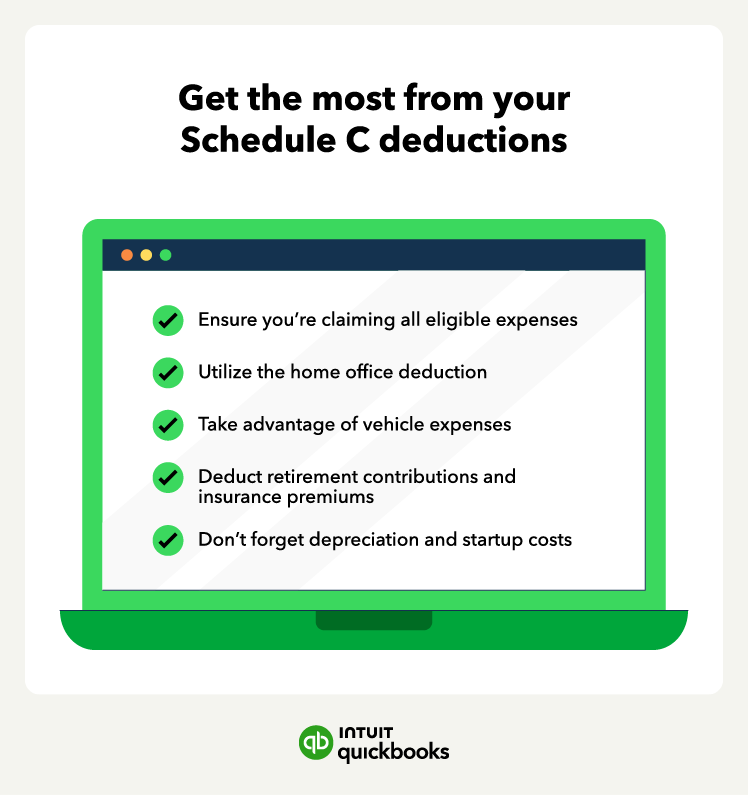

Part II is where you itemize your business expenses. This section is crucial for maximizing your deductions, so be thorough.

Common deductible expenses include:

- Advertising

- Car and truck expenses

- Commissions and fees

- Contract labor, depreciation

- Insurance

- Legal and professional services

- Office expenses

- Rent or lease

- Supplies

- Travel

- Meals

- Utilities

Refer to the instructions for specific rules and limitations for each category.

Step 4: Calculate your cost of goods sold (COGS) in Part III

If your business involves selling goods, you'll need to calculate the cost of goods sold (COGS) in Part III. This includes the cost of materials, labor, and other direct costs associated with producing or acquiring the goods you sell. You'll need to provide information about your beginning and ending inventory, purchases, and other costs.

Step 5: Report vehicle expenses and other expenses in Parts IV and V

Calculate and deduct the allowable vehicle expenses if you use your vehicle for business purposes. If you have other legitimate business expenses that don’t fit into any of the categories in Part II, you can itemize them in Part V.

Step 6: Summarize your business profit or loss

After completing all the relevant sections, you'll calculate your net profit or loss in Part VI. This is done by subtracting your total expenses (including COGS) from your gross receipts. This figure is crucial because it's what you'll report on your Form 1040.

Step 7: Transfer amounts to Schedule 1 then to Form 1040

Transfer amounts to Schedule 1 then to Form 1040

Once you have your net profit or loss, report the amount on Schedule 1. On Schedule 1, your Schedule C income is combined with other kinds of income and deductions, and the total from Schedule 1 is transferred to your personal tax return as line 8 of Form 1040. You'll attach both Schedule C and Schedule 1 to your tax return when filing.

Having all your income and expenses in one place—where you can get paid and manage your money all in one with a business bank account like QuickBooks Money—can help streamline tax time.

Keep your business information consistent across all your tax forms and official documents to avoid any confusion or processing delays with the IRS.

Keep your business information consistent across all your tax forms and official documents to avoid any confusion or processing delays with the IRS.