While consumers may complain about sales taxes, it can also be a hurdle for business owners. If you’re selling just about anything, you’ll need to collect sales tax and send it to the appropriate state tax agency.

Knowing how to collect sales tax, what a sales tax license is, and when to amend your license is key to launching a new business. Here’s all the information you need to know:

How sales tax license works

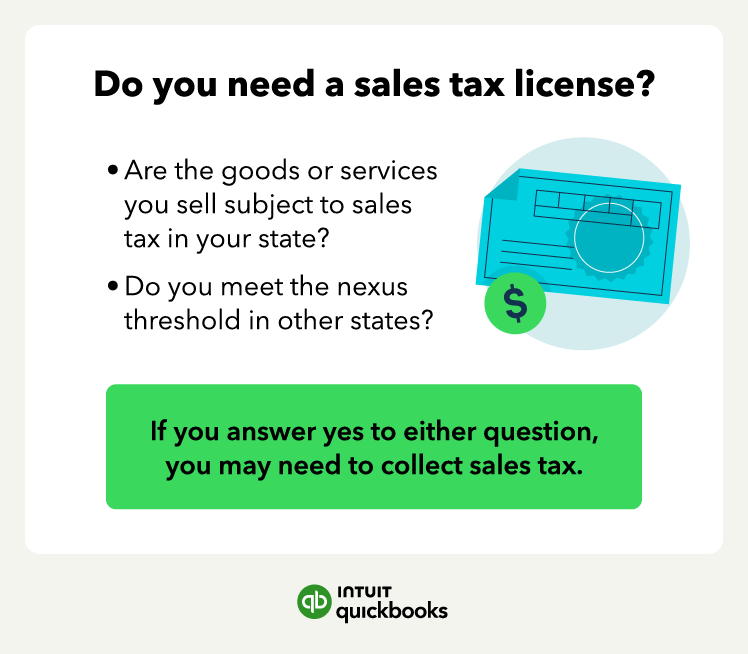

A sales tax license, also known as a seller's permit or sales tax permit, is a document that lets you collect sales taxes on taxable goods or services. You need this license if your business sells goods or services subject to sales tax.

The process of obtaining a sales tax license typically begins with contacting the state agency responsible for issuing such permits. Each state may have a different agency and application process, so it is essential to research and locate the correct agency for the state where you operate.