What is small business accounting?

Business accounting is the process of gathering and analyzing financial information on business activity, recording transactions, and producing financial statements.

Ever feel like your business finances are too time-consuming? Pulling your focus from the things you love about running your company. You're not alone. However, understanding the basics of small business accounting can help you find growth or money-saving opportunities for your business.

Many small business owners manage their own accounting to save money. If you’re in the same boat, you must have a firm grasp of business accounting basics. In fact, a recent QuickBooks survey found that small business owners with low financial literacy lose an average of $118,121 in profit.

Let’s look at the importance of proper bookkeeping and key tips for managing your accounting:

1. Determine your business structure

4. Pay vendors

8. Reconcile your business bank account

12. Prepare and review financials

13. Review and pay quarterly payroll taxes

14. Review long overdue receivables

15. Take stock of your inventory

16. Fill out and file IRS forms

17. File tax returns

What is small business accounting?

Business accounting is the process of gathering and analyzing financial information related to business activity, recording transactions, and producing financial statements.

Accounting focuses on the bigger picture. It takes the details from bookkeeping and turns them into insights that show how your business is really performing. This helps you see if your business is profitable, understand your cash flow, prepare for taxes, and plan for the future.

The basics of small business bookkeeping

Bookkeeping focuses more on the administrative side of managing your money. It’s about staying on top of day-to-day tasks that keep your financial records clean and organized.

That usually means:

Recording transactions

Each time money moves in or out of your business, you need to record it. This includes sales, expenses, bank deposits, loan payments, and payroll. The more consistent you are, the easier it is to see patterns in your cash flow, avoid costly mistakes, and stay ready for tax time without the last-minute scramble.

Saving receipts and invoices

Invoices and receipts are some of the most important records your business has. They prove what you spent, what you earned, and back you up if the IRS ever comes knocking. However, the key is to stay organized. Instead of letting them pile up in a drawer, set up a simple system, whether that’s folders on your computer, cloud storage, or accounting software that lets you snap photos

Reconciling bank statements

Reconciling your bank statement means making sure what’s in your books matches what’s in your bank account. It might sound tedious, but it’s one of the best ways to keep your finances accurate. Consider reconciling every month so you can spot duplicate charges, missed entries, and catch other errors.

Tracking accounts payable and receivable

Accounts payable covers the bills you need to pay (e.g., vendors, suppliers, and service providers) while accounts receivable is the money customers or clients still owe you. When you stay on top of both, you keep your relationships with vendors strong and make sure cash keeps coming in the door.

If you’re just starting out, you can track transactions with spreadsheets, but most small business owners eventually use bookkeeping software to save time and reduce mistakes. Software also makes it easier to scan receipts, send invoices, and run reports in a few clicks.

Accounting requirements for small businesses

Every business, big or small, needs some level of accounting. The key requirements usually include:

Choosing an accounting method

There are two main methods: cash basis and accrual accounting. Cash basis means you record money when it changes hands, while accrual accounting means you track income and expenses when they’re earned or incurred, even if cash hasn’t moved yet. While it takes more effort, accrual gives you a more accurate picture of your financial health, especially as your business grows.

Keeping organized records

Whether you’re preparing for taxes, going through an audit, or applying for a loan, you can quickly find receipts, invoices, and tax documents when your records are organized. Many business owners start with physical folders or spreadsheets, but accounting software can save time by storing everything in one place and making it easy to search.

Preparing financial statements

Financial statements tell the story of your business in numbers. The balance sheet shows what you own and owe, the income statement tracks revenue and expenses, and the cash flow statement shows how money moves in and out. Together, they give you insight into profitability and stability. Plus, when you need outside funding, lenders and investors rely on these documents to gauge your business’s health.

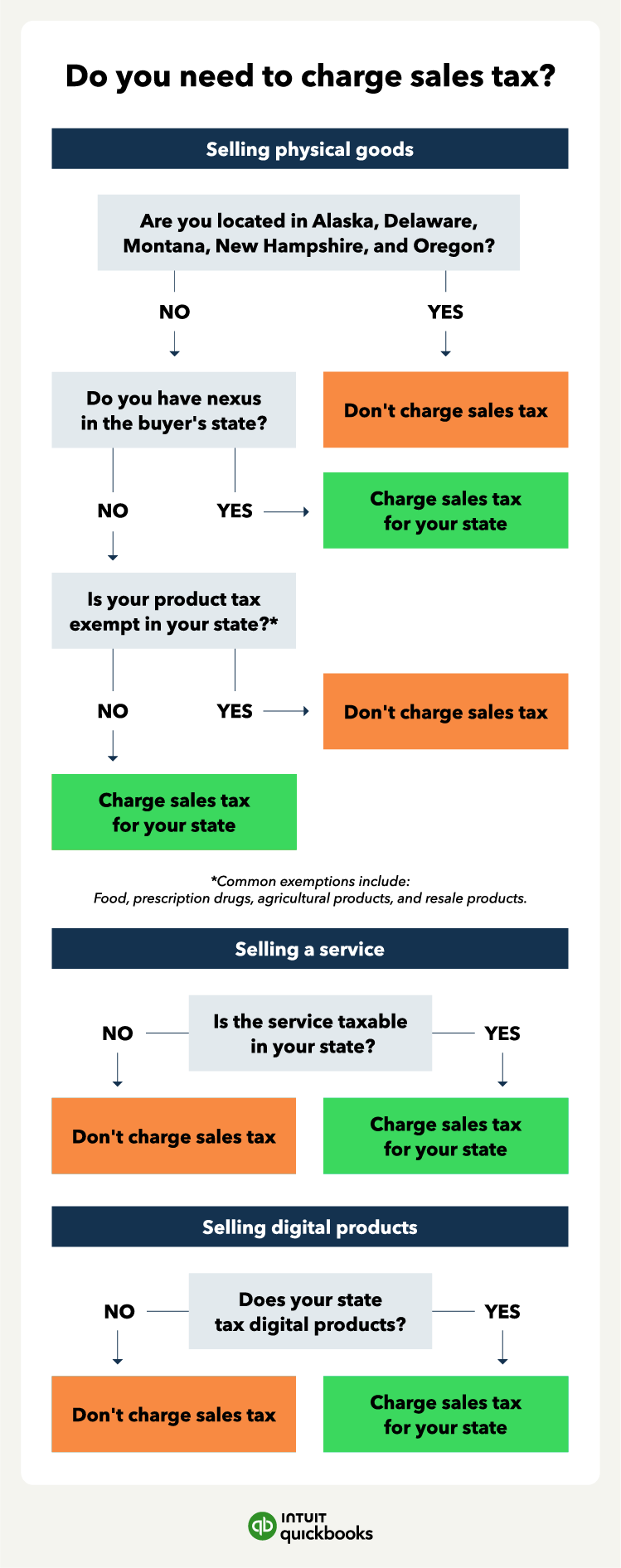

Filing taxes and staying compliant

No one loves tax season, but it’s part of running a business. From income tax to payroll tax and sales tax, staying on top of your obligations keeps you out of trouble and avoids costly penalties. Good accounting software can make this much less stressful by calculating, tracking, and filing some taxes automatically.

Separating business and personal finances

Mixing business and personal money is one of the most common mistakes small business owners make. Opening a dedicated business bank account and credit card makes tracking expenses much easier and gives you a clean paper trail at tax time. It also protects you legally (especially if you run an LLC or corporation) by keeping your personal assets separate from your business finances.

The exact requirements depend on your industry, state, and business size, but the basics above apply to almost everyone.

Can you do your own small business accounting?

Yes, you can absolutely handle your own books, especially when your business is small and straightforward. Many business owners start this way to save money and learn the ropes.

But as transactions pile up or tax rules feel overwhelming, accounting software or a professional bookkeeper can be a lifesaver. For example, QuickBooks automates much of the busywork—e.g., categorizing expenses, syncing with your bank, and preparing reports—so you can focus on running your business.

19 small business accounting tips for business owners

While accounting may not be what motivates you to go to work every day, it’s likely something you’ll encounter whether you do it yourself or outsource to an accounting firm. There are weekly, monthly, quarterly, and annual accounting tasks you need to complete to ensure your business’s success.

Let’s look at the key tips for small business accounting and how often you should do them:

1. Determine your business structure

How often: Once, but review as your business grows

Before you open your doors, one of the first decisions you’ll need to make is how to structure your business. This choice affects how you’re taxed, what paperwork you’ll need to file, how much personal risk you take on, and even how attractive your business looks to banks or investors.

Here are some of the most common types of business structures:

- A sole proprietorship is the simplest and cheapest way to start a business. You keep full control and all profits, but you’re also personally responsible for any debts or legal issues.

- A partnership works like a sole proprietorship but with two or more owners. It’s easy to set up and allows you to share responsibilities, but partners also share liability and may face disagreements.

- A limited liability company (LLC) protects your personal assets while giving you flexible tax options. It’s slightly more complex than a sole proprietorship, and rules vary by state.

- A corporation (C corp or S corp) is more formal and complex but offers strong liability protection and credibility. C corps face double taxation, while S corps avoid this by passing income directly to shareholders. This structure is usually best for businesses planning to scale or bring on investors.

Lenders and investors usually prefer LLCs or corporations because they’re more formal and provide clear governance. On the other hand, if you’re running a one- or two-person shop with low risk, a sole proprietorship or partnership may be all you need to get started.

2. Record transactions

How often: Weekly

You’ll want to gather and record all your transactions, usually weekly, but you can do this daily or bi-weekly, depending on your volume. This includes recording:

- Sales revenue (cash, credit card, or online payments)

- Invoices sent and received

- Receipts for purchases and expenses

- Vendor bills and payments

- Payroll records (W-2s, pay stubs, and withholdings)

- Contractor payments (1099-NEC forms if applicable)

- Bank deposits and withdrawals

- Loan payments and interest

- Tax payments (income, payroll, and sales tax)

- Inventory purchases and adjustments

Although recording transactions manually or in a digital spreadsheet is acceptable, it’s easier to use small business accounting software like QuickBooks, which can integrate seamlessly with your bank account.

3. Document and file receipts

How often: Weekly

After recording transactions, you’ll want to keep copies of your invoices and all receipts. While tossing receipts in a box might seem tempting, it leads to chaos at tax time. Unless you have a very small volume of transactions, it’s better to organize separate files for assorted receipts weekly or as they come in.

The easiest way to stay on top of it is by setting up a bookkeeping system. Whether it’s folders on your computer, cloud-based software, or physical files, a good system makes sure every invoice and receipt has a home, so you’re never scrambling to find proof of a purchase or expense.

Most accounting software, including QuickBooks, lets you scan paper receipts and avoid physical files altogether.

4. Pay vendors

How often: Weekly

You should have records or folders for each vendor that include billing dates, amounts due, and payment due dates. If vendors offer discounts for early payment, you may want to take advantage.

Track your accounts payable and keep enough funds to pay your suppliers on time to avoid late fees. Whether you make payments online or drop a check in the mail, keep copies of invoices sent and received using accounting software to make things easier during tax time.

5. Prepare and send invoices

How often: Weekly

You’ll want to do invoicing weekly in most cases, although some businesses may invoice monthly or as they make credit sales. Either way, set a schedule and make sure you’re consistent with it.

QuickBooks Payments makes it easy with features like recurring invoices, which allow you to automatically charge customers on a set schedule so you don’t miss a beat. Plus, customers who send invoices in QuickBooks Online save over 11 hours per month on average.

Not sure what to include in an invoice? At a minimum, make sure to include:

- The word “Invoice” at the top, so it’s unmistakable.

- An invoice number and date to keep everything organized.

- Your business details and logo so it looks professional.

- The client’s contact info to ensure it gets to the right person.

- A breakdown of products or services with quantities, rates, and taxes if needed.

- Payment terms (like Net 30) and accepted payment methods.

- A friendly note like “Thank you for your business” to add a personal touch.