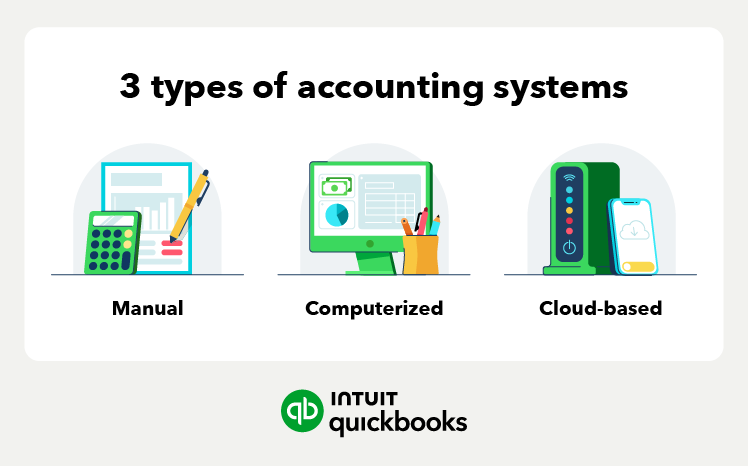

You can choose between three accounting systems. You can use either single-entry or double-entry with all three systems. Each type has unique features and benefits, making it important to understand which system best meets your business needs. The most popular accounting systems include:

Manual

A manual accounting system is a pen-and-paper form of accounting. Using a manual accounting system means recording your transactions in a general ledger. Manual accounting is one of the oldest forms of bookkeeping—it doesn’t require a computer, accounting software, or a complex system.

These systems use a physical accounting ledger (aka a general ledger). That ledger holds all the financial transactions, usually in chronological order. You will then add any new transactions to the ledger.

Running a manual system means you’ll need to keep track of physical invoices and receipts. You’ll use them to enter transactions into the ledger and verify that transactions are accurate.

Manual accounting is simple and straightforward. The downside to a manual accounting system is that it can be time-consuming and less accurate than using software.

Computerized

Computerized accounting systems have become more popular than manual systems, thanks to computers and accounting software. Computerized systems help improve the efficiency of bookkeepers and business owners while improving accuracy.

A computerized accounting system is software that automates the bookkeeping process—from recording transactions to financial reporting. This type of software is also customizable. With computerized systems, transactions are quickly recorded and stored.

Additionally, such systems can allow you to automate various accounting tasks, such as processing payroll or managing accounts payable.

Cloud-based

A cloud-based accounting system is essentially a computerized system—except it runs on remote servers. This means you use the internet to access the system and your data.

The big benefit for business owners is they can access their financial info from anywhere—as long as they have internet. Cloud-based accounting systems often run via mobile apps or directly in your browser. This means greater flexibility and cost-effectiveness compared to manual or standard computerized systems.

Cloud-based accounting is great for companies of all sizes, but you get all the same benefits of a computerized accounting system, such as:

However, all accounting systems have broader advantages that can make your accounting processes more efficient.

Accounting system pros and cons