Your bank balance doesn’t always tell the full story. While your online statement might show one number, your actual cash position could be very different. Unprocessed transactions—like uncleared checks or pending deposits—can create financial blind spots, potentially leading to overdrafts or inaccurate reporting.

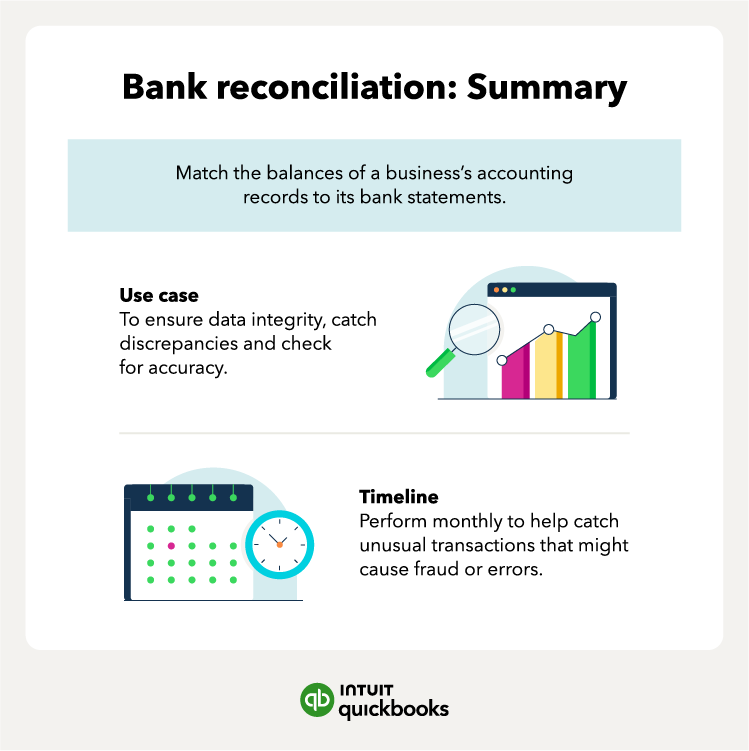

That’s why frequent bank reconciliation is essential. By comparing your accounting records with your bank statement each month, you can better manage your cash flow and understand your true cash position.

This guide walks you through the reconciliation process, highlights common pitfalls to avoid, and shows you how tools like QuickBooks can simplify the job.

Jump to:

- Understanding bank reconciliations

- When to do a bank reconciliation and why

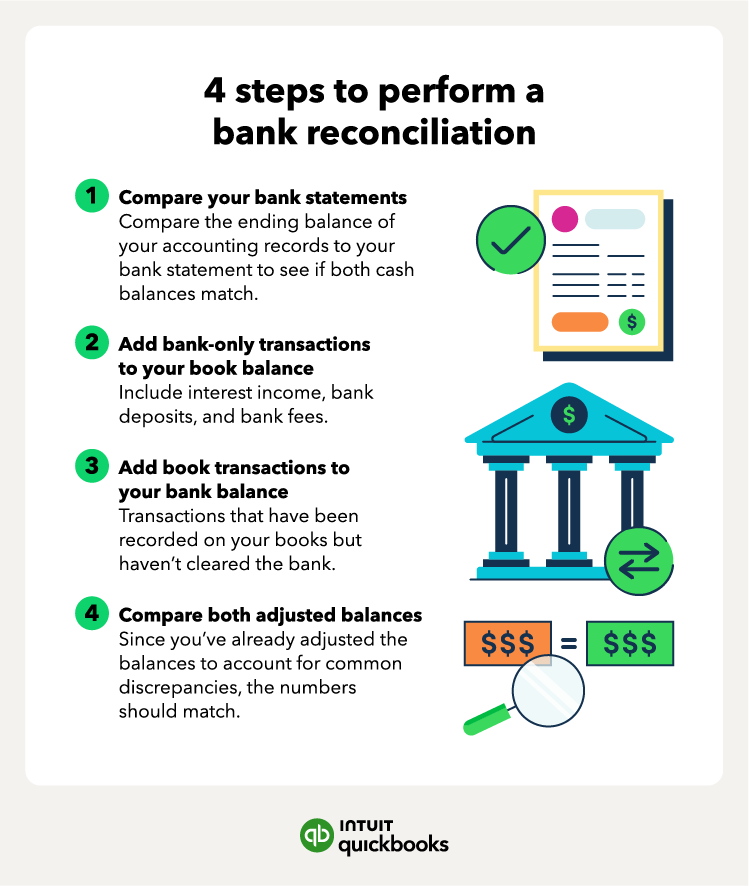

- 4-step process for doing a bank reconciliation

- Common errors and how to avoid them

- Benefits of regular bank reconciliation

- Reconcile multiple accounts

- The role of a bookkeeper in bank reconciliation

- Tips for efficient bank reconciliation

- Checks and balances for your business