Variable costs are expenses that change from month to month based on production. Depending on your company's output, variable costs may be higher or lower than before.

The higher your production output, the higher your variable costs will be for that period. On the other hand, the lower your production output, the lower your variable costs will be. While this may seem fairly straightforward, it can become confusing when dealing with them in real time.

Variable costs can be direct or indirect costs, meaning they can be directly related to the product itself or more generalized to the production process.

Some common examples of variable costs in a business include:

- Labor costs

- Raw materials

- Freight costs

- Machinery supplies

- Utilities

- Shipping option costs

- Credit card fees on purchases made by customers

- Sales commissions

- Advertising costs

Understanding your variable costs can help benefit your business, from helping you determine your pricing to make informed decisions that can help increase your profitability.

To help you better understand variable costs, let’s look at how it differs from other costs you may deal with.

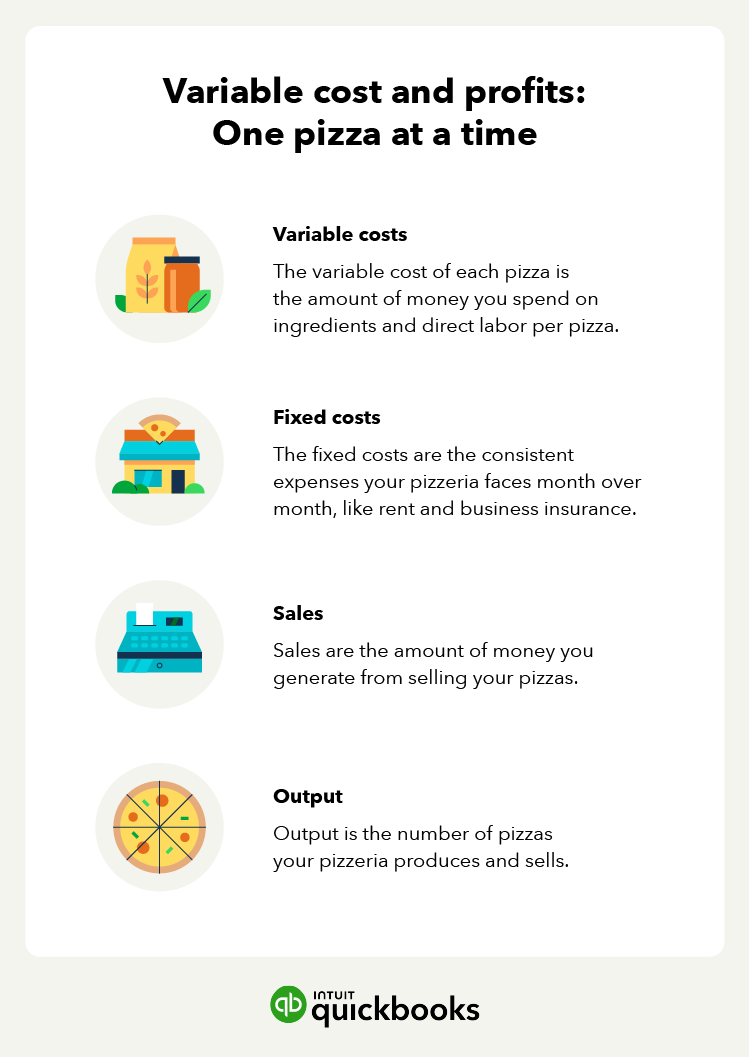

Variable vs. fixed costs

The difference between variable and fixed costs is that fixed costs stay the same no matter how your production output changes. Examples of fixed costs include business insurance, rent, and employee salaries.

It is important to remember that fixed costs can still change over time. For example, your rent may increase in the future, but unlike variable costs, that change won't result from your production. If you need help tracking your business’s expenses and other transactions, you may want to consider using bookkeeping software.

Variable cost vs. marginal cost

Marginal cost represents the overall change in the total cost of production when a company increases its production by one unit. Unlike variable costs, marginal costs account for both fixed and variable costs.

Whenever there is a change in the production cost, you'll have a marginal cost. Because of this, marginal costs exist whenever there are variable costs.

You can calculate marginal cost using the following formula:

Marginal cost = change in cost ÷ change in quantity

For example, let’s say your current production allows you to produce 10 units for $2,000. After increasing your production, you’re able to produce 20 units for $3,000. In this case, your marginal cost would be $100 ($1,000 ÷ 10).

Variable cost vs. average variable cost

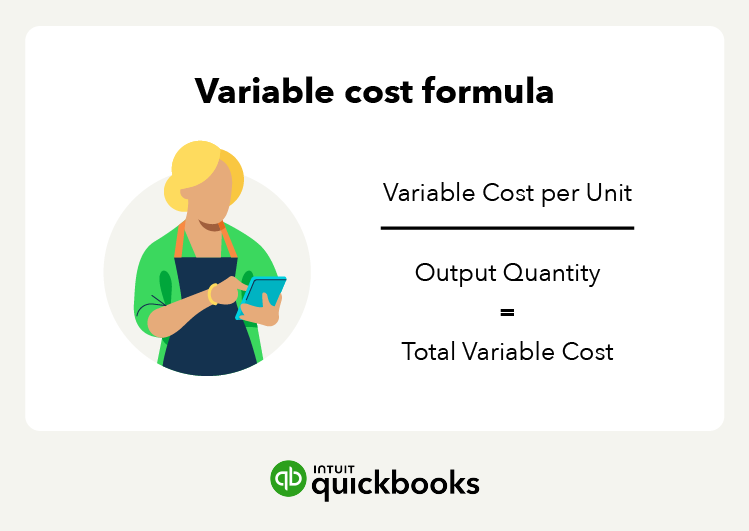

While variable cost and average variable cost may seem the same, each cost means something completely different. The difference between variable and average variable costs is that the average variable cost represents a comparison of total variable costs to your output.

You can calculate average variable cost using the following formula:

Average variable cost = total variable costs ÷ total output

For example, if your total variable cost is $10,000 and your output is 2,000 units, your average variable cost is $5.

Now that you’ve answered the question, “What are variable costs?” let’s take a look at how you can calculate them.