For many entrepreneurs, the dream of scaling requires a capital infusion. However, you're likely wondering whether taking out a business loan will negatively impact your hard-earned personal credit score.

It’s a valid concern, especially since a recent QuickBooks survey found that 66% of entrepreneurs have even used personal savings to fund their ventures. That fact highlights how deeply personal and professional finances are often intertwined when running a small business.

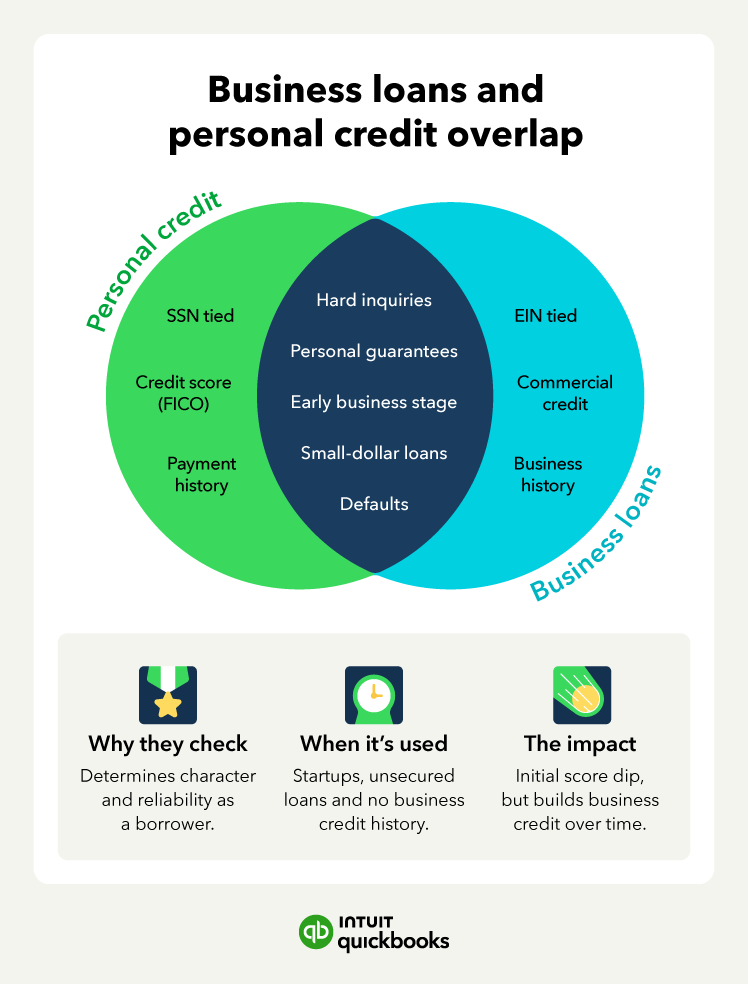

The reality is that while business and personal credit are distinct systems, they aren't entirely walled off from one another. Understanding how and when a business loan affects personal credit is essential for protecting your financial health while you grow.

Jump to:

- Overview: How business loans and personal credit overlap

- What is personal credit, and how is it calculated?

- How your business structure influences personal credit risk

- How business credit cards, bank accounts, and credit lines impact personal credit

- Do SBA loans affect personal credit?

- How to protect your personal credit when borrowing for your business

- Protecting your financial future

Before signing a loan agreement, ask the lender specifically if they report monthly activity to consumer credit bureaus or only to commercial ones.

Before signing a loan agreement, ask the lender specifically if they report monthly activity to consumer credit bureaus or only to commercial ones.

Keeping your personal credit utilization below 30% is one of the fastest ways to maintain a high score, which in turn helps you qualify for better business loan rates.

Keeping your personal credit utilization below 30% is one of the fastest ways to maintain a high score, which in turn helps you qualify for better business loan rates.