13. Corporate programs

Type of funding: Equity

Large corporations utilize corporate programs to invest in businesses to bring new ideas and technologies into their business. Like incubators, they offer resources like mentorship and office space. To be eligible for funding through corporate programs, businesses usually need to meet certain criteria:

- Industry focus

- Stage of development

- Revenue potential

- Alignment with the corporation's mission or goals

In return, you may have to give the company a stake in your business or agree to certain terms, such as exclusivity or noncompete clauses.

Best ways to prepare for raising money

Depending on the ways you take, there are a few steps you should work through before hitting the pavement, such as:

- Write your business plan: You’ll need a solid business plan to win investors over. Your business plan should have details about marketing and finances. You should include an executive summary and competitor analysis, like a SWOT analysis.

- Understand your financial needs: Before asking for funding, you need a clear picture of your financial needs. Take the time to calculate your expected overhead and potential costs. The minimum amount of money you need to start your business depends on your industry, working capital, taxes, and where you operate. When building your financial projections, focus on your sales forecasts and expense budgets.

- Rehearse your pitch: It’s time to prepare the pitch you’ll use to convince investors to fund your business. In general, you want your pitch to be around 45-60 seconds long—about the length of an elevator ride between floors—hence the term “elevator pitch.”

You can always rely on friends, family, and mentors for feedback. Once you have your pitch in order, you can record yourself making the pitch. You don’t have to post it on social media, but you can use the recording to see opportunities to improve.

Tips for minimizing your startup costs

When starting a business or deciding to scale up, you can lower the amount of capital you need by minimizing your costs. Here are five practical tips and strategies to help you minimize your startup costs:

- Plan and budget: When launching or growing your business, create a business plan and budget. This will help you determine your funding needs and identify areas where you can reduce spending. You can use free budget templates to help get started.

- Embrace cost-saving measures: Look for innovative ways to cut costs without sacrificing quality. Consider options like purchasing used equipment versus new.

- Utilize virtual office space: Instead of leasing traditional office space, consider using virtual or coworking spaces. These options often provide flexible leasing terms at a fraction of the cost.

- Hire freelancers or part-time employees: Rather than immediately hiring full-time employees, consider utilizing freelancers. This can help you save on salaries, benefits, and other employee-related costs, while still getting the necessary work done.

- Leverage technology: Take advantage of technology tools and software that can streamline your operations. This can reduce the need for manual labor, optimize processes, and save costs in the long run.

By implementing these strategies and being mindful of your expenses, you can increase your chances of long-term success. Remember that every dollar saved at the beginning can make a significant difference in your business’s growth and profitability.

Run your business with confidence

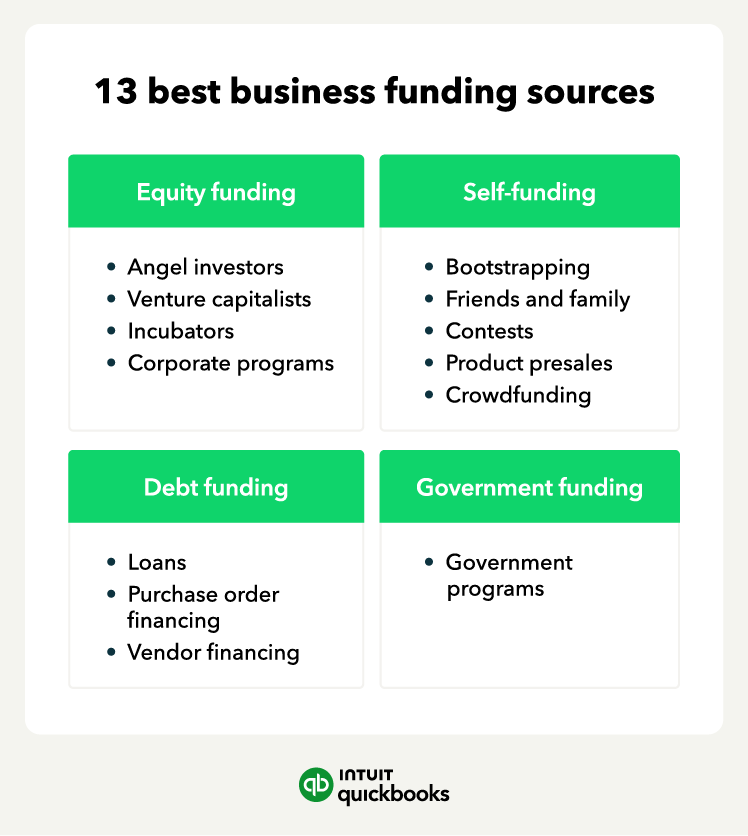

After researching these 13 methods and unique ideas on how to get funding for a business, spend time investigating the terms and conditions of each to make sure they fit your business.

On top of that, you need to ensure your finances are stable before reaching out for funding. Online accounting software like QuickBooks ensures you can easily create financial reports to show your business is on the right path and manage your business finances with ease.