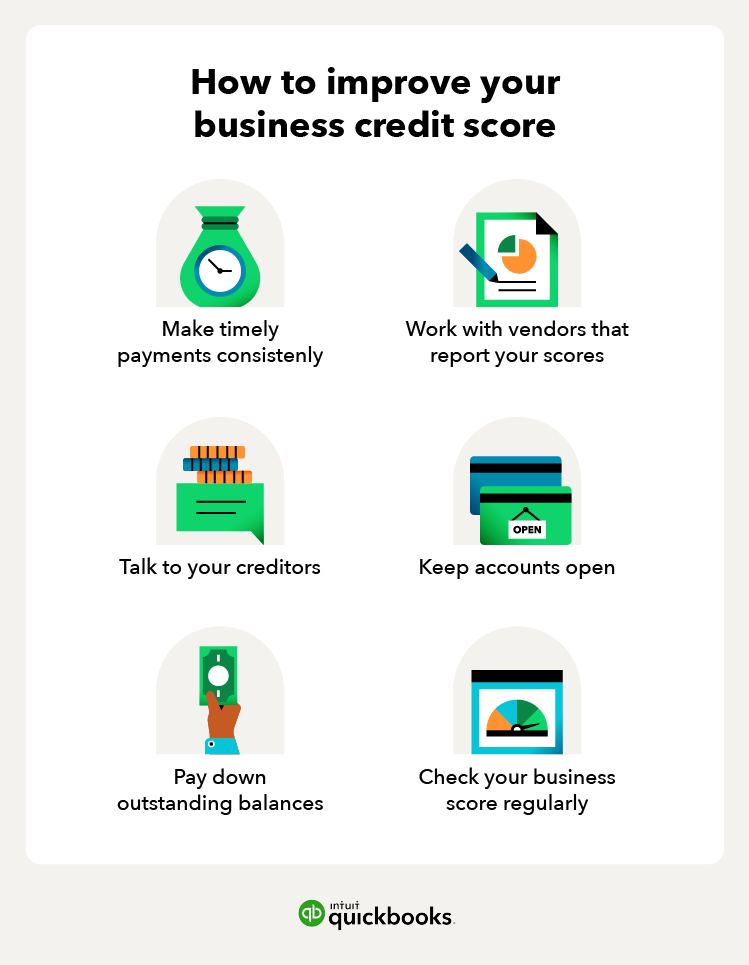

Payment history is the single most important factor in your score. Always pay suppliers, creditors, and lenders on or before the due date. Even one late payment can significantly lower your rating.

Building a strong balance sheet to make sure that funds are collected and disbursed on time is critical to all aspects of your business, including your ability to build and maintain a good business credit score.

Work with partners who report to the business credit bureaus

Not all vendors report payment activity. Verify that your suppliers report to Dun & Bradstreet, Experian, or Equifax. If they don’t, consider adding a vendor who does, so your positive payment history shows up on your report.

Pay down outstanding balances

Credit utilization, or the amount of credit you’re using relative to what’s available, is a major factor in your score. Aim to use less than 30% of each credit line. Start by paying off high-interest accounts first.

Keep accounts open

Even if you don’t use a given card anymore, closing too many accounts limits how much credit you have available and can also impact your score. It might be worth it to keep a credit card open even if you don’t use it often anymore, and potentially even keep one recurring bill—say, your business cell phone—to keep it active.

Talk to your creditors

Managing the finances of a small business can be tricky. After all, if a client doesn’t pay you in a timely manner, you may not be able to pay the creditors you owe.

If you’re facing a cash crunch, communicate with creditors early. Many will work out payment plans rather than report late payments, but use this sparingly to avoid damaging your reputation.

Regularly monitor your business score and dispute any errors

Unlike personal credit, business credit reports aren’t free. Consider using credit monitoring tools like Nav, Experian Business, Dun & Bradstreet, or CreditSignal to track changes and set alerts for suspicious activity. This helps you act quickly if issues arise.

Whether it’s a misapplied payment or an incorrect public record, mistakes can happen. Each bureau has a process for disputing errors:

- Dun & Bradstreet: Submit updates through their iUpdate system.

- Experian: File disputes online with documentation.

- Equifax: Contact their Business Customer Care with supporting evidence.

Regularly checking your reports ensures errors don’t drag down your score unnecessarily.

Diversify your credit mix

Using different types of credit (like vendor accounts, business credit cards, and small loans) demonstrates that you can responsibly manage multiple forms of borrowing. This diversification can strengthen your score over time.

Consult a small business advisor

Sometimes, improving your credit score is about knowing which steps will have the most impact on your unique situation.

A small business advisor can review your financials, help you build a stronger balance sheet, and guide you toward financing options that make sense for your business. They can also connect you with lenders or programs that are more likely to report positive activity to the credit bureaus, helping you strengthen your score faster.