How small businesses can navigate the future of CRA rule 1071

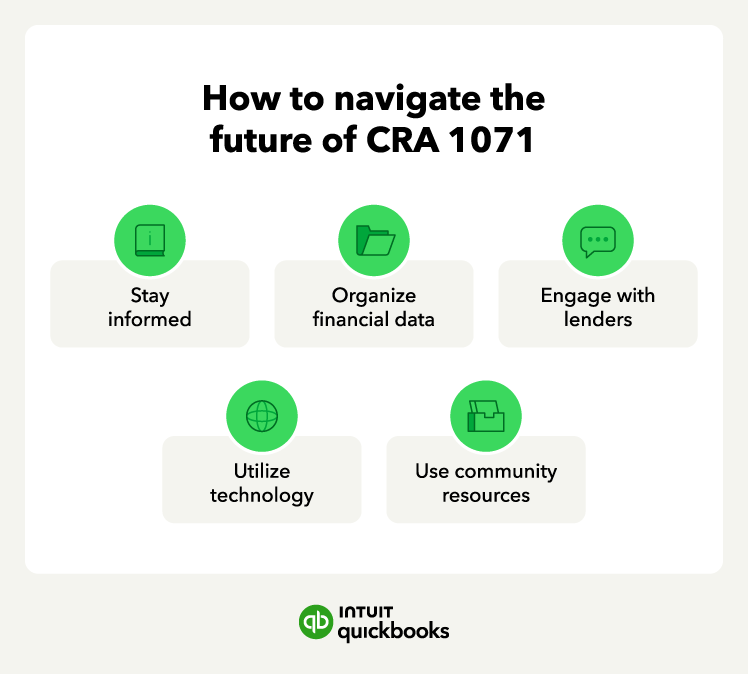

Looking ahead, CRA Rule 1071 is set to keep evolving as small businesses adjust to its requirements. The push for fair lending is here to stay, and financial institutions will likely keep refining how they support diverse communities. As they collect and analyze more lending data, we can expect to see clearer trends and insights that could shape future policies aimed at leveling the playing field.

Potential regulatory changes and trends

We might see some changes in regulatory requirements. They could ask for even more detailed data, which could be a double-edged sword—great for transparency but may be overwhelming for some businesses.

Plus, with the rise of digital banking and fintech, how small businesses connect with lenders is likely to shift. Expect more streamlined processes that still keep compliance in mind. And there’s a growing buzz around creating tailored loan products that really cater to specific groups, so keep an eye on that!

Implications for the final rule

The final version of the rule could bring some exciting opportunities, especially for small businesses in underserved areas. It might include incentives for lenders who go the extra mile to support businesses that make a positive community impact.

As these changes roll out, staying informed will be key. By understanding what’s coming, your business can better position itself to take advantage of new resources and advocate for their needs in this ever-evolving lending landscape.