If you’re facing financial challenges with your small business or find yourself in a sales slump, you’re not alone. Luckily, there are some steps you can take to help get your business in order, such as help with financing and cutting back costs. Read more for tips on how to avoid liquidation.

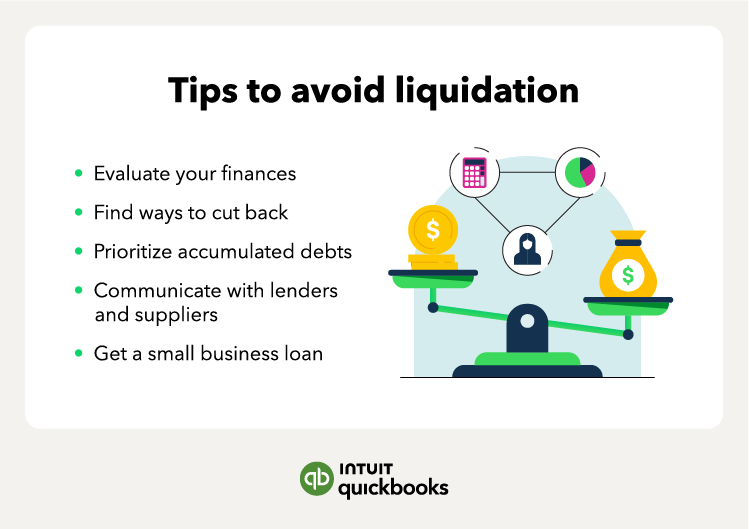

1. Evaluate your finances

To get a better idea of whether or not your business can stay afloat, you’ll need to take a look at your financial situation. Begin by asking yourself these important questions:

- Does your business currently have enough cash flow to be able to pay financial obligations such as payroll, utilities, rent, and other expenses?

- Are there enough emergency funds available for your business?

- Have you been paying your debts back on time? This includes personal debts that you’ve accumulated on behalf of your business.

Use the quick ratio formula to determine your ability to pay back bills. Also consider hiring a credit counselor through the National Foundation for Credit Counseling to help you further assess the financial situation of your business.

2. Find ways to cut back

Thinking of different ways to cut back and reduce spending can help. Consider cutting costs by:

- Finding cheaper rent in another building or negotiating with your landlord

- Outsourcing payroll or admin work

- Reducing utility usage, like getting rid of a phone line or switching to cheaper business insurance

- Checking on any outstanding equipment leases

- Reducing staff or reducing employees to part-time hours

- Limit nonessential spending, such as parking validation

You can also use the gross profit formula to help identify how much to cut back.

3. Prioritize accumulated debts

It may be a good idea to sort out all of your debts and make a list that prioritizes which ones to pay off first. It’s recommended that small businesses should first pay off things like:

- Taxes

- Payroll

- Property taxes

These payments are important to pay off first because if you owe money to creditors, the IRS will be the first in line to collect any assets that can help satisfy the claims.

After the debts above have been paid, focus on paying off bills that are 60 days overdue or more. Then, turn your attention to operating expenses, suppliers and vendors, insurance, and lastly, business credit cards.

4. Communicate with lenders and suppliers

If a majority of your business’s inventory comes from lenders and suppliers, it may be worth asking for cheaper prices or negotiating a payment arrangement to cut costs.

That’s why it’s important to build and maintain good relationships with suppliers and lenders—if you ask for a favor in return, they’re more likely to respond favorably in order to keep your business.

5. Get a small business loan

Take advantage of resources that are available to you, such as looking into a small business loan. There are several types of loans to consider, including:

- Traditional loans

- Business lines of credit

- Invoice factoring

- Specialty loans

- SBA loans

Be sure to check out the Small Business Administration (SBA) website to see if you qualify. The resources below can provide more information: