Every growing business needs reliable financial metrics to make informed decisions. One of the most important metrics is retained earnings—a key indicator of your business's profitability and how much it reinvests. Understanding how to calculate retained earnings helps you assess long-term financial health and your ability to fund growth, reduce debt, or distribute dividends.

Here’s everything you need to know about retained earnings, including the formula, examples, and practical tips. Use the links below to jump to any section:

Jump to:

- What are retained earnings?

- What affects retained earnings?

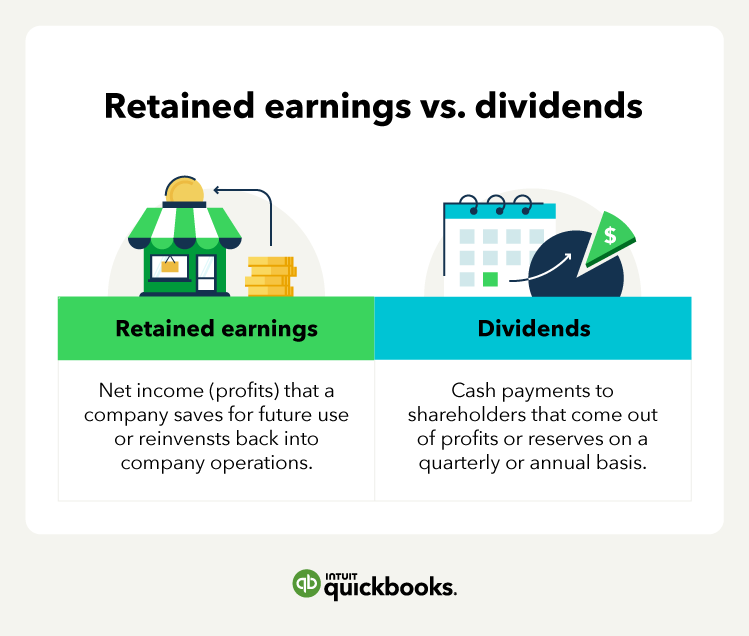

- Retained earnings vs. dividends vs. net income

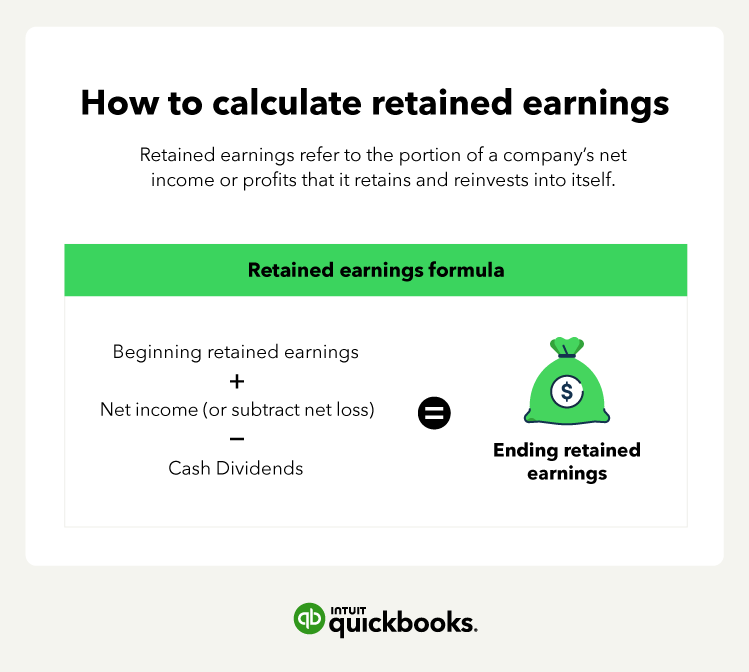

- How to calculate retained earnings

- What affects the retained earnings balance?

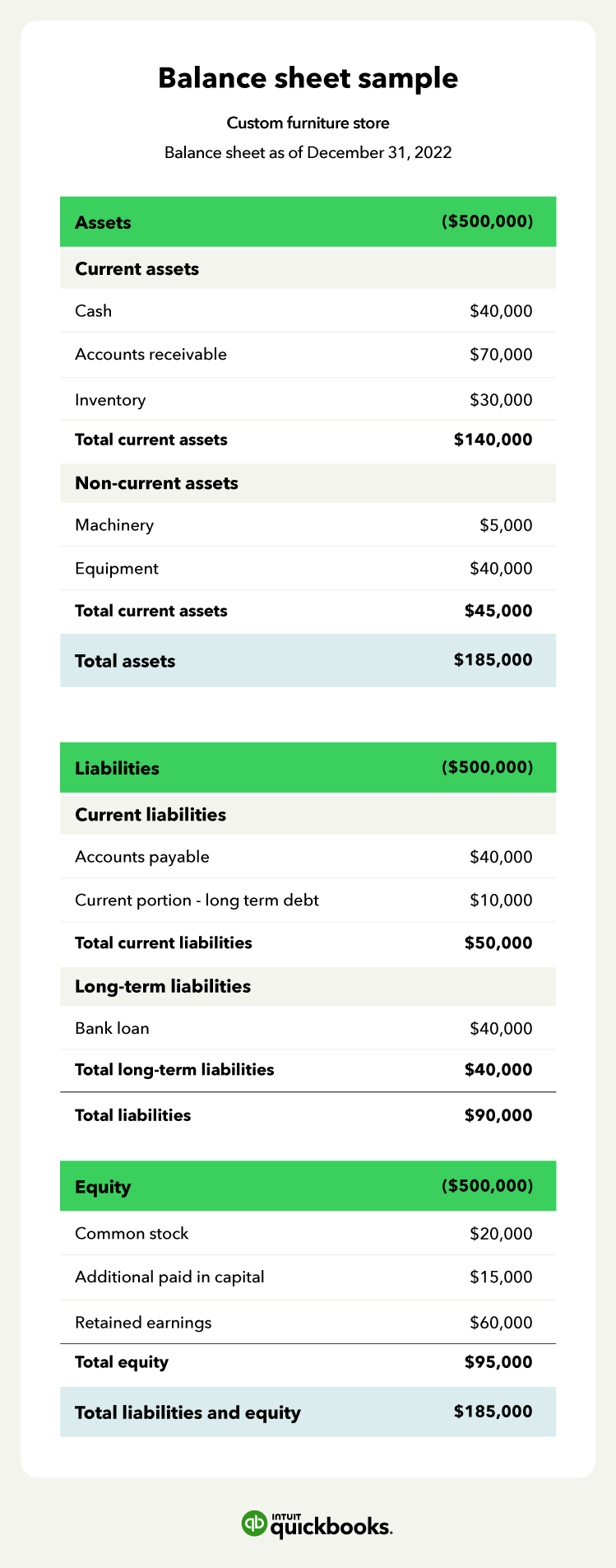

- How retained earnings appear on the balance sheet

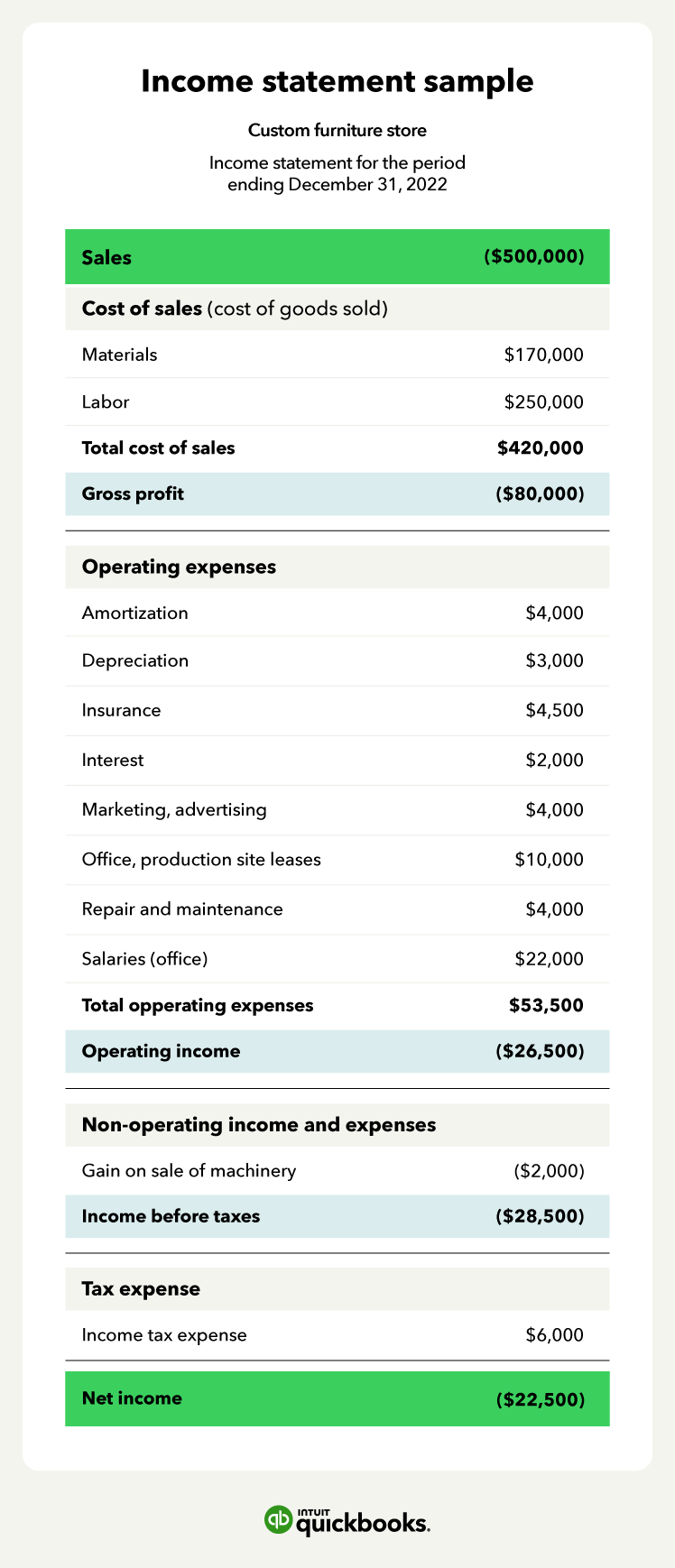

- Income statement sample

- Classifying assets and liabilities

- Balance sheet sample

- Prep early for a stress-free tax season [Conclusion]