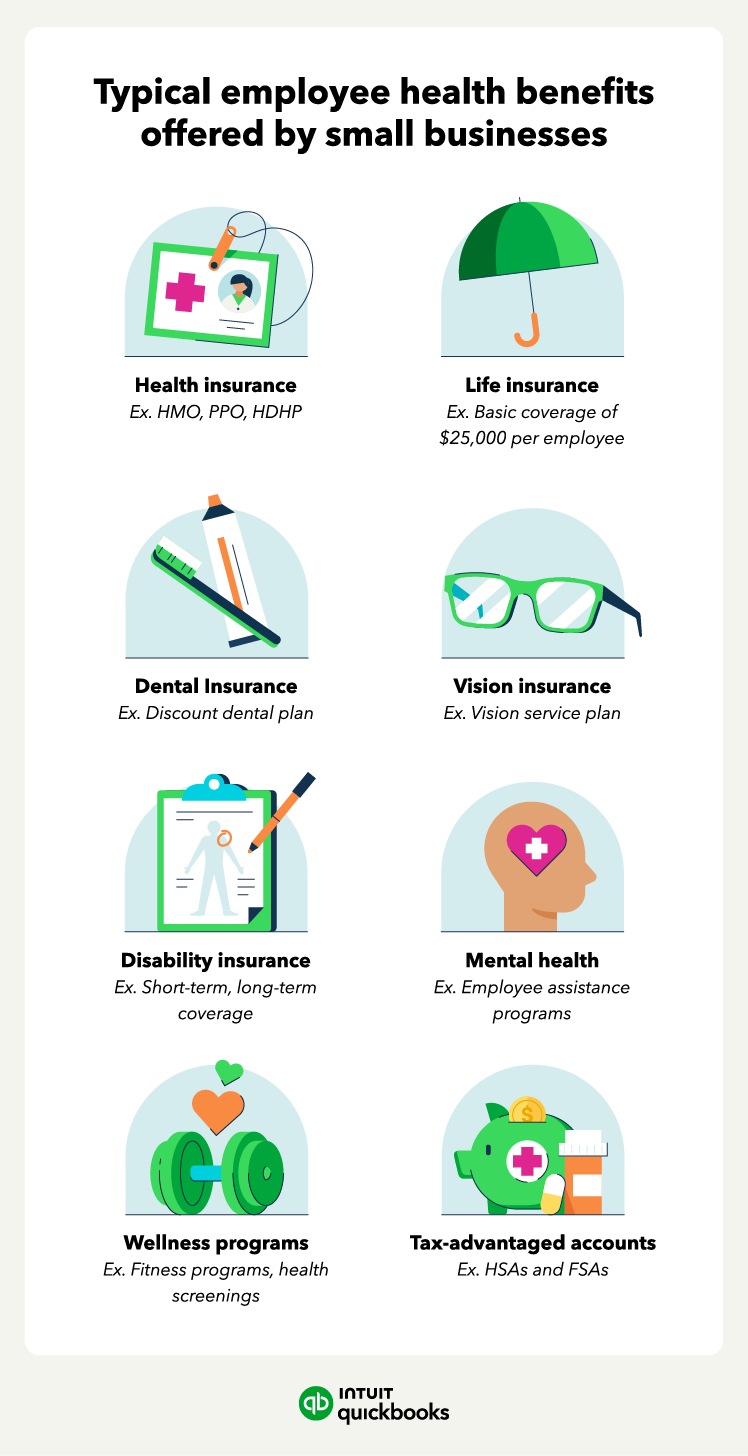

Types of health benefits you can offer

There are various health benefits you can offer. Here are the top health insurance and benefits included in most small business health packages:

Health insurance

Health insurance plans typically cover a variety of medical expenses, from doctor visits and prescriptions to hospital stays and surgeries. Traditionally, group health insurance is the most common option for small businesses. It allows you to offer a variety of plans to your employees. There are different plan options to consider, such as:

- Preferred Provider Organization (PPO) offers a large network of doctors and specialists you can see without a referral, but may come with higher out-of-pocket costs.

- Health Maintenance Organization (HMO) requires you to choose a primary care physician and specialists within the HMO network. HMOs typically have lower premiums but may limit your choice of doctors.

- High Deductible Health Plan (HDHP): HDHPs have lower monthly premiums but come with a higher deductible.

Note that HDHP plans are often paired with a Health Savings Account (HSA), which allows you to save money pre-tax to cover qualified medical expenses.

Dental and vision insurance

Dental and vision insurance can help employees cover the costs of preventive care and other dental and vision services. This helps employees maintain their oral and eye health, reducing out-of-pocket expenses.

Disability insurance

Disability insurance provides financial protection if an employee becomes unable to work due to illness or injury. This benefit helps ensure income security during challenging times.

Life insurance

Life insurance offers financial support to an employee's beneficiaries in the event of their death. This benefit can provide peace of mind and help surviving family members manage financially.

Mental health

Mental health programs offer confidential counseling and support services to employees dealing with emotional or mental health challenges.

Wellness programs

Wellness Programs: Wellness programs can help employees improve their health and well-being. These programs can include things like health screenings, fitness challenges, and smoking cessation programs.

Tax-advantaged accounts

There are also tax-advantaged accounts that can help your employees save on healthcare costs:

- Health Reimbursement Arrangements (HRAs) are accounts that you can set up to reimburse employees for qualified medical expenses.

- Health Savings Accounts (HSAs) are accounts that allow employees enrolled in HDHPs to set aside pre-tax dollars to cover qualified medical expenses.

- Flexible Spending Accounts (FSAs) allow employees to set aside pre-tax dollars to cover qualified medical and dependent care expenses.

Note that, unlike HSAs, funds in FSAs generally do not roll over from year to year. However, you can set up both HSA and FSA deductions directly in QuickBooks.

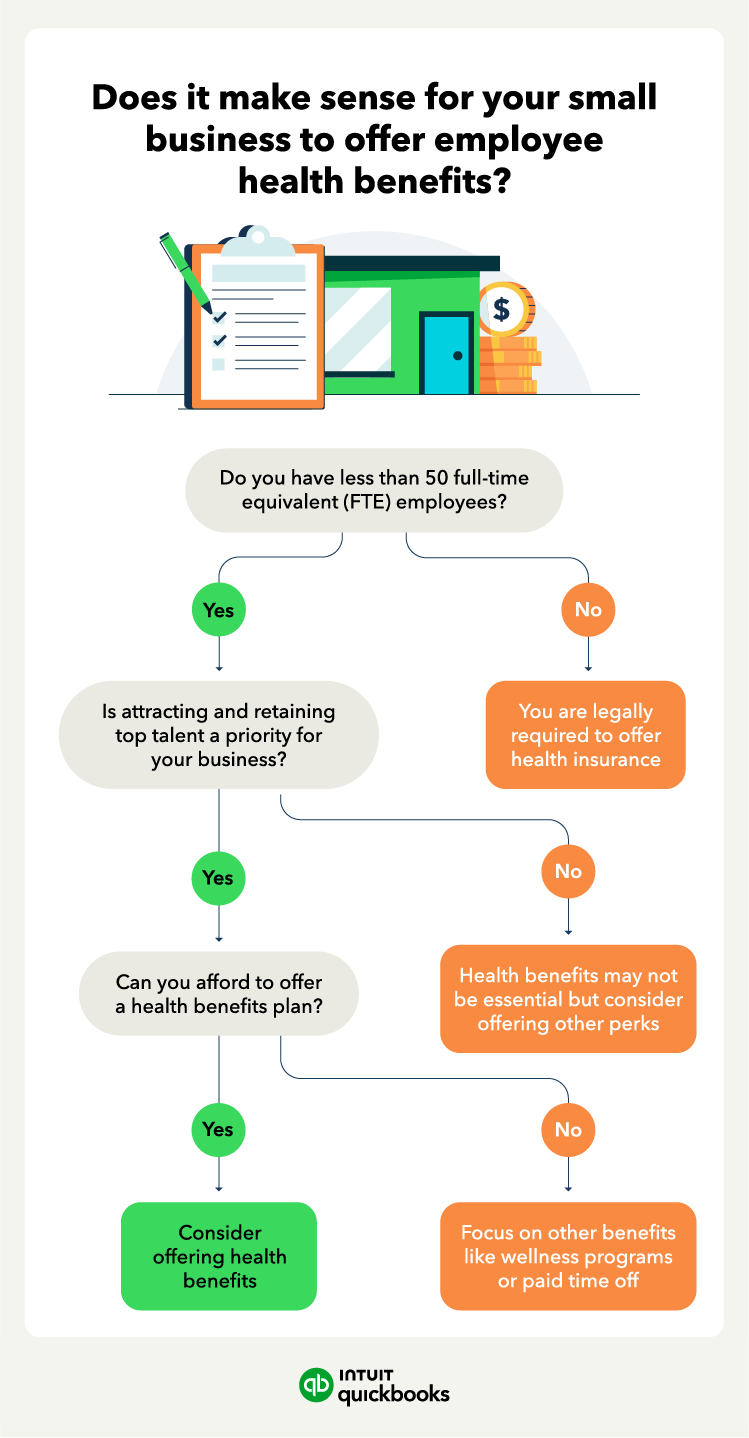

If your business qualifies as small (fewer than 50 full-time employees), you are

If your business qualifies as small (fewer than 50 full-time employees), you are

If you’re self-employed, you can sign up for

If you’re self-employed, you can sign up for