How to implement employee benefits

Deciding to offer employee benefits and getting employees enrolled doesn’t happen in a day. You need to plan ahead and ensure you have all your bases covered. If you’re ready to move forward and implement an employee benefits program for your small business, there are a few key steps to follow:

- Figure out which benefits you want to offer. This may require some negotiation with other business partners.

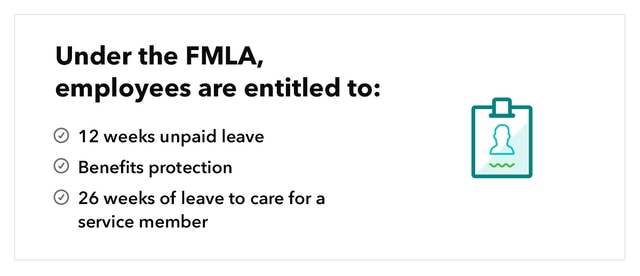

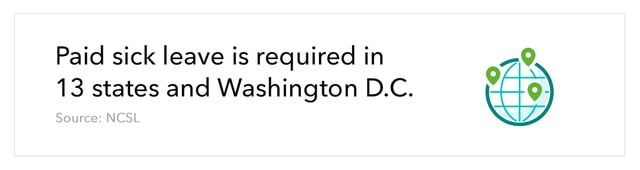

- Discuss your benefits package proposal with an advisor. Speak with an HR advisor to determine if your benefits proposal is going to violate any laws. You may also want to consult an employment law attorney.

- Find benefits providers. This applies to medical, dental, and vision, as well as 401(k) plans. QuickBooks has partnered with Allstate Health Solutions to offer medical, dental, and vision insurance . We’ve also partnered with Guideline to provide 401(k) plans .

- Set a date to open enrollment for employee benefits. Plan ahead for when you’ll roll out benefits to ensure you’re able to answer employee questions and get everything set up smoothly.

- Provide employees with documentation and instructions regarding benefits. Enrolling in 401(k) plans and other benefits may require special instructions for logging in and setting up an account. Make sure to provide employees with any information they may need to sign up.

- Review employee benefits offerings over time. You shouldn’t set and forget your employee benefits package. To remain competitive you should consider what others in the industry are offering and what benefits seem to be the most popular. You may also be able to find new providers that provide benefits management at a lower cost.

Let’s apply these steps to a real-world example. Say your small business has decided to offer the basic popular benefits—health insurance, 401(k), PTO, and life insurance. You’ll need to review the laws regarding these benefits; at this point you’d reach out to your HR advisor. Once you have a solid foundation for your benefits package, you need to find providers. Usually, 401(k) benefits, medical, and life insurance are all managed by different entities.

Now that you have your providers established, create a plan for roll out—during this time you’ll draft instructions and prepare administrative personnel. Once you open enrollment, make sure your employees have access to resources if they need help or have questions about their benefits. After employees have enrolled, it’s usually smooth sailing until it’s time to re-enroll, which gives employees the opportunity to adjust their plans. That’s really all there is to it.

While you might be eager to start offering benefits, following these basic steps can cut out a lot of headaches down the line.