Attracting and keeping talented employees takes more than a simple paycheck. As your business grows, competing for experienced workers can become more challenging.

According to a QuickBooks report, 2 in 5 small businesses expect to hire, increasing competition for skilled employees. And when wages alone aren't enough, the benefits you offer start to matter more.

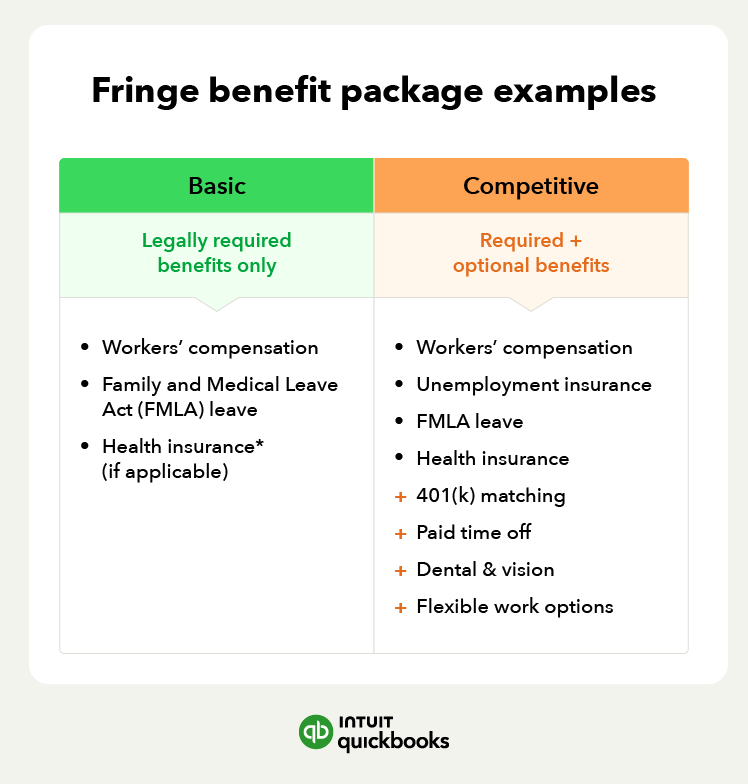

To stay ahead, small business employee benefits like fringe benefits can add value to your compensation package and help you retain top talent.

Let's explore how fringe benefits work, the different types, and what to consider when offering them:

Jump to: