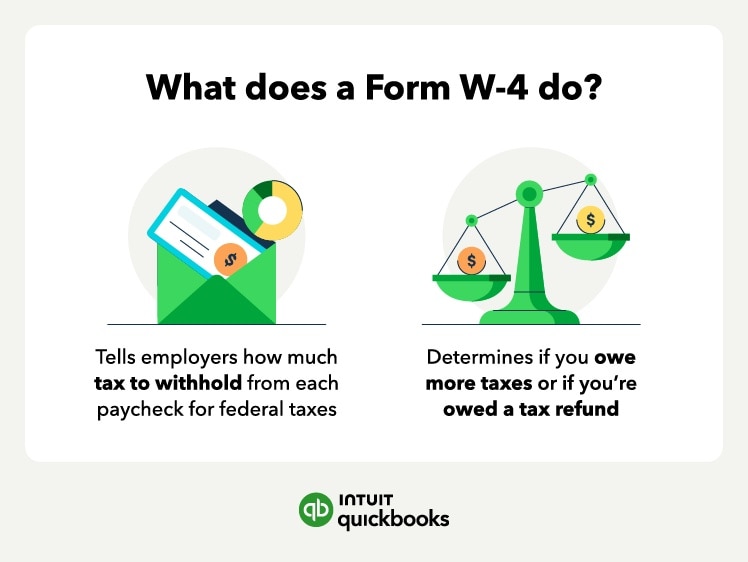

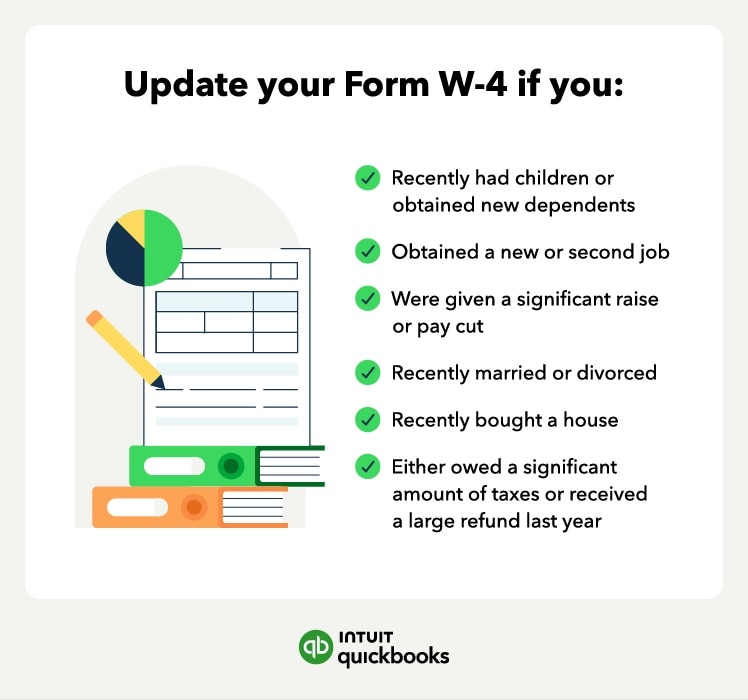

If you’ve started a new job recently or expect tax changes in 2026, your employer has likely handed you an IRS Form W-4. This simple tax form plays a big role in your finances because it tells your employer how much tax to withhold from each paycheck.

Even seasoned business owners sometimes struggle with tax forms, and the W-4 is no exception. But once you understand how it works and what each section means, filling it out becomes much easier.

This guide walks you through the form step by step, explains what’s changed, and helps you choose the right withholding amount for your situation.

What to know when filing a Form W-4

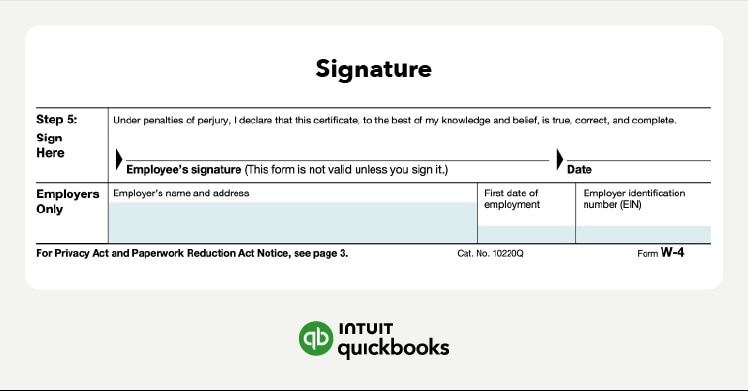

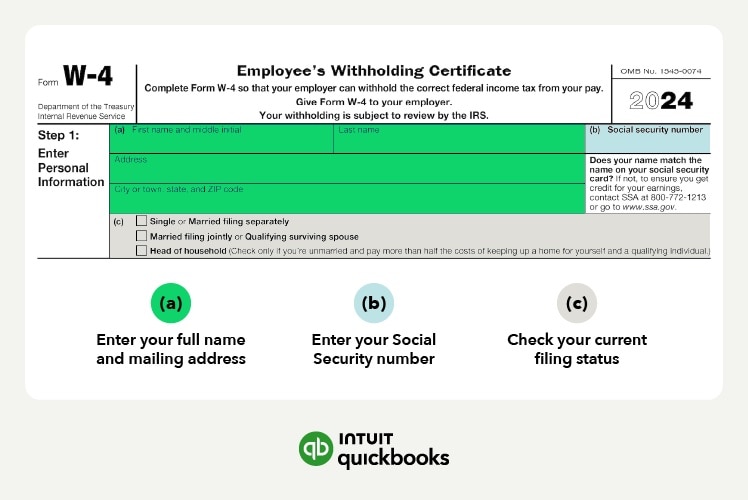

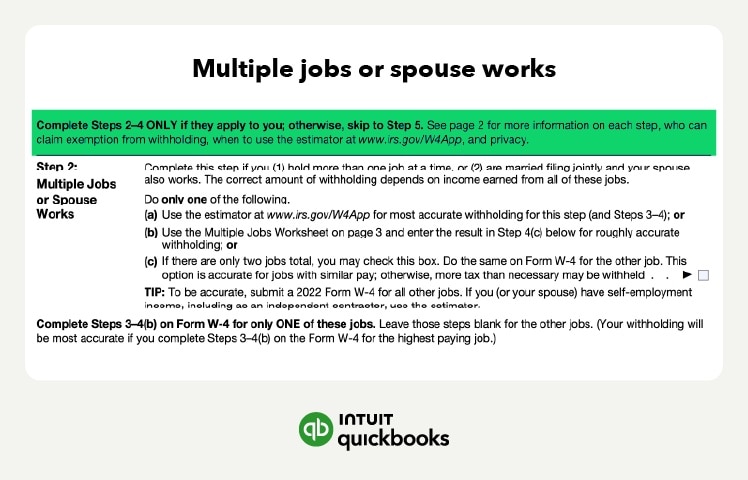

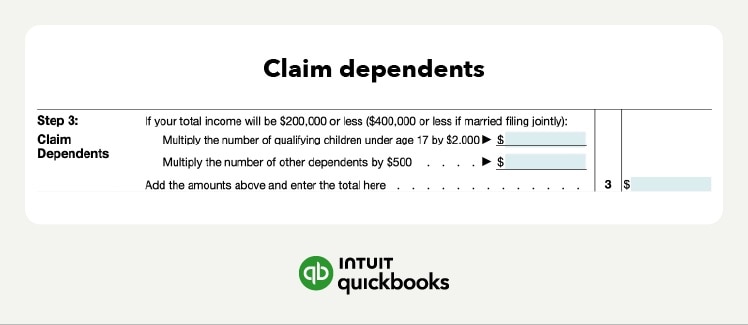

How to fill out a W-4: Step by step

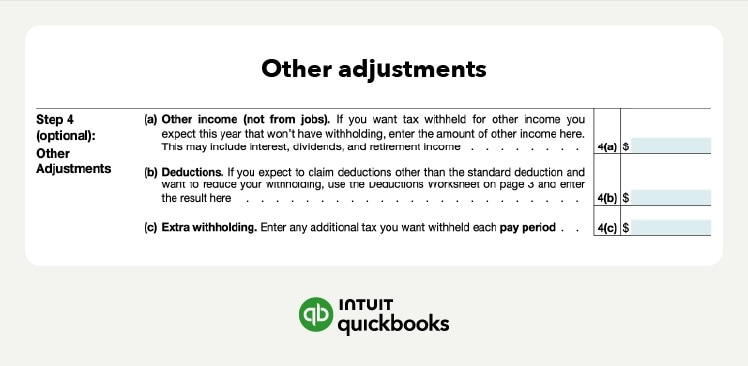

If you want more cushion at tax time you can enter a small extra amount in Step 4(c). Adding

If you want more cushion at tax time you can enter a small extra amount in Step 4(c). Adding