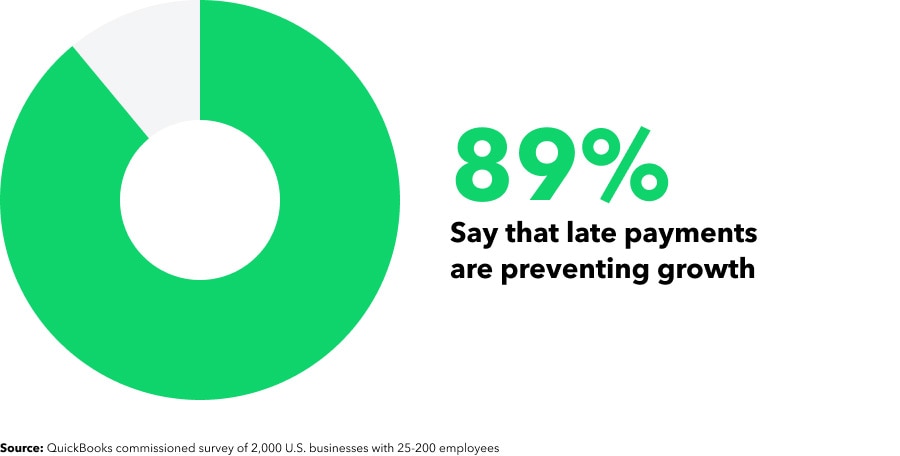

76% of businesses said that their company must address its late payments before they could focus on growth. And 89% of these businesses said that late customer payments have set back their company’s long-term growth goals.

Late payments ultimately hold you back from completing more pressing tasks, but when customer invoices are paid on time, it enables you to focus your time and funds on growth.

How do outstanding invoices impact business owner stress levels?

“A business entity that is weighed down by the outstanding payments is more likely to face a downfall because of the fewer payment reviews, less payroll, and reduced productivity. This struggle further leads to the diminishing morale of the employees.

Late payments not only affect the businesses. Rather, it affects the entire economy. Due to the late payment issues, the GDP of an economy is mainly concerned. Further, the company weighed down by the sizable outstanding amount finds it hard to maintain smooth financial operations.”

- David Reid, Sales Director at VEM Tooling

Outstanding invoices don’t just impact cash flow and business growth. They can also cause anxiety and impact a business owner’s stress levels.

Worrying about late payments, cash flow, and how you’re going to pay your monthly business overheads is stressful. 78% of mid-sized businesses surveyed said they were more stressed about late customer payments this year compared to previous years.

Overdue invoices are a source of unnecessary stress, and a business owner’s energy could be better spent on doing more essential tasks that grow the business. To reduce unnecessary stress, businesses need to minimize the number of outstanding invoices they deal with. But what can businesses do to lower their number of late payments?

How to minimize overdue payments

Our research showed that overdue payments held businesses of all sizes back from sustainable growth. But the issue is especially affecting growing mid-sized businesses.

Here are two ways mid-sized businesses can manage and reduce the number of overdue payments:

1. Use payment processing solutions to streamline financial admin

Using the right technology and software for your business will help you keep your financial administration processes on track. When you organize your financial administration, it’s much easier to know when you can expect incoming and outgoing payments. You can also easily follow up when payments are due or late.

Even in 2021, 44% of mid-sized businesses stated that anywhere from half to all of their payment processes (processes such as using spreadsheets rather than a digital or automated system) were manual. 66% of businesses also agreed that their current payment systems did not do enough to effectively handle late customer payments.

Unfortunately, using manual payment processing methods increases the likelihood of human error and doesn’t allow you to automate any of your financial admin processes. But using cloud-based payment processing solutions allows you to improve accuracy and automate parts of your invoice payment process, including protocol for handling late payments.

Looking for a quick guide to speeding up payments and following up on overdue invoices? Download our checklist: 21 steps for avoiding late payments and getting paid on time.

2. Create realistic and effective financial terms

Some late payments are inevitable. Life happens and you can’t control what’s going on in your clients’ worlds. But there are steps you can take to minimize your risk of late payments.

Taking the time to set realistic expectations and payment terms with your clients can help keep everything on track. You’ll know when to expect payment and clients will know when they need to make payment.

Internally, you’ll also need to train team members and standardize company protocol for handling late payments.

Incorporating automated payment processes into your financial admin software can also help ensure clients and team members stick to payment protocol. By simply storing all your invoices and payment details in one place, you can speed up your processes and help keep things on track.

The way forward

“Many small business owners barely have enough time to run their business, let alone chase after customers to pay outstanding invoices. Poor accounts receivable management leads to poor cash flow, often business owners do not realize it until it negatively impacts their business. It's vital for small businesses to equip themselves with the right payment processing solution that is affordable.”

- Nichole Heid, Tax Advisor and Business Consultant

When businesses implement the right payment processing technology across their financial administration processes, it’s easier to process both on-time and late payments. When you implement effective processes, it’s also easier to prevent late payments.

The key is to find a payment processing solution that meets your business’s needs. Then, once you’ve streamlined your financial admin processe, take some time to understand and implement payment processing best practices. Together, these efforts should improve your ability to receive more payments on time.

To learn more about how to expedite customer payments and/or efficiently follow up on past due invoices, download our checklist: How to speed up payments or follow up on past due invoices. If you would like to learn more about B2B payments, then take a look at another article: How to manage and accept B2B payments: A guide for small businesses.

QuickBooks Payments can help you with your business’s growing payment needs. QuickBooks Payments also integrates with QuickBooks Online Advanced. Simply activate it in your account to get any job paid, online or on-site. Learn more here.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit and application approval. Subscription to QuickBooks Online or QuickBooks Online Advanced is required. Additional terms and conditions apply.

On behalf of Quickbooks, Wakefield Research identified and contacted 2,000 U.S. small business owners with 25 to 200 employees in November 2021 to complete a 30-question online survey about business growth and operations.

QuickBooks Online Advanced welcomes the reuse of this data by others, provided the original source is cited with attribution to this link.