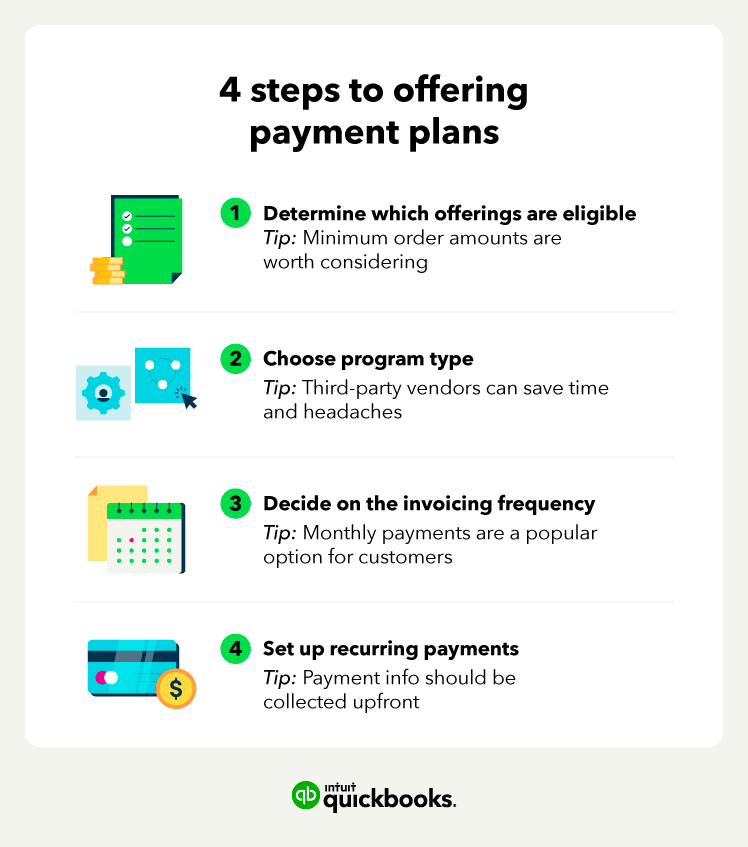

There are a number of ways to optimize your offering of partial payments to customers. Depending on the software you use for payment, you may already possess the option to offer this benefit. If this isn’t already in place, you should follow the four steps below.

Determine eligible products and services

Are you going to allow only certain products or services to use this benefit? For example, you may decide that only orders over $100 are eligible.

Predetermine your criteria and consider all of your options such as:

- Popular store items

- Incentivizing customers to increase their order

- Ease of breaking a price into smaller portions

Choose a program type

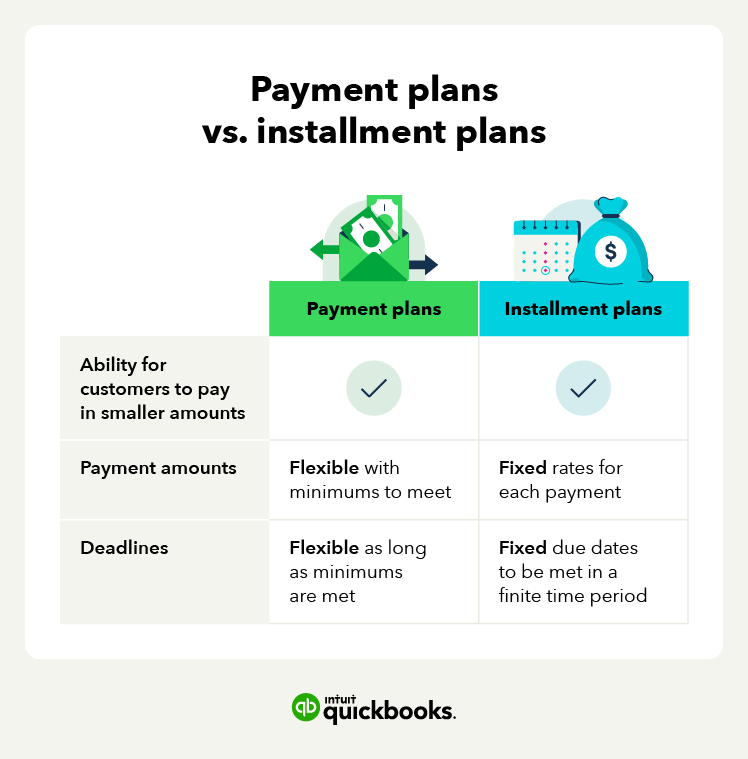

There are two main ways a business can accept partial payments and installment payments: By managing installment plans within the business, or with the help of a third-party vendor.

Self-management: By managing payment plans yourself, you’ll be in charge of conducting credit checks, issuing financing, and managing payment collections.

Third-party management: By using a third-party vendor, they’ll make credit offers and collect payments. A benefit of third-party vendors is that they can save you both time and money and help keep you out of legal trouble.

Decide on the invoicing frequency

You have complete control over the invoicing frequency. As a business owner, the more cash you can rake in each month, the better. You don’t want to have outstanding balances for too long and risk having to cover the missing capital.

However, you also want to allow breathing room for payments from your customers, seeing as that’s the main draw of partial payments. Many businesses choose a monthly payment plan, whereas others place it on a weekly schedule.

Set up recurring payments

Within your payment processor, set up recurring payments specific to each customer. You’ll need the customer’s:

- Name

- Phone number

- Linked account or credit card

After you’ve set them up in your system, all payments moving forward should come from their linked account or credit card.