1. Gather unpaid invoices

In step one, you’ll gather all the unpaid invoices you have for customers. That’s any invoice with an open balance on it, even if it’s a partial balance.

2. Calculate days past due

For each invoice, you’ll want to calculate the number of days past due. For example, if the invoice was due on the 15th and it’s now the 22nd, the invoice is seven days past due.

3. Categorize invoices

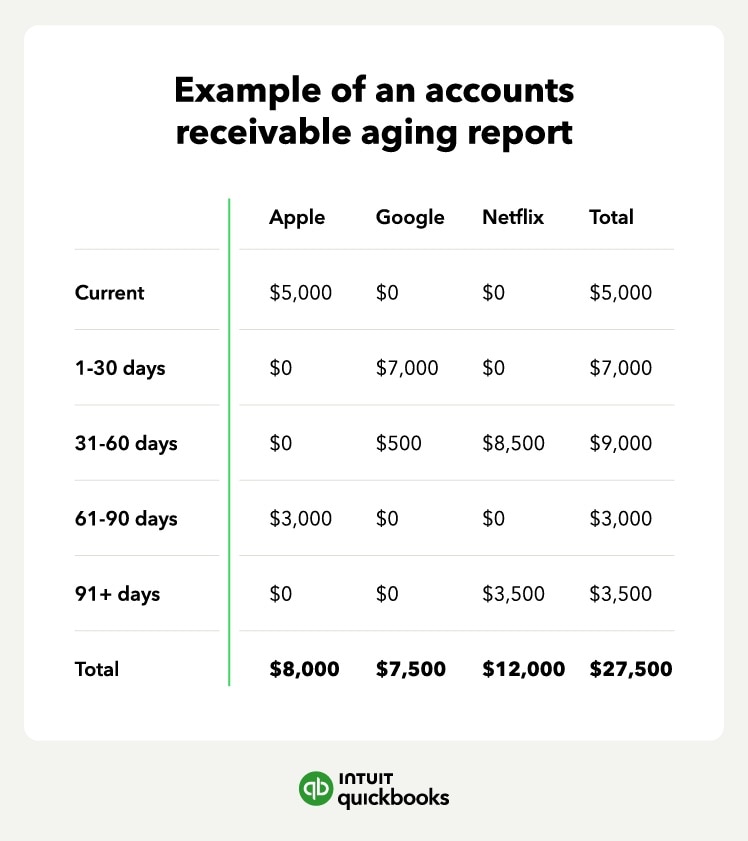

Next, you'll want to group each of the customer’s invoices according to the aging schedule.

For example, a customer has the following unpaid invoices:

- One invoice for $1,000 that is not past due

- Two invoices that total $1,500 and are 15 days overdue

- One invoice for $100 that is 37 days overdue

You would then categorize those invoices based on your aging schedule ranges. A sample accounts receivable aging report would then be:

- Current: $1,000

- 1–30 days: $1,500

- 31–60 days: $100

4. Create an aging schedule

You’ll list all your customers that have an open invoice and then do the same thing we did in step three for all your customers. Once complete, you can total the amounts to see how much of your invoices are current, 1-30 days past due, and so on.

A/R aging reports aren’t perfect, however. For example, many business owners bill customers toward the end of the month. This can make an aging A/R report misleading because if a customer pays just a few days later, it can show up as past due on the report.

Set automatic reminders for customers once invoices hit the 30-day mark to speed up collections and reduce overdue balances.

Set automatic reminders for customers once invoices hit the 30-day mark to speed up collections and reduce overdue balances.