Enhanced customer experience

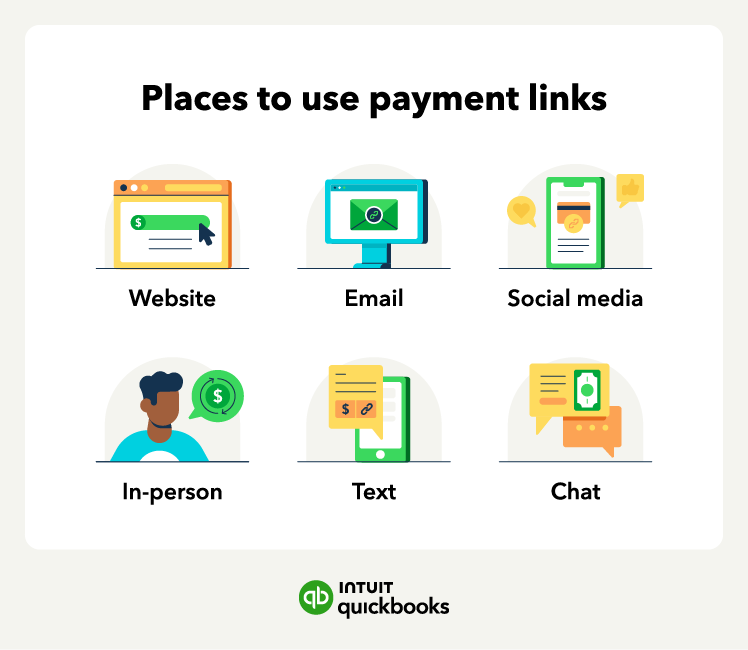

Payment links improve the customer experience because customers can pay anytime, anywhere, with convenient electronic payments, regardless of business hours or your physical location. They are even optimized for smartphones, allowing easy and quick payments on the go.

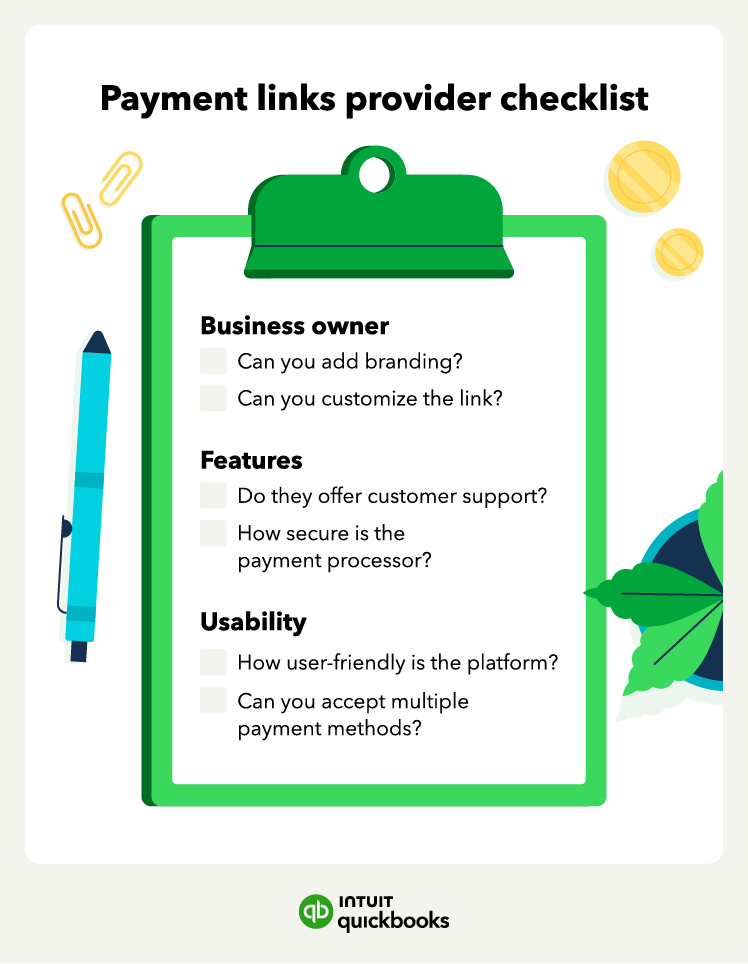

Reputable providers often allow you to offer various payment methods on the linked page, such as credit/debit cards and popular digital wallets, which also makes it easier to pay.

Increased sales

A streamlined payment process makes it easier for customers to complete their purchases, helping to fight shopping cart abandonment. It can also facilitate quick transactions for products or services promoted instantly on social media or during live chats.

With payment links, you can also easily accept payments from international customers and create a clear and direct path to purchase from all your marketing efforts.

Operational efficiency

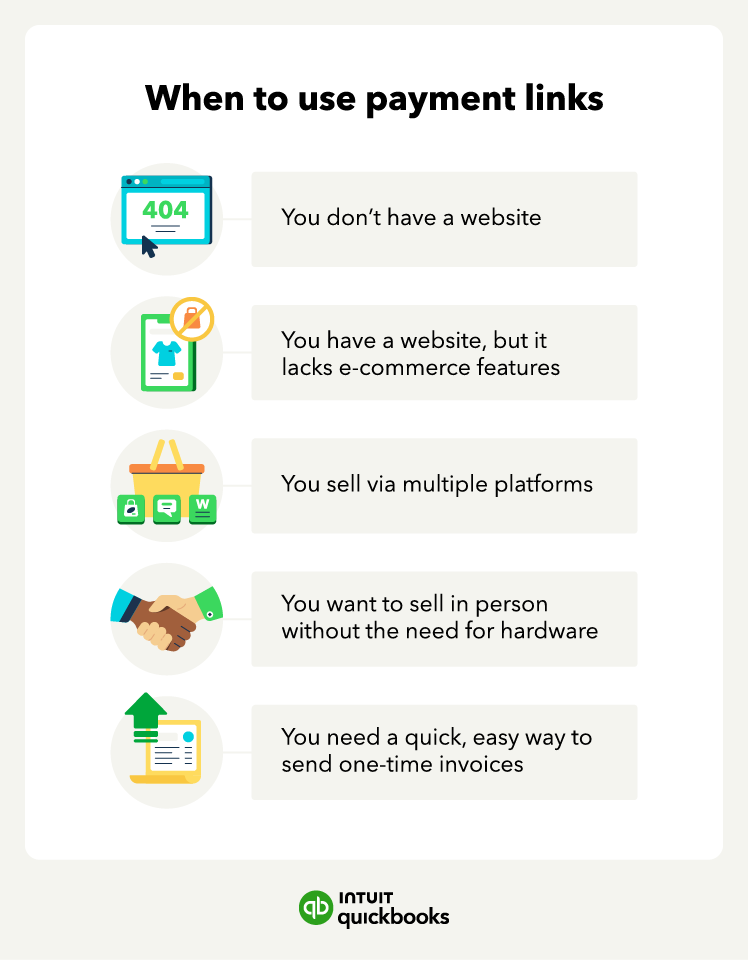

Payment links are ideal for solopreneurs, freelancers, or small businesses without an online store because they encourage prompt payment. They can also help you tackle and anticipate disruptive cash flow problems.

Versatile for various scenarios

Payment links are highly adaptable for custom invoicing for tailored services, accepting donations for nonprofits or fundraisers, selling event tickets without a dedicated ticketing platform, and collecting payments for pre-orders or back-ordered items.

QuickBook's AI payments agent can help you monitor your payment process in all these scenarios, optimizing invoicing and payment collection. You gain access to it with QuickBooks Payments.

Cost-effectiveness

With payment links, you can avoid the need for expensive e-commerce platform subscriptions or complex point-of-sale (POS) systems.

Payment links can eliminate the necessity for costly card readers or terminals, and easily adapt to growing sales volumes without requiring significant infrastructure changes or increasing operational costs.