How to calculate payroll taxes: Tips for small business owners

Today, you’re going to meet Hector—a small business owner running a bakery in the sunny state of California. As a business owner, Hector has a lot on his plate. Not only is he responsible for baking delicious treats for his customers, but he also has to abide by the law and pay payroll taxes to Uncle Sam.

Calculating payroll taxes can be difficult, especially for business owners like Hector whose passion is creating mouth-watering pastries—not crunching numbers in the back room. To help small business owners like Hector and yourself, we’ve created this guide and video about how to calculate payroll taxes. Make sure to subscribe to the QuickBooks YouTube channel for more content like this, and smash that like button if you find this video valuable.

Now, let’s get to the fun part. Read through to learn about the different payroll taxes and how to calculate them, or jump to a specific section using the list below.

- What are payroll taxes?

- New changes to payroll taxes in 2024

- Payroll taxes: Where to start

- What employees are taxable

- The types of payroll taxes you will pay

- Federal income taxes

- State and local taxes

- FICA and FUTA

- State unemployment (SUTA)

- Self-employment tax rate (SECA)

- Payroll tax penalties

- How to make calculating payroll taxes easier

What are payroll taxes?

Payroll taxes are taxes based on salaries, wages, commissions and tips an employee makes. They are withheld from their paychecks by their employer, who then pays them to the government. Payroll taxes are used to fund social insurance programs like Social Security and Medicare and show up as FICA and MedFICA on pay stubs.

- It’s important not to confuse federal payroll taxes with federal and state income taxes, even though both are taken out of an employee’s pay. The difference between these two taxes is that payroll taxes fund specific social programs, while income taxes go to the U.S. Treasury’s general funds. Additionally, every worker pays a flat payroll tax rate, while income taxes vary based on an employee’s earnings.

New changes to payroll taxes in 2024

Business owners must stay informed about the latest payroll tax and employee benefits updates. Here are some key changes that went into effect for 2024.

Social Security tax change

The Social Security tax wage base has increased from $160,000 in 2023 to $168,600 in 2024. This means an additional $8,600 of an employee's earnings may be subject to Social Security tax.

Retirement plan contributions

The contribution limit for 401(k) and 403(b) plans has increased to $23,000 annually, up from $22,500 in 2023. Employees aged 50 and over can contribute an additional $7,500, for a total of $30,500.

Flex Savings Account (FSA) contributions

In 2024, the contribution limits for Health Care Flexible Spending Accounts (HCFSA) and Limited Expense Health Care Flex Spending Accounts (LEX HCFSA) were raised by $150. FSA participants can contribute up to $3,200 through payroll deductions throughout the plan year. These contributions are exempt from federal income tax, Social Security tax, and Medicare tax.

The maximum annual contribution limit for the Dependent Care FSA (DCFSA) remains the same in 2024. It's still capped at $5,000 per household, or $2,500 for those married and filing separately.

Payroll taxes: Where to start

Now that you know what payroll taxes are, where do you start? As a small business owner, there are numerous taxes you are responsible for paying. Some taxes for small business owners include:

- Payroll taxes

- Federal and state income taxes

- Capital gains taxes

- Self-employment taxes, when applicable

- Property taxes

- Dividend taxes

- Employers aren’t the only ones responsible for paying taxes, either. Employees also have to contribute their fair share, including payroll taxes and federal and state income taxes.

Taxable employees

Whether you’re a salaried employee, an hourly employee, seasonal employee, part-time employee, or full-time employee, you’re taxable. If you hold a job in the United States, you are responsible for paying payroll taxes on top of federal and state income taxes. All employee gross income, tip income, commissions, stock options, bonuses, and gifts are taxable.

The types of payroll taxes you will pay

When it comes to payroll taxes, there are a few different taxes you will pay, including:

- Federal income taxes

- State and local taxes

- FICA

- FUTA

- SUTA

- SECA

- In the sections below, we’ll cover each of these taxes and how to calculate them.

Federal income taxes

As stated earlier, income taxes are different from payroll taxes but are taken out of an employee’s paycheck. Federal income taxes are levied on an employee’s wages, salaries, or other sources of income. They are collected by the IRS and sent to the U.S. Treasury’s general fund to pay off debt, issue loans, and for other reasons. Employees fill out IRS Form W-4 to notify their employers of how much tax they want to withhold from their paycheck each pay period. This is based on their filing status, dependents, and any anticipated tax credit and deductions.

To calculate federal income taxes, the IRS uses tax tables (or wage brackets) and an employee’s filing status, also called marital status. The tax brackets for 2020 go as follows:

- 12%: Incomes over $9,875 ($19,750 for married couples filing jointly)

- 22%: Incomes over $40,125 ($80,250 for married couples filing jointly)

- 24%: Incomes over $85,525 ($171,050 for married couples filing jointly)

- 32%: Incomes over $163,500 ($326,600 for married couples filing jointly)

- 35%: Incomes over $207,350 ($414,700 for married couples filing jointly)

- 37%: Incomes over $518,400 ($622,050 for married couples filing jointly)

Federal income taxes are taxed at a marginal rate, which is the tax rate you’d pay on one more dollar of taxable income. For example, let’s say one of Hector’s employees is a single filer making $47,000. That employee would be in the 12% tax bracket. However, let’s say Hector promotes that employee, giving them a $5,000 raise, making their salary $52,000. In this case, the taxes would be as follows:

- The first $47,125 would be taxed at 12%.

- The additional $4,850 (which brings their total income to $52,000) would be taxed at 22%, as it exceeds the threshold for the next tax bracket.

This example illustrates that while the employee’s overall income increases, only the portion above $47.150 is taxed at the higher rate of 22%.

State and local taxes

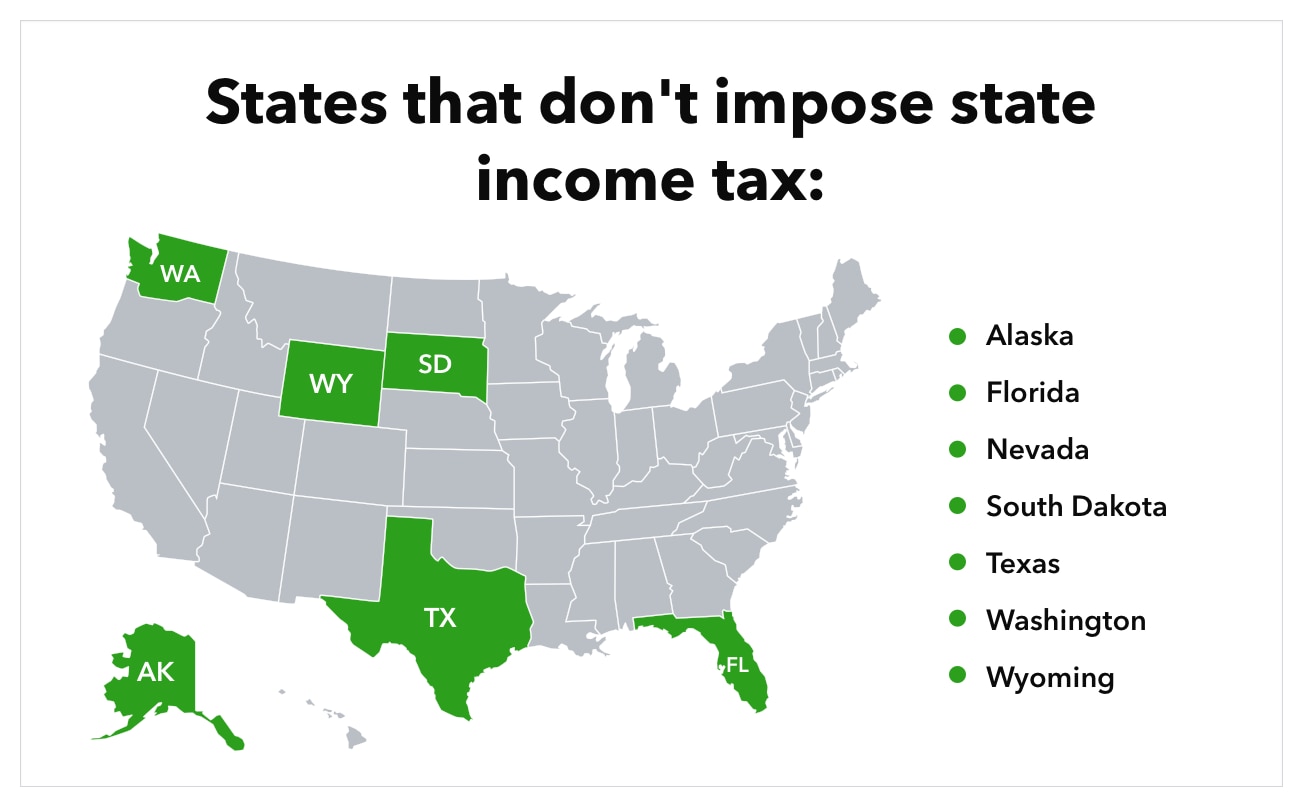

Depending on your state, you may have to pay state and/or local income taxes. Currently nine states do not impose a state income tax: Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire does have a tax on dividends and interest.

Generally, state and local taxes are lower than federal income taxes and go toward the state government. Each state and local government has its own tax rates, which means the amount you pay can vary. Fortunately, the IRS allows taxpayers to claim a deduction on their federal tax return for the amount they paid in state income tax.

If you recall, Hector’s bakery is located in California, which has one of the highest state income tax rates in the country. There are nine tax rates in California, starting at 1% and going up to 12.3%. Similar to calculating federal income taxes, taxpayers have to make adjustments to their gross income to get to their adjusted gross income. Adjustments are made by taking certain tax deductions and credits into consideration. You will then use your state’s tax rates to determine how much state income tax you owe.

FICA and FUTA

When it comes to payroll taxes, there are two types: FICA and FUTA, which we’ll cover in detail below.

What is FICA?

FICA stands for the Federal Insurance Contributions Act, which are taxes used to fund both Social Security and Medicare programs. Social Security helps older Americans, disabled workers, and families when a spouse or parent dies. Medicare, on the other hand, is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with end-stage renal disease.

For employees, the following amount will be taken out for FICA taxes:

- 6.2% of an employee’s gross pay goes to Social Security tax

- 1.45% of an employee’s gross wages goes to Medicare tax

In total, 7.65% of an employee’s gross wages will go toward the FICA tax. On top of this, employers must match these percentages, for a total of 15.3%. So, while Hector collects FICA taxes from his employees to give to the IRS, he will also be responsible for paying 7.65% of FICA taxes.

However, for employees who make more than $200,000, the employer must withhold an additional amount for the additional Medicare tax. The additional Medicare tax rate is 0.9% of earned income over

- $250,000 for joint filers

- $200,000 for singles

- $125,000 for married persons filing separately

This tax is paid solely by the employee. The only responsibility of the employer is to withhold it.

What is FUTA?

One payroll tax that employees aren’t responsible for is unemployment taxes, called FUTA taxes, named after the Federal Unemployment Tax Act. Instead, employers take on the responsibility of paying FUTA taxes, which help unemployed workers claim unemployment insurance. Typically, employers will pay both federal and state unemployment taxes, deposit the tax each quarter, and file an annual form.

The 2024 FUTA tax rate is 6% and applies to the first $7,000 you pay in wages to each employee during the year, which is the federal wage base. However, business owners can take a credit against their FUTA tax for amounts paid to their state’s unemployment funds. The credit can be as much as 5.4% of FUTA taxable wages.

For example, let’s say Hector owes the FUTA tax (6%) and is eligible for the maximum credit deduction (5.4%), which means his FUTA tax liability will be 0.6% of the first $7,000 he pays to each employee. In this scenario, here’s how Hector will calculate his quarterly FUTA liability:

- Hector will add up the wages paid during the reporting period to employees subject to FUTA tax$7,000 (Mary the baker) + $4,000 (Paul the cashier) + $5,000 (Daisy the manager) = $16,000 wages earned in Q1

- Hector will then multiply the quarterly wages of his employees by 0.006, assuming he’s eligible for the maximum credit of 5.4%$16,000 X 0.006 = $96 FUTA liability for Q1

State unemployment (SUTA)

Similar to federal unemployment taxes, business owners are responsible for state unemployment taxes set forth by the State Unemployment Tax Act (SUTA). However, SUTA tax rates and wage bases vary by state, so you will have to check with your state about these details and requirements.

To calculate the SUTA tax, you will follow the same process as calculating the FUTA tax. For example, California has a wage base of $7,000 per employee and a SUTA tax rate of 3.4%. Because Hector’s bakery is in California, he will follow this example:

- $7,000 per employee X 3 employees (Mary, Paul, and Daisy) X 3.4% = $714 in SUTA tax

Self-employment tax rate (SECA)

The Self-Employed Contributions Act established the SECA tax, which is a tax levied from the U.S. government on those who work for themselves. Self-employed individuals must pay the tax equivalent to both the employer and employee portions of the FICA tax. This means they are taxed at 12.4% (6.2% + 6.2%).

The SECA tax is calculated on the basis of net earnings, which is gross income minus any expenses incurred while doing business. There are also limits to the SECA tax. Social Security tax is only applied to the first $168,600 of a self-employed worker’s net pay, which results in a maximum tax of $20,906.40 for 2024.

The Medicare tax rate is 2.9%, and there are no exemptions above a certain income. All in all, the SECA tax comes to 15.3% (12.4% + 2.9%).

- For example, let’s say Hector only works for himself and classifies as self-employed. If he makes $100,000, he will have to take out 15.3% of that income for SECA taxes, which would be $15,300 ($100,000 X 0.153%).

Payroll tax penalties

While filing and paying taxes isn’t everyone’s favorite thing to do, it needs to be done. If you don’t, you can face some pretty serious penalties. Below are the failure to deposit penalty percentage rates you could face:

- 1–5 days late: 2% penalty

- 6–15 days late: 5% penalty

- 16+ days: 10% penalty

- More than 10 days after the first IRS bill: 15% penalty

In addition to late payment penalties, you can face other payroll tax penalties, such as

- Failure to file penalty: 5% per month of unpaid tax on the due date, reduced by the amount of failure to file penalty for the same month (maximum is 25%)

- Failure to pay penalty: 0.5% per month of unpaid tax, then 1% per month after Notice of Intent to Levy (maximum is 25%)

- Along with these penalties, you also have to pay interest. Interest rates are set quarterly and typically vary between 3% and 6%.

How to calculate employee payroll taxes

Step 1: Gather employee information and payroll data

Collect employee details, including W-4 forms, pay rate, hours worked, and any pre-tax or post-tax deductions. Determine the correct pay period, for example, weekly, biweekly, or monthly.

Step 2: Calculate gross pay

Multiply the employee’s pay rate by the number of hours worked. Include any overtime pay, bonus, commissions or other earnings.

Step 3: Calculate taxable wages

Add up the pre-tax deductions, such as health insurance premiums and retirement contributions, from gross pay. Subtract this total from the gross pay. This number is the amount of taxable wages.

Step 4: Calculate federal income tax withholdings

Refer to the employee's W-4 form and the IRS Publication 15-T tax tables to determine the correct withholding amount based on their filing status, allowances, and pay frequency.

Step 5: Calculate FICA taxes (Social Security and Medicare)

Multiply your employee’s taxable wages by the Social Security tax rate and by the Medicare tax rate. For 2024, the Social Security tax rate is 6.2% for both employer and employee, with a wage base limit of $168,600. The Medicare tax rate is 1.45% for both employer and employee, with no wage base limit.

Step 6: Calculate additional Medicare tax, if applicable

For employees earning over $200,000, apply the additional 0.9% Medicare tax on wages exceeding this threshold.

Step 7: Calculate State and Local Income Taxes (if applicable)

Follow your state and local tax laws to determine withholding amounts based on the employee's W-4 and residency. These can vary significantly by location.

Step 8: Subtract post-tax deductions

Deduct any post-tax deductions like union dues or wage garnishments from the employee’s pay.

Step 9: Calculate net pay

Subtract all calculated taxes and deductions from gross pay to determine the employee’s net pay, also known as their “take-home pay.”

Remember that employers are responsible for FUTA taxes and usually pay SUTA. These do not come out of the employee’s paychecks. However, as a business owner you must track them as they are paid out of a company's gross wages.

Make calculating payroll taxes easier

You made it! You learned the ins and outs of the various payroll taxes, how to calculate them, and the penalties you can face if you avoid taxes. As a small business owner, you have a lot on your plate. The last thing you want is to make an error when filing your payroll taxes that could result in a penalty or, worse, a tax audit.

To make calculating payroll taxes easier, invest in payroll services and software like QuickBooks to calculate payroll taxes. Payroll software is more accurate, less work, and offers tax penalty protection, meaning you can have peace of mind knowing your payroll taxes are in good hands.

Whether you've started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.