Setting up a payroll system can feel like a steep climb if accounting isn’t your strong suit, but it’s the backbone of your business's health. In fact, when asked what one job they would trust AI to do perfectly, 17% of small business owners ranked bookkeeping and taxes as the top tasks they would outsource.

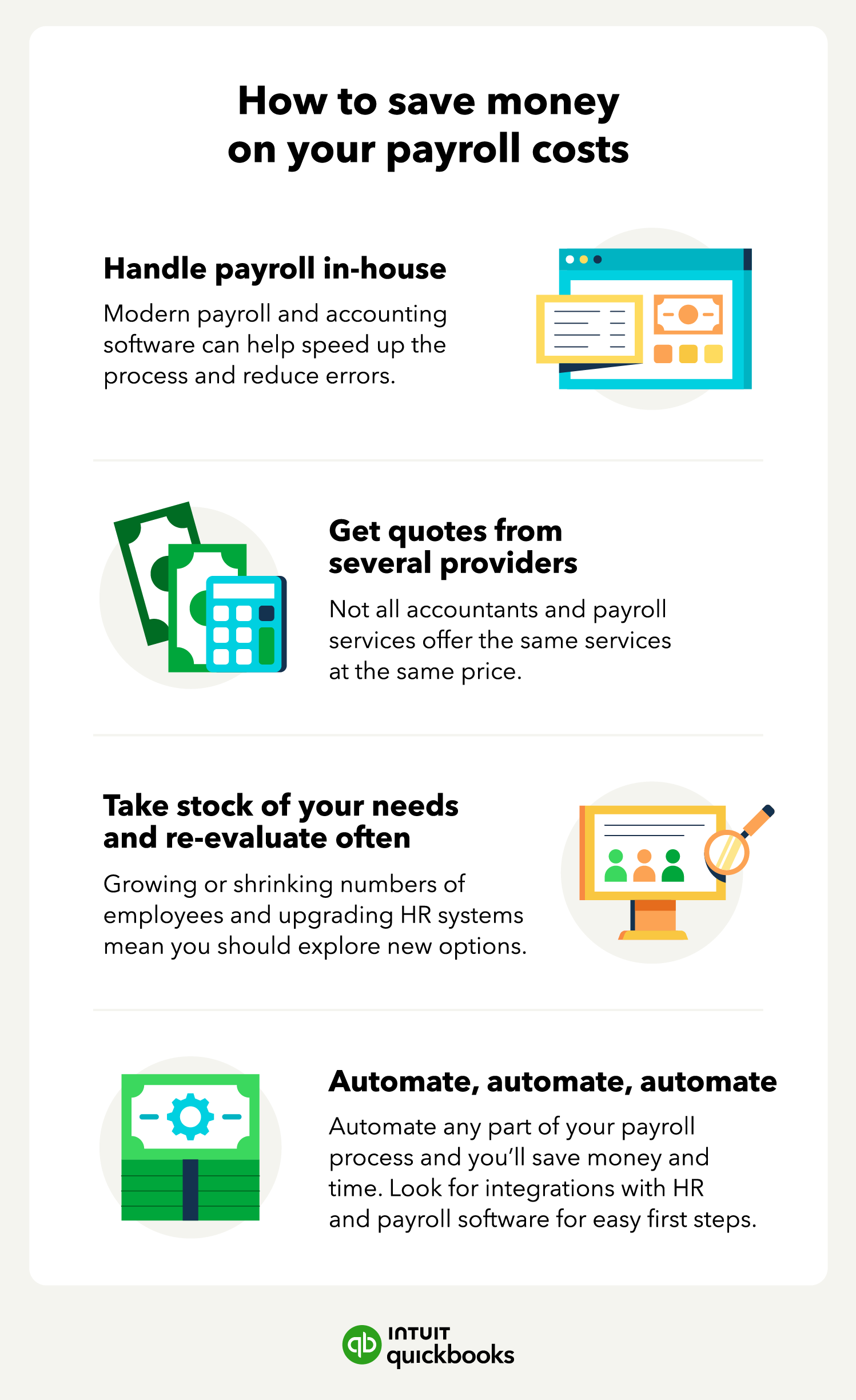

The true cost of payroll extends far beyond the salaries you pay your staff. It includes software subscriptions, tax filing fees, and the value of the time you spend managing it all.

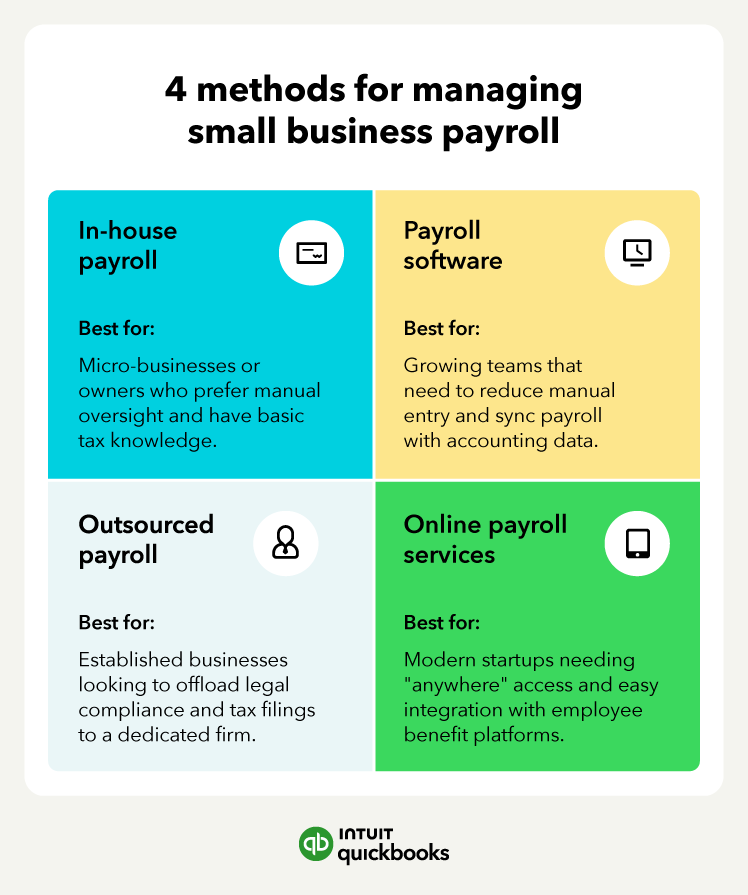

The right choice for your business depends on your company size, how often you pay your team, and the complexity of your benefits. This guide breaks down exactly what you’ll pay for different payroll methods this year.

Jump to: