Example of how to calculate gross pay

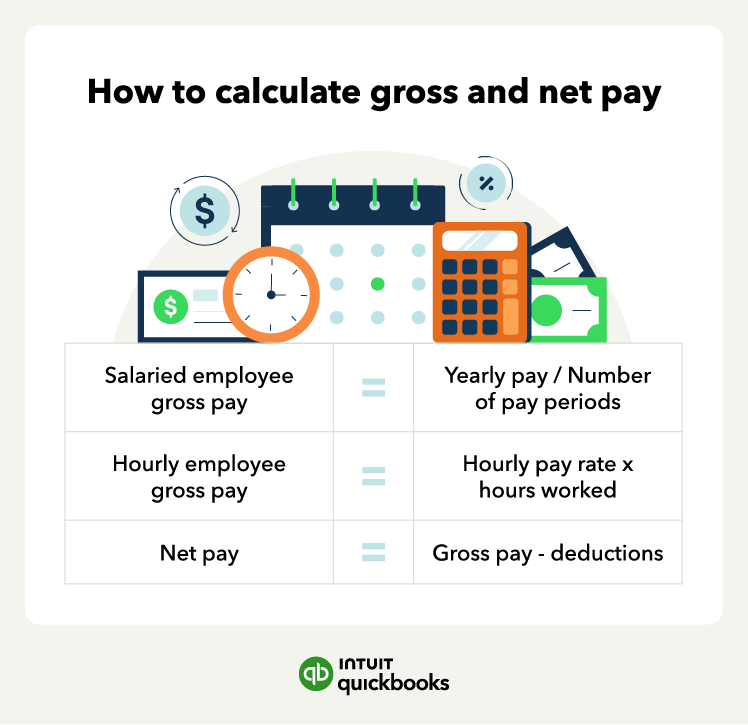

You can calculate gross wages two ways, one for salaried employees and another for hourly employees:

Salaried employee gross pay

To calculate a salaried employee’s gross pay for a single pay period, divide their annual salary by the number of pay periods your company has in the year according to your payroll schedule. Here’s how to calculate the gross pay for employees:

1. Determine the number of pay periods you have in a year. For example, if you pay your employees every week, there are 52 pay periods. Here are the most common pay schedules a company will choose from:

- Weekly = 52 pay periods

- Every two weeks = 26 pay periods

- Semimonthly = 24 pay periods

- Monthly = 12 pay periods

2. Divide your employee’s annual salary by the number of pay periods. If you have a salaried employee making $60,000 per year, here’s how gross pay would look, divided by each type of pay period:

- Weekly: $60,000 / 52 = $1,153.85 per pay period

- Every two weeks: $60,000 / 26 = $2,307.69 per pay period

- Semimonthly: $60,000 / 24 = $2,500 per pay period

- Monthly: $60,000 / 12 = $5,000 per pay period

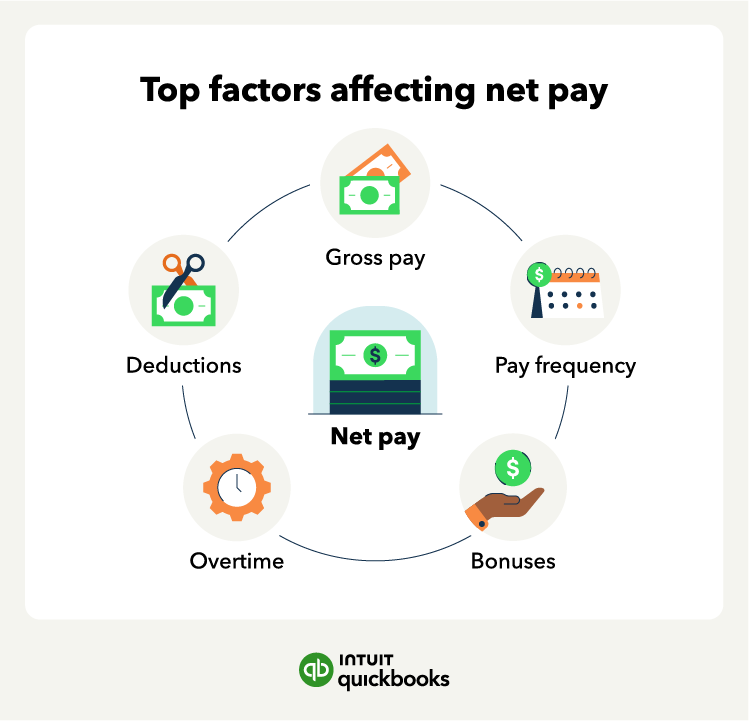

3. Add additional earnings for the pay period, including commissions, bonuses, or overtime pay (if the salaried employee is nonexempt).

For example, say your pay schedule is set to weekly, and your salaried worker from above is set to receive a $100 commission this week. Their gross pay would be the $1,153.85 weekly salary plus the $100 commission for a total of $1,253.85.

Hourly employee gross pay

Now say you have an hourly employee. To calculate an hourly employee’s gross wages for a pay period, multiply their hourly pay rate by the number of hours according to your time tracker. The gross pay formula for hourly employees is:

Hourly employee gross pay = Hourly pay rate x number of hours worked

You’ll then add any additional income they’ve earned during that pay period, including overtime pay, commissions, or bonuses.

Here’s an example of gross pay using a one-week pay period:

1. Multiply the hourly rate by the number of hours worked, up to 40 hours per week. Let’s say you have an hourly employee that makes $15 per hour. If the employee works 40 hours, their gross pay is:

- Gross pay = Hourly rate x hours worked

- $600 = 40 hours x $15 per hour

2. Account for overtime, tips, and commissions. Remember that, typically, overtime is 1.5 times the employee’s hourly rate. Say your hourly employee works two overtime hours and earns a $50 commission. The employee’s overtime pay rate is $22.50, so they make $45 plus their commission. This puts their gross pay at:

- Gross pay = Total hourly pay + overtime + commissions

- $695 = $600 + ($22.50)2 + $50