Companies may include optional holidays, like those with cultural or religious importance. Some companies also offer floating holidays that employees can use at their discretion. Consider your workforce's diversity and background, and accommodate specific holidays relevant to your region.

2. Clearly state who’s eligible

Eligible employees for holiday pay typically include full-time employees who work 40 hours per week. Part-time employees may also be eligible, depending on your specific criteria.

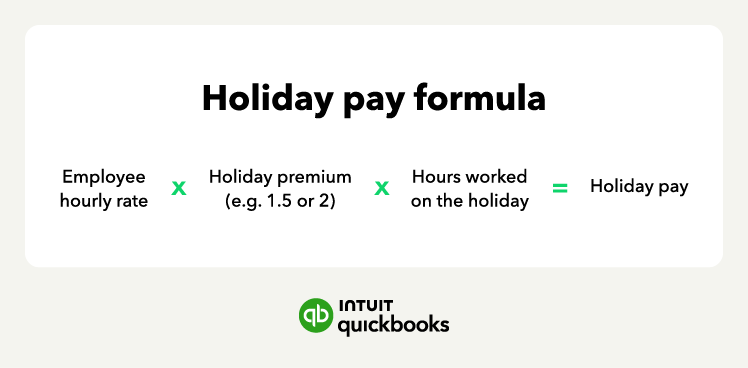

3. Decide how you’ll calculate holiday pay

The most common holiday pay rate formula is 1.5 times or 2.0 times the employee's regular pay rate. For example, if you pay 1.5 times and an employee earns $15 per hour, their holiday pay rate would be $22.50 per hour. Alternatively, if you offer 2.0 times holiday pay, the hourly holiday pay for the employe above would be $30 per hour.

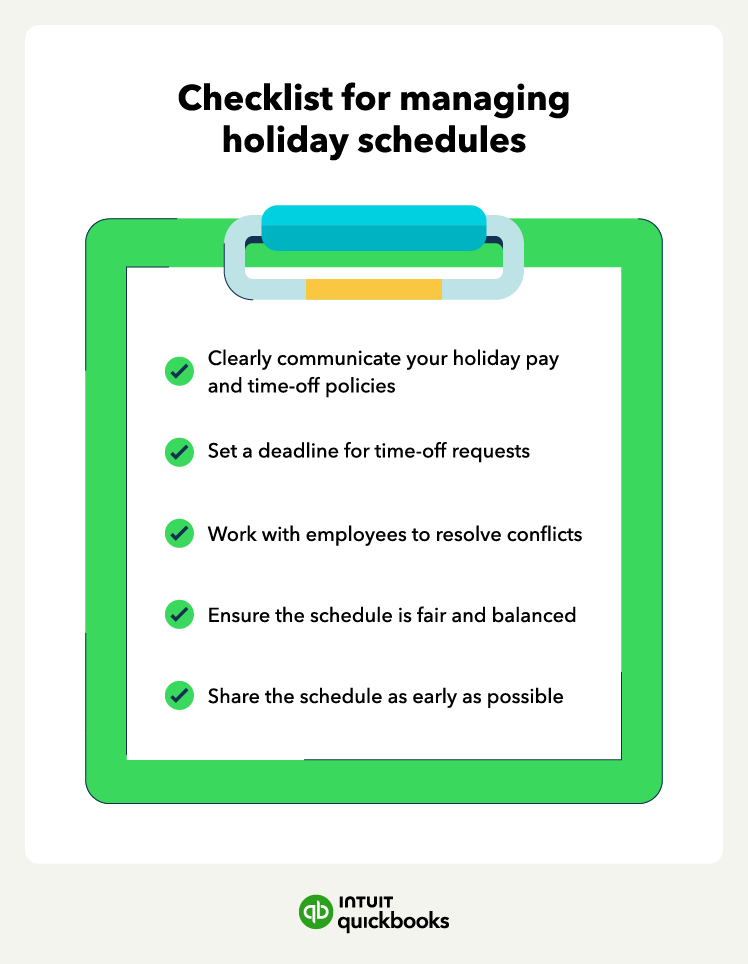

4. Communicate your holiday pay policy

Let employees know about your holiday pay policy, and remind them ahead of the holiday. Clearly outline your policy in employee handbooks and employment contracts.

Businesses, like retailers, that plan extended hours for holiday shopping should also communicate their schedules to employees. Consider hiring seasonal employees if you find yourself in need of additional help.