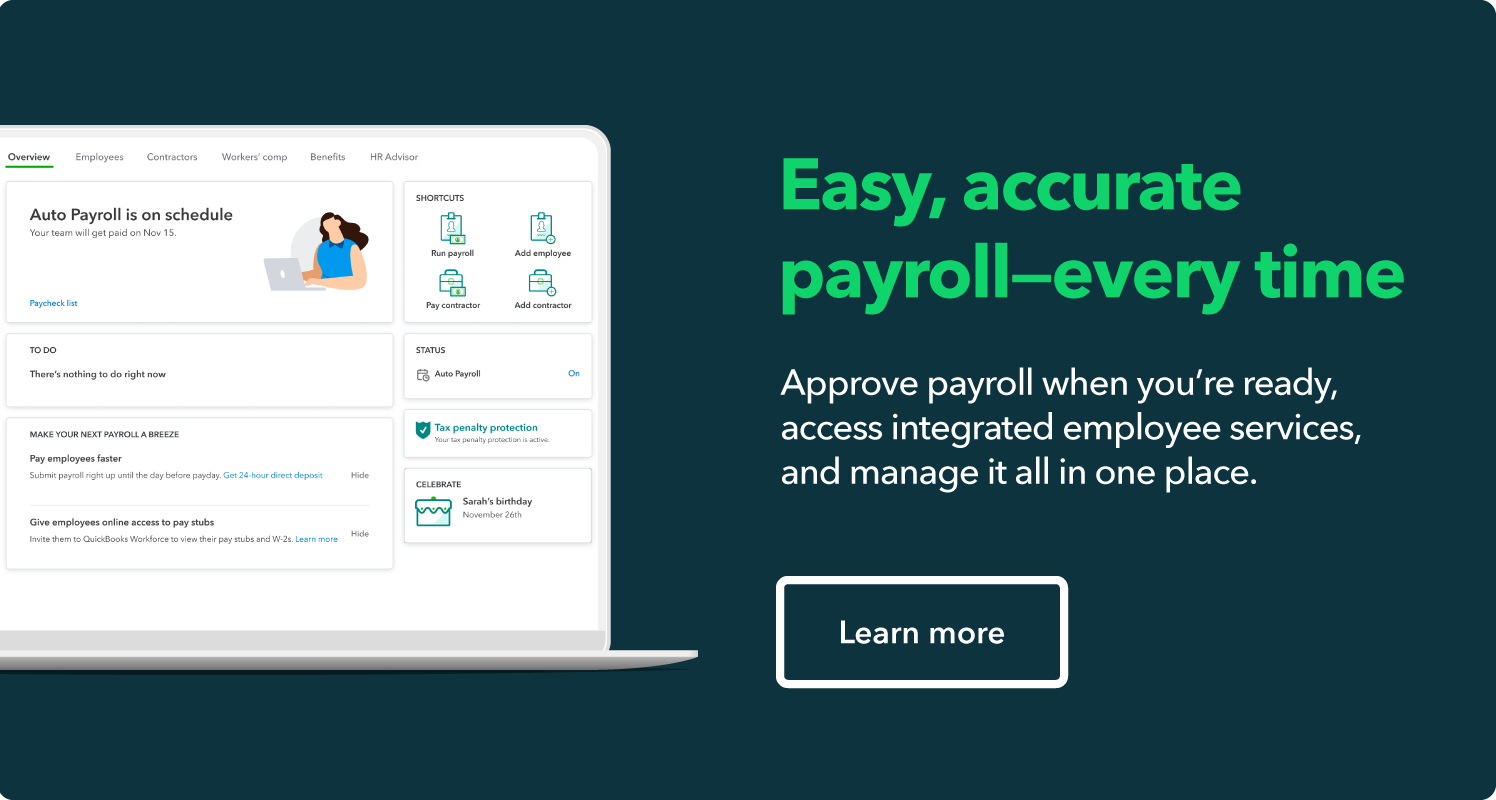

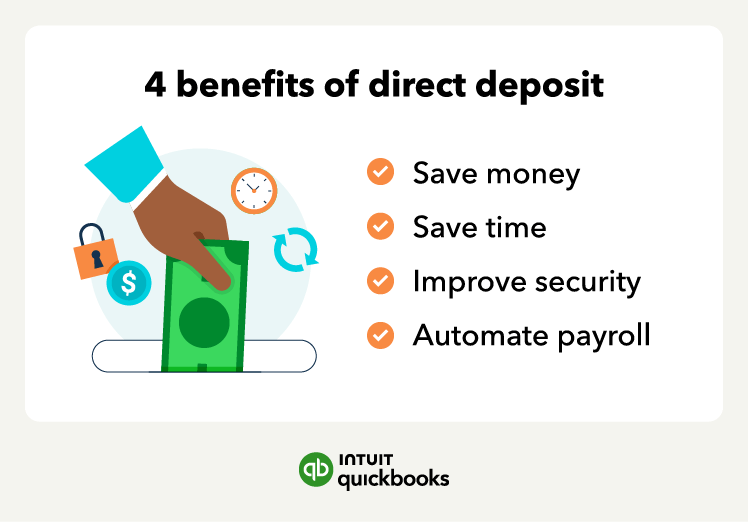

Paying your employees doesn’t have to be a chore. If you use direct deposit, not only will you save money and time, but it can ensure your employees are paid quickly and efficiently. If you’re ready to help your team become part of the 93% of Americans that Payroll.org says receive their pay through direct deposit, keep reading this guide about how to set up direct deposit for your employees.

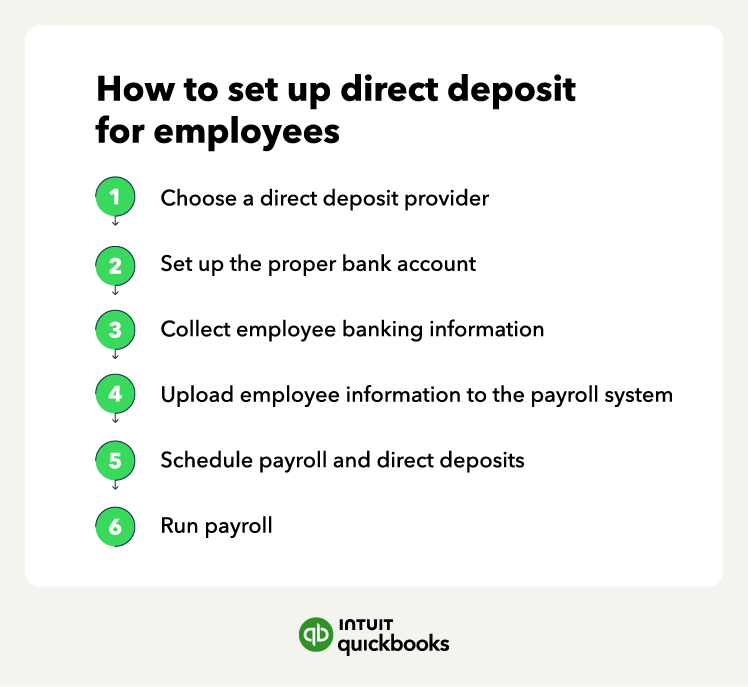

We’ll walk you through everything you need to know about direct deposit, including its benefits and potential drawbacks, and how to set up payroll for direct deposit in 6 simple steps:

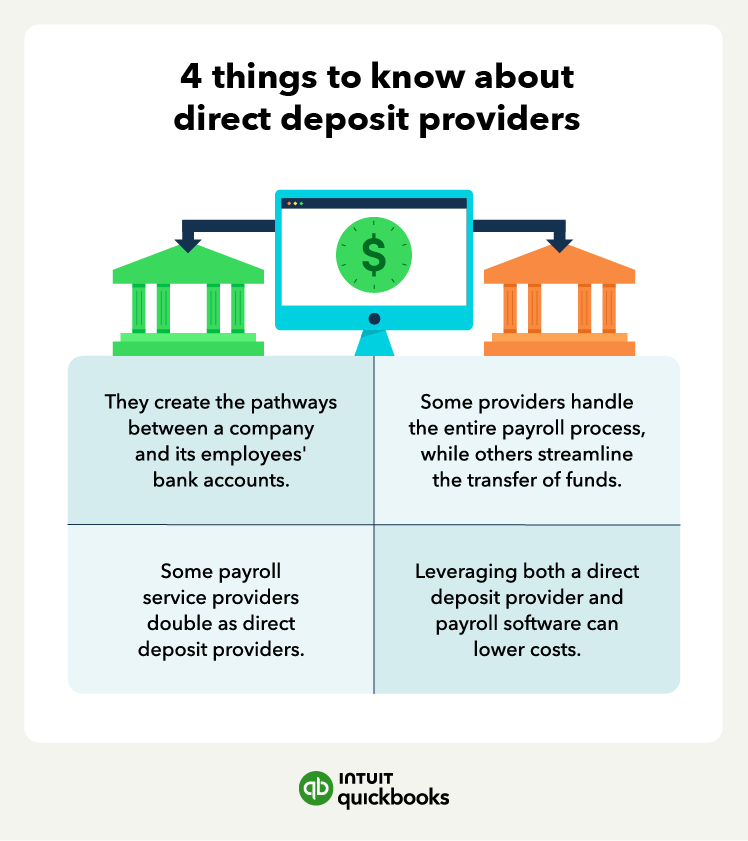

- 1. Pick a direct deposit provider

- 2. Start setting up direct deposits

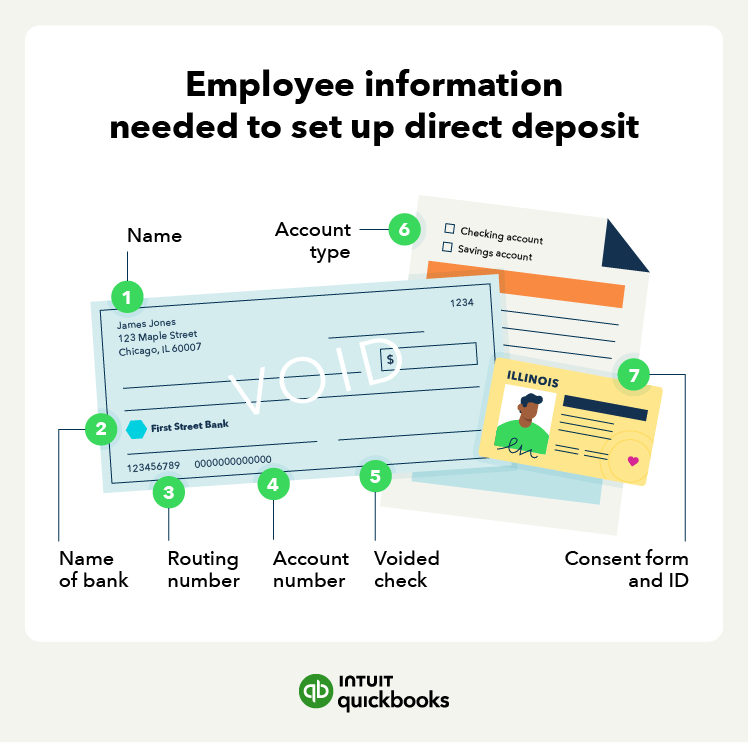

- 3. Collect employee information

- 4. Upload employee information into payroll system

- 5. Schedule payroll and direct deposits

- 6. Run payroll