When you consider starting a business, the payroll process probably isn’t the first thing that comes to mind. Yet, every business needs a payroll process. When you run payroll, you’re ensuring everyone on your team is compensated for the work they’ve done.

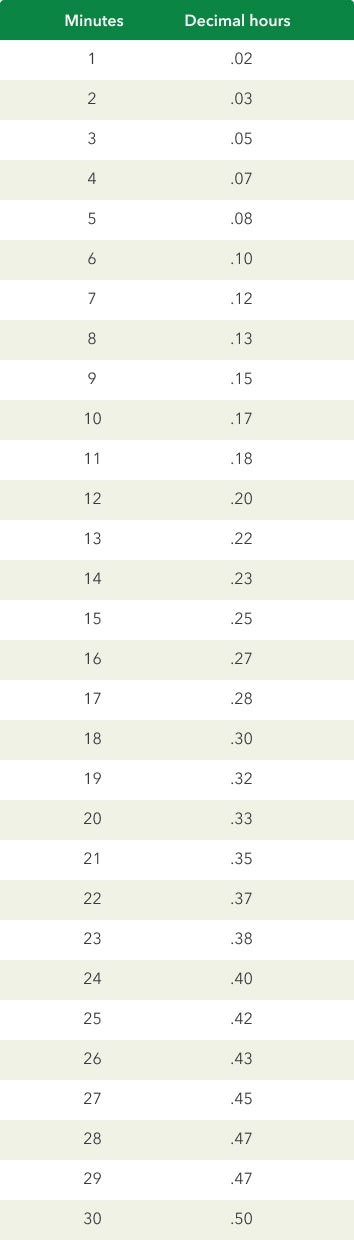

While paying employees sounds simple, the process can get complicated. This is especially true for owners of very small businesses who run payroll manually. When you run payroll by hand, you typically have to convert employee timesheets to decimals to calculate wages. Converting minutes to decimals can be tedious work, which is why we’ve included a payroll conversion chart in this article. With a payroll conversion chart, you can quickly figure out minute to decimal conversions and improve accuracy when you run payroll.

To learn more about the payroll process and view our payroll conversion chart, keep reading. You can also skip right to the payroll time conversion chart or any other section using the links below.