Managing payroll is an important part of running any business and a smart way for solopreneurs and small business owners to stay on top of finances. That’s where a payroll ledger comes in. It’s a simple yet powerful tool that helps you keep track of employee pay.

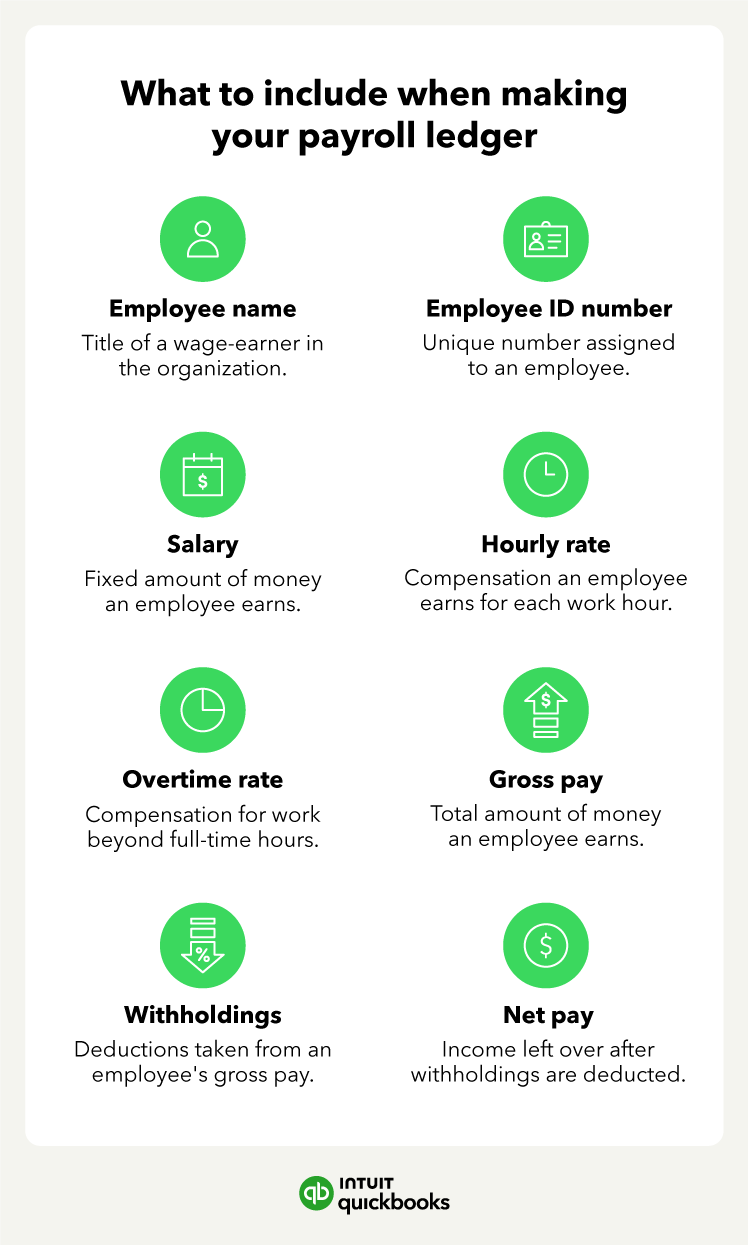

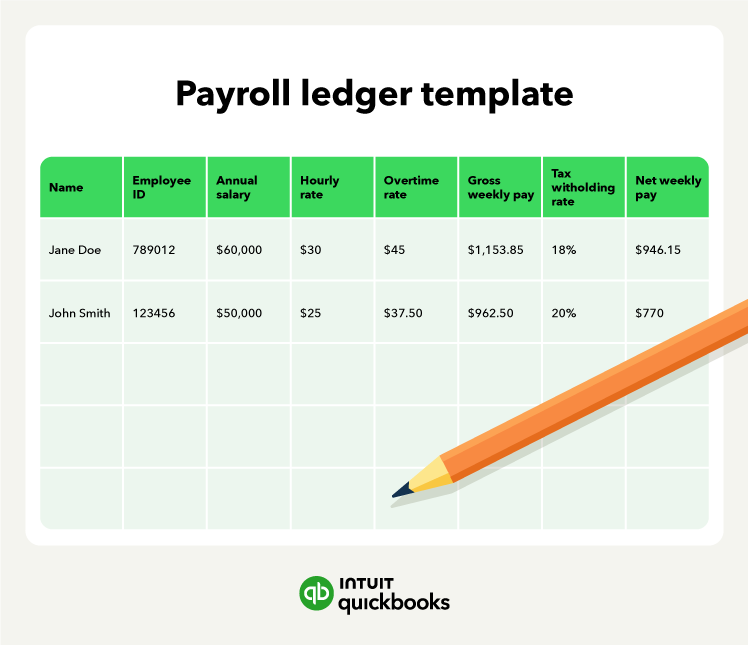

At its core, a payroll ledger is a central record of key details like wages, salaries, overtime, bonuses, deductions, and tax withholdings. Think of it as the backbone of your payroll system, giving you a clear framework to organize and manage all your payroll data.

According to a QuickBooks Small Business Insights survey, only 44% of small business owners planned to give pay raises over the following three months—down from 50% a year earlier, showing how tight margins affect payroll decisions.

In this guide, we’ll show you how to create and use a monthly payroll ledger, explore the benefits, and explain how payroll software like QuickBooks can help you automate the process.

Jump to: