Remote work is more prevalent than ever, with nearly 60% of employees being able to work remotely at least part of the time, according to a recent McKinsey survey. That means small businesses now need to place remote workers from different states (and even different countries) on their payrolls. Use this guide to learn how to set up payroll for your remote workers and manage one of the most tedious functions for payroll departments—taxes.

Payroll for remote employees: A tax guide

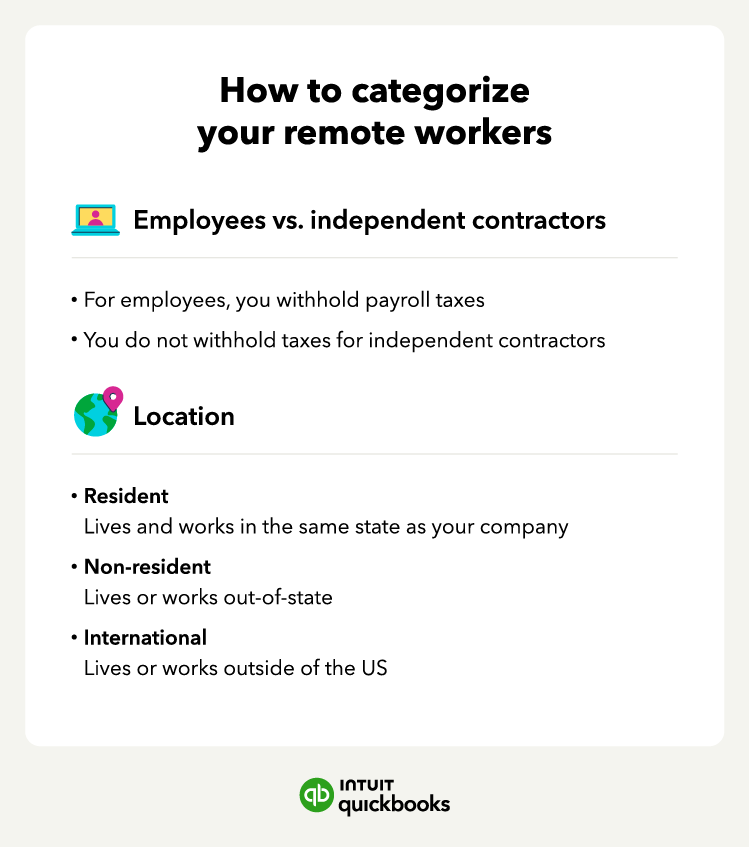

With a global team, you may be wondering how to set up payroll for remote workers in your payroll system, especially when different states and countries have their own laws. The first step is to identify what type of employees you have. You’ll want to classify your remote employees based on their role, as well as where they live.

Employees vs. independent contractors

There are two types of worker classifications that you'll use for your remote workers. You can either hire them as employees or hire them as independent contractors (aka 1099 contractors). Here are the key differences to know:

- Employees: As defined by the IRS, an employee performs a service for an employer who determines what to do and how to do it. There can be full-time employees and part-time employees.

- Independent contractors: An independent contractor, aka a freelancer, is self-employed. Many companies with remote employees prefer hiring independent contractors because they are in charge of their own taxes.

If you have employees, the law requires you to withhold payroll taxes from their paychecks, such as federal and state income taxes and Federal Insurance Contributions Act (FICA) taxes. Depending on the area your remote workers live in, you’ll be responsible for different payroll taxes than the ones you pay for your in-house staff.

When you pay an independent contractor to complete a job or project, you don’t have to withhold payroll taxes from their paycheck. Because independent contractors determine how they work, they have to pay self-employment taxes.

Knowing whether to classify remote workers as employees or contractors is important for determining how to pay them and which payroll tax laws you need to adhere to. If you misclassify an employee, they may face a hefty tax bill.

Location

Now that you have categorized your remote workers as employees vs. independent contractors, you should further classify them using location. Where your employees live also determines how you will set up your payroll accounting.

The benefit of hiring remote workers is that you can access a larger pool of workers worldwide. However, when it comes time to pay taxes, where they live can make things tricky. The two types of locations you’ll have are:

- Resident: If a remote employee resides and works in the same state as their company, employers will pay state and local taxes, state unemployment insurance taxes, and withhold state income taxes. Depending on the city or town, you may also have to withhold local taxes from your employee paychecks.

- Nonresident (out-of-state/international): How employers set up payroll will be different when it comes to out-of-state and international remote workers.

For out-of-state employees, employers will withhold income taxes in the state in which that employee lives and works. However, some states might have reciprocal agreements with neighboring states. This means employees can withhold their income taxes in the state they live in and only have to file one tax return.

International employees can come with their own set of challenges. In some cases, foreign countries might require businesses to open a local branch when hiring international workers and to follow local laws.

Many companies will hire independent contractors to get around this, as they can register as self-employed workers. When paying international remote workers, companies might also face expensive bank fees, transfer fees, and exchange rates when wiring money.

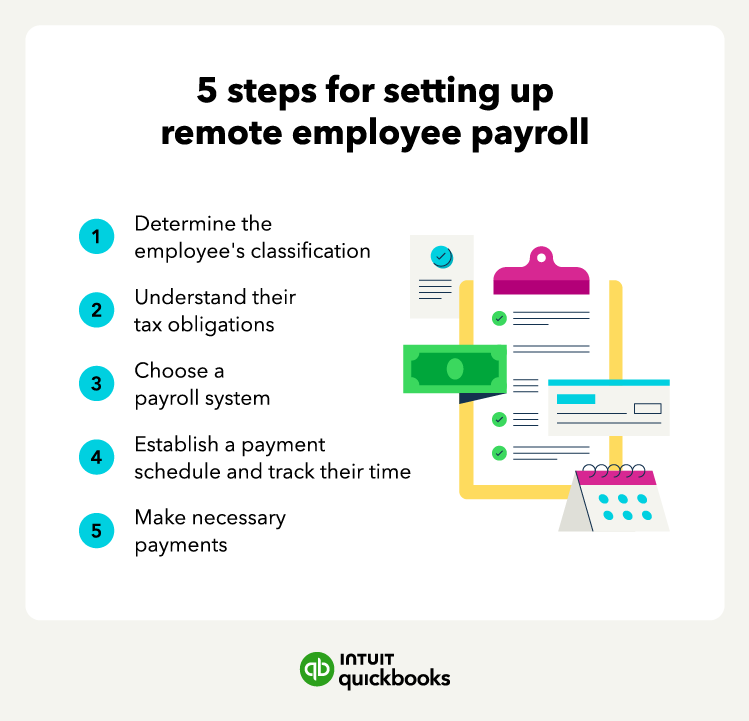

How to set up payroll for remote workers

Once you determine your employee classification, you’re one step closer to setting up payroll. Now it’s time to choose the right payroll method because you want to pay your employees correctly and follow all employment laws.

Pick a payroll method

You can run your payroll through a service provider or do it manually. Here are the key differences:

- Service provider: Many companies with in-house and remote employees often rely on payroll service providers. Payroll service providers, such as QuickBooks, can do the heavy lifting by giving employers tools to handle taxes and payroll at an affordable cost.

- Manual: Businesses that don’t want to outsource their payroll can process it manually. In-house payroll keeps control in a company’s hands and allows them to take full ownership.

In-house payroll will often require more technology and staff, which can increase costs. Meanwhile, cloud-based payroll software can run payroll, along with paying bills, tracking time, and keeping track of inventory.

Choosing the wrong service provider can cause problems, however. A bad payroll service provider can produce errors, be expensive, and leave business owners responsible for the service’s mistakes.

Track employee time

Because remote employees can be anywhere in the world, business owners have less oversight and control.

That’s where the right time-tracking solutions can verify that employees log the appropriate hours for specific projects and jobs and input their time off. Without the right solutions, companies can end up overpaying or underpaying an employee. Here are some to consider:

- Cloud-based time trackers: Online tools that allow you and your employees to track and manage their time and tasks from any device with internet access

- Employee-based trackers: Software for employees to monitor and track activities, productivity, and performance.

- Desktop monitoring trackers: Tools or software programs that enable employers or administrators to monitor and record the computer activities of employees

With the right time-tracking software, a company won’t have to worry about missing hours or timesheet errors.

Pay remote employees

Once you have the time for your remote workers, it’s time to pay them. Employers have multiple options when it comes to paying remote employees. Below are the most common payment methods employers can use:

- Direct deposit: This option is typically the most common payment method for remote employees. Direct deposit is also the most convenient option, as deposits are automatic for an employee’s wages.

- Checks: Physical paychecks were once the most common payment method for employees but are less common thanks to direct deposit.

- Mobile apps: Today, third-party tools are becoming more mainstream. PayPal, Venmo, Apple Pay, and Cash App make it easy for employers to pay employees. However, an employee will need a smartphone or computer and may have to pay fees when withdrawing money from their mobile wallet.

If you go the direct deposit route, you will need an employee’s banking information, such as their routing number and bank name. Employers should be aware of setup fees, monthly fees, and transaction fees.

To pay an employee with a paycheck, an employer doesn’t need an employee’s banking information, and employees don’t need a bank. Through paychecks, employees can go to a check-cashing service and receive their wages for a small fee.

However, writing checks can be time-consuming, especially if you have a large remote workforce. Businesses can print checks to save time, but printers can break and run out of ink.

4 steps to set up payroll taxes for remote employees

Whether you have remote or in-house employees, you must withhold federal, state, and local payroll taxes from every employee's paycheck. Companies will use Forms W-4 and I-9, which cover an employee’s tax withholding allowance and employment eligibility.

If your remote workers are independent contractors, you’ll need Form 1099-MISC and Form W-9. Form 1099-MISC reports miscellaneous income, such as freelance work, for the tax year. The W-9 collects an independent contractor’s information, such as name, tax identification, or Social Security number.

Federal taxes

One of the most significant federal taxes that applies to all remote workers is the Federal Insurance Contributions Act (FICA) tax, and it's composed of two parts:

- Social Security tax is 12.4% of taxable wages, with both the employer and employee responsible for contributing 6.2%.

- Medicare tax, on the other hand, is 2.9% of taxable wages, with both the employer and employee responsible for contributing 1.45%.

Additionally, employers must withhold federal income taxes from employees' paychecks. The amount of federal tax withheld from an employee's paycheck is determined by their tax bracket and the number of withholding allowances claimed on their W-4 form.

Employers must deposit the taxes withheld from employee paychecks, along with the employer's portion of Social Security and Medicare taxes, to the appropriate federal tax agency on a regular schedule.

State taxes

State taxes can vary widely depending on where the employee is located and can impact both the employer and the employee.

As an employer, it's important to determine which states have taxing authority over your remote workers. Most states have specific rules that determine whether certain types of payroll taxes apply to nonresident employees, so it's crucial to be aware of these regulations and to ensure that you're withholding the correct amount of state taxes from your employees' paychecks.

Local taxes

When it comes to payroll for remote employees, it's not just state and federal taxes that employers need to consider. Many local governments also have their own unique tax requirements to take into account.

For example, cities like New York have a local income tax that employers must withhold from employee paychecks. In some cases, local taxes may only apply to residents of that specific city, while in others, they may apply to anyone who works within the city limits.

Tips for setting up remote employee payroll

To ensure your remote team gets paid on time without any issues, consider these best practices for managing payroll for your remote workers.

Integrate payroll into one system

As a business owner, you have a lot on your plate. Rather than having a payroll system separate from the rest of your accounting software, it’s best to integrate them to improve efficiency.

You’ll want to consolidate time tracking, workers’ compensation, and health benefits. In particular, each state may have different workers’ compensation insurance requirements. Integrating workers’ compensation with your payroll will ensure this insurance premium is accounted for should a worker get sick or injured on the job.

Many employers also offer health and disability insurance as an employee perk to retain and attract top talent. Integrating your human resources and payroll services can ensure you’re withdrawing the right amount of deductions each pay period. This way, there will be little room for error or confusion when deducting health insurance from a remote worker’s paycheck.

Automate where you can

Automating your payroll is essential to saving time and increasing efficiency. By streamlining payroll and benefits, you can import time clock data, make correct payment calculations for each remote worker, and process the right deductions.

Direct deposit is a key item to automate, as it allows employers to seamlessly deposit an employee’s wages without having to write checks. Automating payroll makes it easier to keep accurate records and follow any tax and labor laws.

Organize your payroll records

Depending on the size of your remote team, it can be easy to get disorganized. A disorganized payroll can lead to missed or late payments. Keeping your payroll records organized isn’t only important for paying your employees on time and at the right pay rate.

Agencies often require businesses to hold onto payroll information for at least three years. A payroll service can neatly store each employee’s records in its online database.

Stay up to date on payroll laws

The last thing a business wants is to be in the middle of a lawsuit for breaking a payroll law. That said, businesses should have payroll staff or use a professional payroll service that is up to date with payroll laws.

Some common payroll laws focus on minimum wage, paying employees promptly, collecting and filing taxes, and overtime pay. Different states might have their own laws regarding payroll, so check with your local government agency to see what laws you need to follow.

Next steps for streamlining your payroll process

Setting up payroll and tracking time for remote workers can be a challenge, especially if you don’t know a lot about payroll laws and how to pay employees. This guide is a great step in learning how to set up a payroll for remote workers. Now, you might be ready to learn how to automate your payroll process.