The process of wage garnishment looks like this for employers:

1. You receive a garnishment order: Your business gets a court order or notice of wage garnishment from a government agency—usually via mail.

2. Verify the order: Review the order and confirm it with the appropriate agency.

3. Notify the employee of the order: Inform the employee in writing about the wage garnishment and amount.

4. Set up the withholding amount: Enter the withholding amount in your payroll software or contact your payroll provider.

5. Deduct the garnishment from wages: Ensure the garnishment amount is being deducted from their paycheck.

6. Remit payments to the proper authority: The employer sends the withheld amounts to the designated recipient (e.g., creditor, court, or government agency).

7. Terminate the garnishment: The wage garnishment continues until the debt is paid in full, the court order expires, or the employee leaves the company.

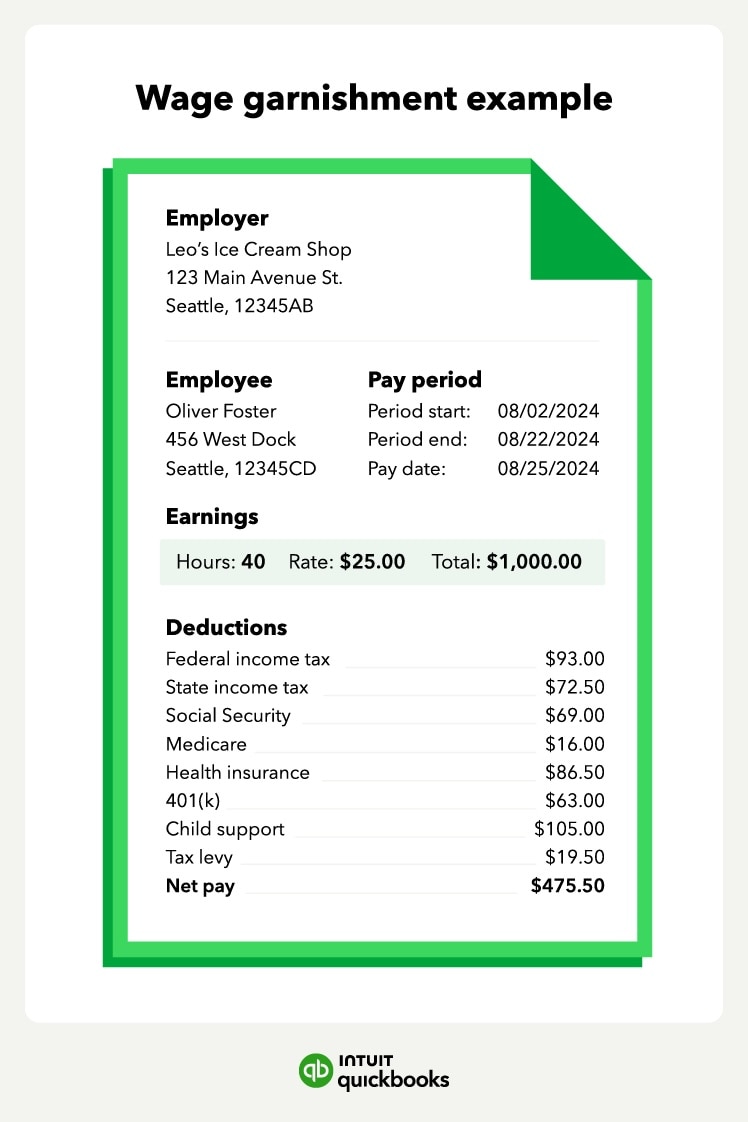

The wage garnishment order details the employee to be garnished, the amount, and where to send the payments. Note that the amount might be a fixed amount or a percentage of the employee's wages, and the period will vary.