With tax day behind you, it’s time to switch gears and focus on boosting your business. We’ve got integrations and features that can help you work smarter while bringing you closer to your business goals.

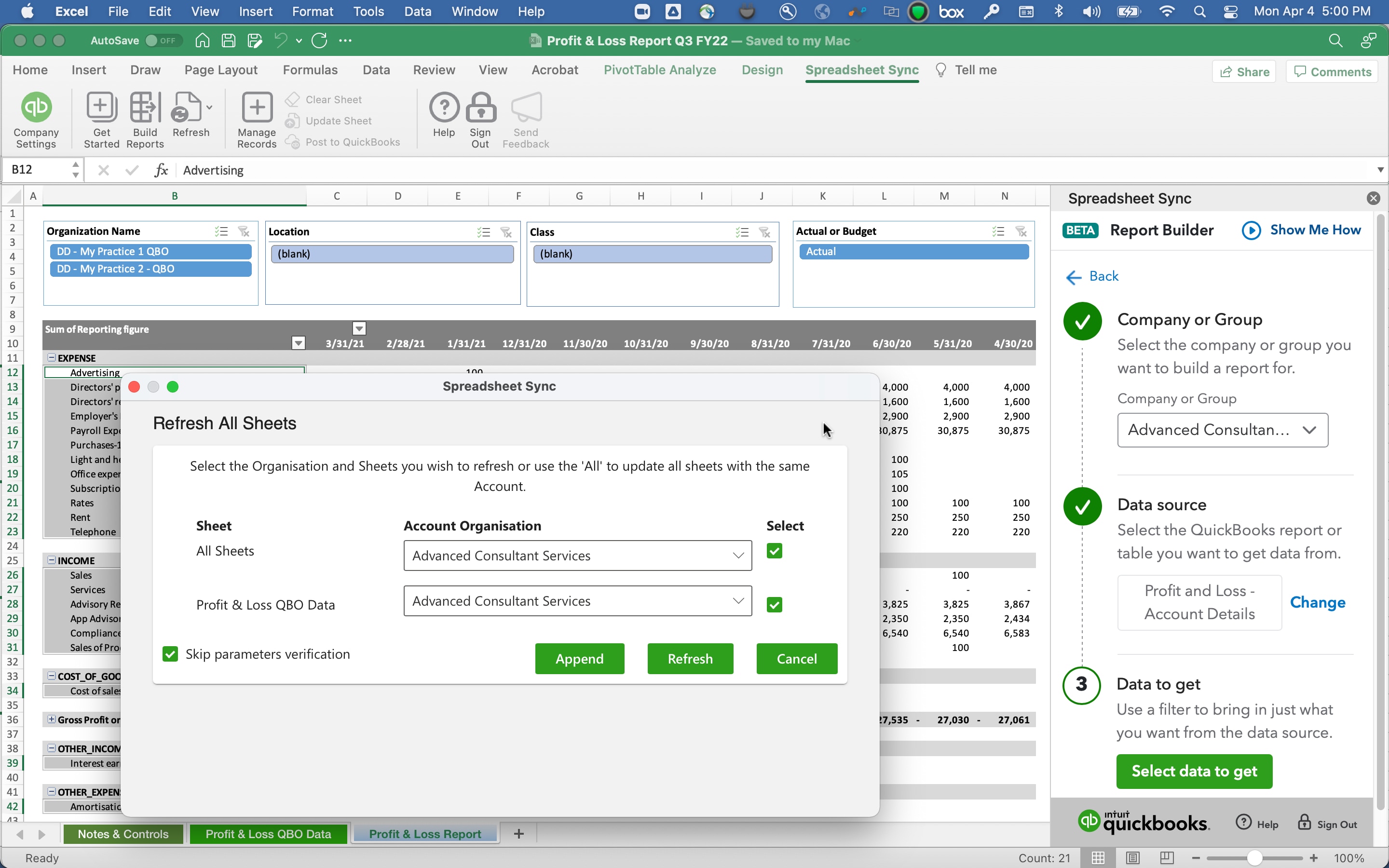

Spreadsheet sync for QuickBooks Online Advanced

In a nutshell: Microsoft Excel now directly connects with QuickBooks® Online Advanced, making data transfer and reporting a lot easier.

Spreadsheet Sync for QuickBooks Online Advanced offers two-way syncing with Excel. This enables you to build customized reports, analyses, budgets, forecasts, and visuals in a tool you probably already use, without compromising on convenience or data accuracy.

Keep your data in sync: Avoid manual errors by seamlessly connecting with Excel. Add and edit data in bulk in your spreadsheet and sync it directly into QuickBooks Online Advanced.

Dig deeper into your finances: Track your business performance by leveraging Excel to customize reports with your QuickBooks Online Advanced data. Use pre-made templates, build consolidated reports for multiple companies, and refresh your data in a single step.

Work with the tools you’re used to: No need to throw out your spreadsheets. Work with your data how you want, and create flexible workflows with familiar tools when you combine the power of Excel and Advanced.