You may have heard the term “ROI” before—and for good reason. Understanding the return on investment (ROI) in your small business can make the difference between failure and success. Let’s explore the concept more in-depth below.

What is ROI? How to calculate ROI for your small business

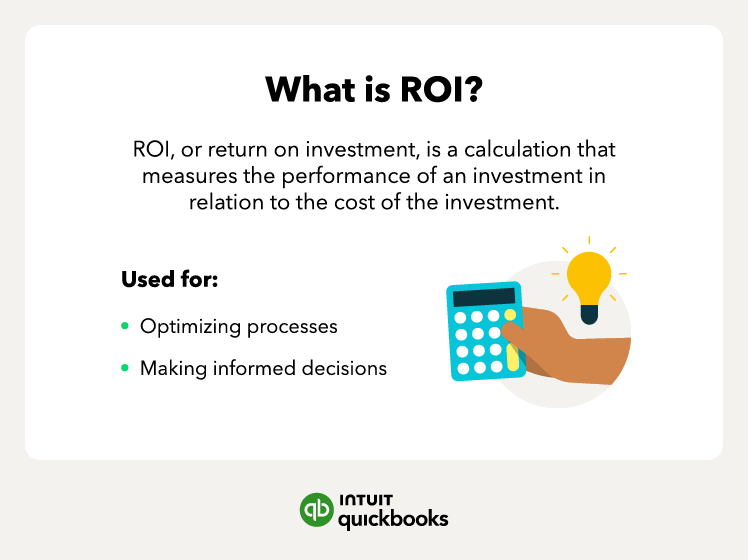

What is ROI?

ROI, or return on investment, is a calculation that measures the performance of an investment in relation to the cost of the investment. As a company, you want the highest ROI possible to receive the maximum benefit from an investment.

ROI matters in a business sense because having the ability to see if an investment will be lucrative or not can influence your decision-making and give you better tools for success.

ROI use cases

ROI is used to make comparisons among different investments to determine which will deliver the best outcome for the organization. It’s important to note that “investments” is a blanket term for both financial and non-financial assets. An investment could be purchasing a piece of property, for example, or could mean spending the time on optimizing a process. Here are some scenarios you may encounter with using ROI in terms of investment:

- A financial asset: Using ROI, you could compare how the cost of purchasing a physical asset will yield a return in the future.

- Optimization: Using ROI, you could determine how much time or labor you could save by optimizing a process.

- Digitization: Using ROI, you could determine if making a digital transformation in a business process would yield high results and ultimately earn the company more revenue or save time.

How to calculate return on investment (ROI)

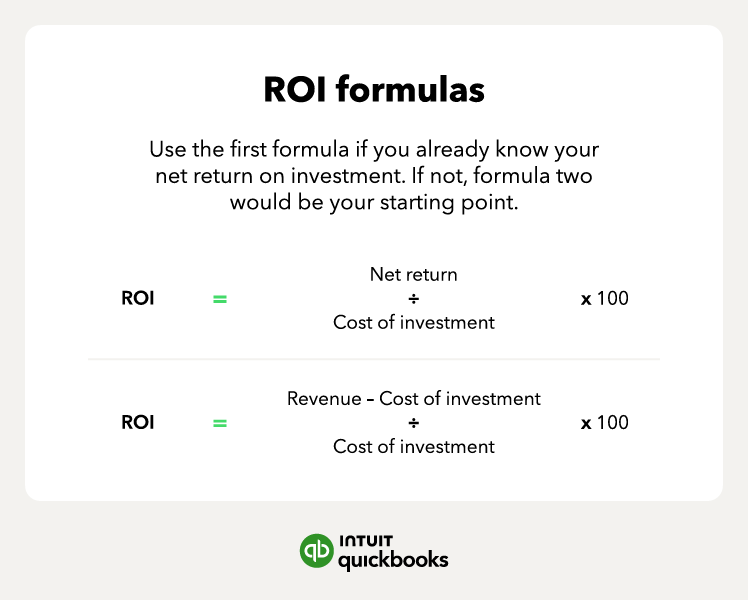

Calculating return on investment can be done using two different methods. One uses the net return on investment while another uses the final and initial value of the investment.

The ROI formula

There are two ways to find ROI. Deciding on which formula you use only depends on the information you have available. For instance, if you already know your net return on investment, then go straight to formula one. If not, formula two would be your starting point.

The first formula is as follows:

- ROI = (net return on investment ÷ cost of investment ) x 100

The second formula is this:

- ROI = [ (final value of investment – initial value of investment) ÷ cost of investment ] x 100

ROI example

Using ROI, you can learn from past purchases to get smarter about future ones. Let’s say that you joined a networking group a year ago that costs $500 in annual dues plus $50 per meeting. You’ve attended eight meetings, taking two hours each, and the hourly rate is $150. All of it together is:

- Annual fee = $500

- 8 meetings x $50 = $400

- Time = 8 meeting x 2 hours x $150 = $2,400

- Total costs = $3,300

Although your time may not be something you normally think about in conjunction with a cash expenditure, it should be included to determine the total business cost of the networking group. If you weren’t using those two hours for networking, you could have been doing another business activity that generated actual revenue.

On the revenue side of this example, let’s say you found three clients from this networking group, and each will bring in $1,000 per year for several years. For example:

- Revenue this year = $3,000

- Revenue minus costs of current year = -$300

- Revenue in second year = $5,000

- Revenue minu costs for second year = $1,700

In the first year, you lose $300 to this marketing source. However, in the second year—assuming you keep the clients you picked up the first year and acquire three more in the second year—you begin to gain from the cumulative effects of the clients you’ve found through the group.

What is a good ROI? Interpreting your results

There is no set number for dictating what is and isn’t a good return on investment. Some studies show that 7% is average while others claim 10% is the threshold to match. As far as interpreting your results, it ultimately depends on your industry, your risk tolerance, and the amount of time it takes to generate a return.

ROI limits and considerations

ROI is a great indicator of which investments show promise vs. those that don’t. However, the ROI metric can’t tell you everything. Here’s what you’re missing by relying solely on ROI:

- Time considerations: ROI disregards the factor of time. For instance, while one investment may show a higher ROI than the other, the other may be completed three years sooner than the first.

- Value of money considerations: ROI treats all money the same, when in fact money today is worth more than money in the future because it can be invested and earn interest.

The only way to even out these limits is to use additional formulas. For example, you can use the rate of return (ROR) to compensate for ROI’s lack of timeline consideration and use net present value (NPV) to compensate for ROI’s lack of value of money consideration.

How to increase your ROI

As a business owner, it’s your responsibility to lead the charge in creating growth opportunities for your company. This includes finding sustainable ways to increase your ROI. There are several ways to do this:

Reduce costs

Reducing costs in your business is one way to eliminate marks against your ROI. Since your return on investment is based on both your prices and your cost to produce, reducing your costs is a natural starting point. Here are some ways to accomplish this:

- Examine overhead costs: These include rent, utilities, and insurance. Look for ways to cut back, like exploring other rental options or comparing prices between insurance providers.

- Examine production costs: These include costs directly connected to creating the product, like equipment and raw materials. Compare suppliers to try to squeeze out a better pricing deal and search for used machinery to avoid markup costs on new machines.

Raise prices

As we mentioned above, the pricing scheme is another part of the ROI puzzle that can be manipulated to your advantage. If your business objectives have ROI quarter over quarter, your prices may be to blame. Here’s how to adjust them:

- Look at the competition: If your industry and your competitors are making price hikes to accommodate for some inconsistent ROI, it would be smart to consider it for yourself.

- Look at inflation: Have your raw materials or other production costs gone up? It’s likely due to inflation and you need to adjust your prices accordingly.

Reassess your ROI

Your ROI isn’t a “set it and forget it” type of metric—it has to be watched closely each month. Track your ROI for each sale, promotion, and marketing campaign to see where you are earning and losing the most sales.

The problem may not be with your prices or your production costs but may lie at the end of the cycle when the sale is made. For example, your sales pitch can be on point but if your checkout process is difficult, then you could be losing customers.

ROI alternatives

There are alternative formulas to ROI that are favored by some industries since ROI is limited in some capacity, as we mentioned earlier. Alternatives to ROI include

- Internal rate of return: The lifetime return of an investment, shown as a percentage, which also takes into account the timing of cash flows

- Return on equity: The annual return of a company divided by its shareholders’ equity

- Return on assets: The annual return of a company divided by the company assets

- Rate of return: The expected annual growth rate for an investment

- Net present value: The value of cash now versus the value in the future

Getting your money’s worth

Think of ROI as a fancy way of asking whether or not you are getting your money’s worth when you make a business purchase or spend. With accounting software and integrations, you can easily track the costs of your investments and the time it takes to recoup those costs.

Using ROI can help you make your business more profitable in a shorter amount of time. Try adding ROI to your business toolbox and watch your company grow.