Is your business in good standing with your state? It needs to be for things like opening a small business bank account. It’s an official document, usually issued by the secretary of state, showing your business is authorized to do business in the state.

While not always required, a certificate of good standing is often needed for specific scenarios. Think of it as a seal of approval for your business. Let’s look at what a certificate of good standing is, why you need one, and how to get one in your state.

Jump to:

- When do you need a certificate of good standing?

- Who is eligible for a letter of good standing?

- How to get a certificate of good standing

- Fees by state for a certificate of good standing

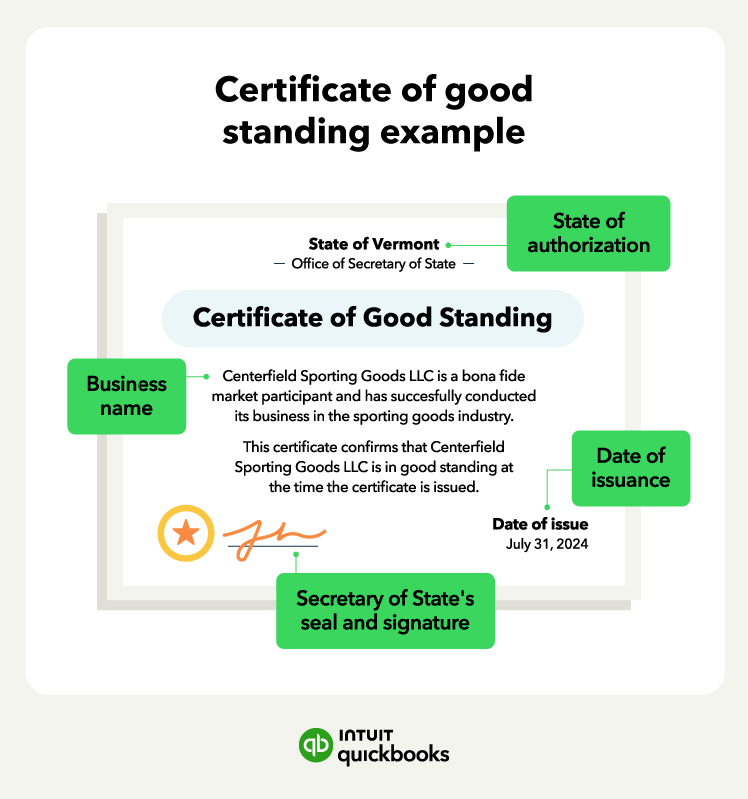

- What does a certificate of good standing include?

- Why you need to keep your business in good standing

- Run your business with confidence

- Certificate of good standing FAQ

Certificates of good standing may have expiration dates that vary by state and purpose—certificates are usually valid for up to 90 days.

Certificates of good standing may have expiration dates that vary by state and purpose—certificates are usually valid for up to 90 days.

Lenders or creditors may have specific requirements regarding your certificate's validity, such as requiring it to be no older than 60 or 90 days.

Lenders or creditors may have specific requirements regarding your certificate's validity, such as requiring it to be no older than 60 or 90 days.