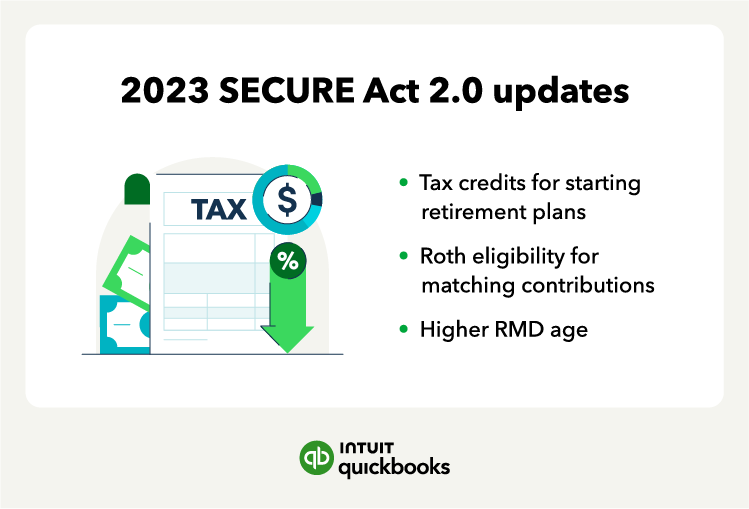

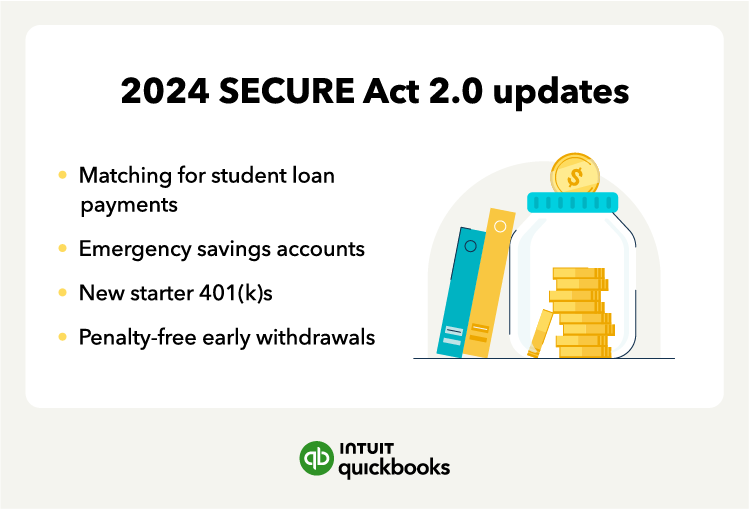

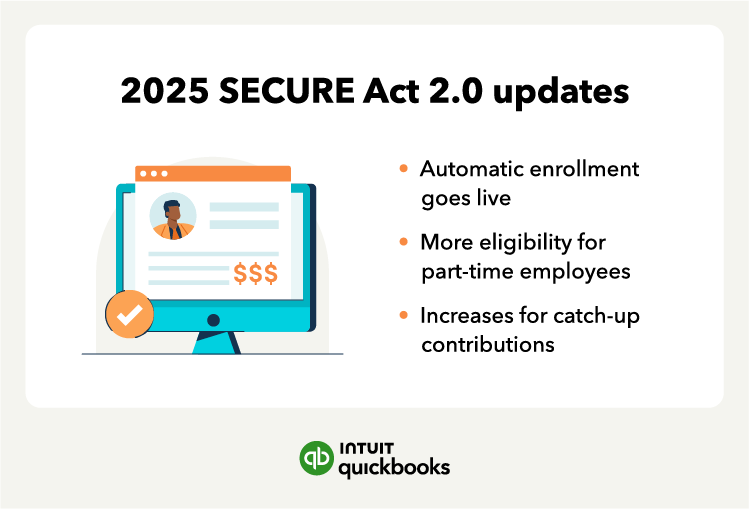

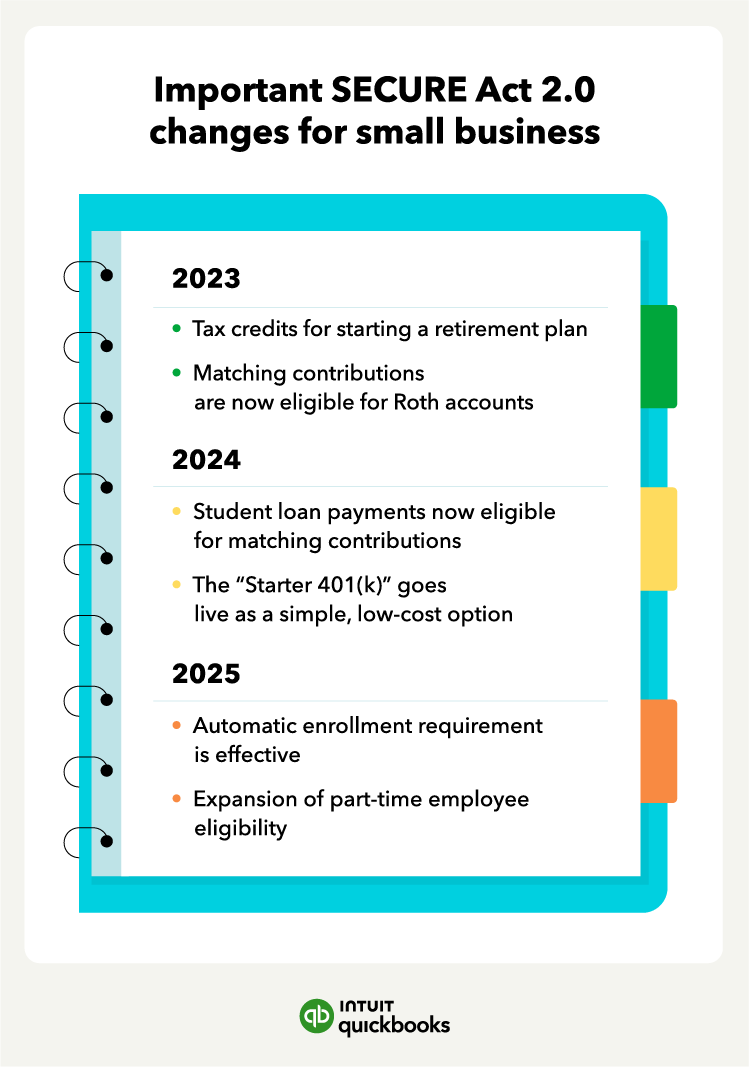

SECURE Act 2.0 became law in 2022, and will affect small business owners and their 401(k)s and other retirement plans for the next several years. In particular, the legislation includes many provisions that will help small businesses and their employees save for retirement.

The act aims to go a long way in boosting employee satisfaction. Let’s explore the key changes you can expect to navigate—as well as new offerings you’ll be able to put in place in the coming years—but first, what is SECURE Act 2.0?

What is SECURE Act 2.0? What was SECURE Act 1.0?

SECURE Act 2.0 builds on the the Setting Every Community Up for Retirement Enhancement Act of 2019 (aka SECURE Act 1.0). SECURE Act 1.0 made a number of key changes to retirement savings, including providing a tax credit to small businesses that offer automatic enrollment in retirement plans and allowing long-term part-time employees to participate in retirement plans

SECURE Act 1.0 was a significant step forward in improving retirement security for Americans. However, there were still a number of challenges, such as the low participation rates in retirement plans among small businesses and low-income workers.

SECURE Act 2.0 makes a number of additional changes to the retirement savings landscape to make it easier for small businesses to offer retirement plans to their employees. This is important because retirement savings can help employees save for their future, but it can also help attract and retain top talent.