Collecting and paying taxes aren’t a favorite topic among businesses. State sales tax can mean extra time and work for business owners.

If you operate in a state that requires sales tax, you need to get a sales tax license and stay current on the sales tax rate for your state. Otherwise, you risk hefty fines.

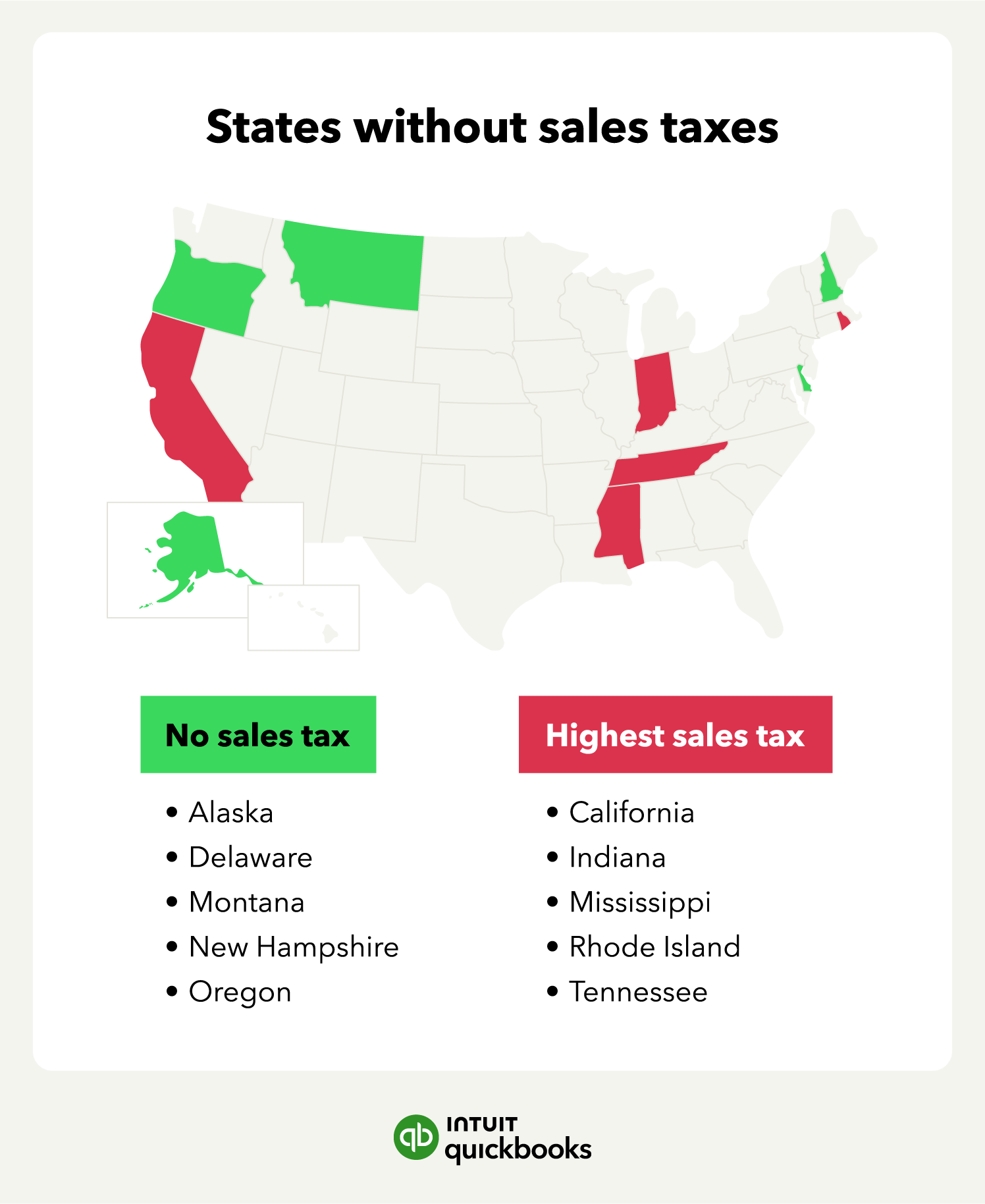

However, some states don’t collect sales tax. Currently, five states do not have state sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon.

But that doesn’t make them entirely tax-free. We’ll look at the five states that don’t have a sales tax rate but highlight other tax rates you need to know: