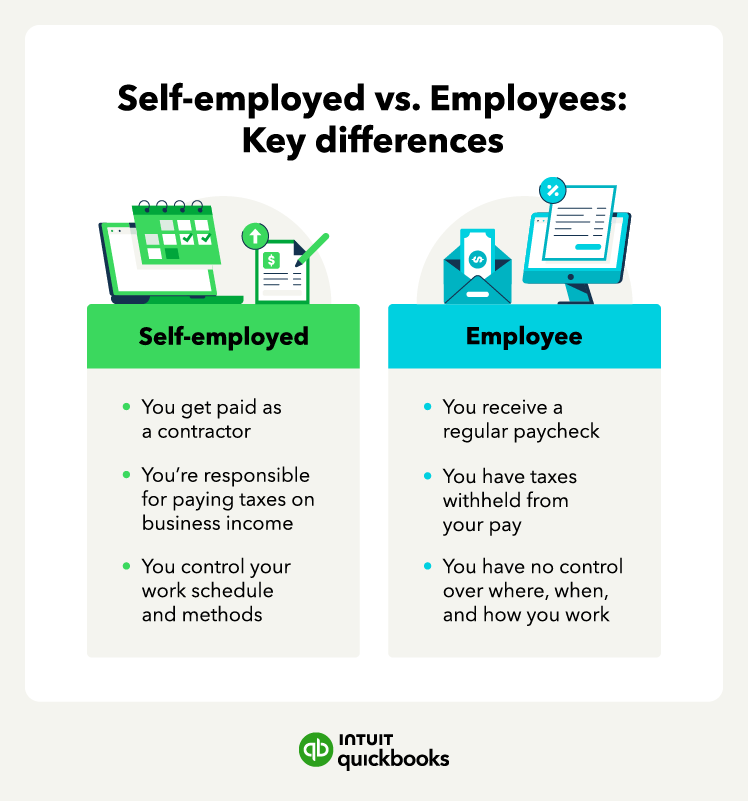

Self-employed individuals typically tailor their skills and services to meet the demands of a client or customer, while business owners will have a more established and structured offering.

The easiest way to think of a business owner is someone who has products or services to sell. They may even have a brick-and-mortar business, a storefront, or employees. Note that you can be a sole proprietor and consider yourself a business owner, where you can register as a self-employed business owner.

Unlike self-employment, being a business owner often involves managing a team and dealing with more complex administrative tasks.

Types of self-employment

Although many people use the term "self-employed" interchangeably with terms like "freelancer,” “independent contractor,” and “sole proprietor,” there are subtle differences. Here are the key synonyms for self-employed individuals:

Freelancers

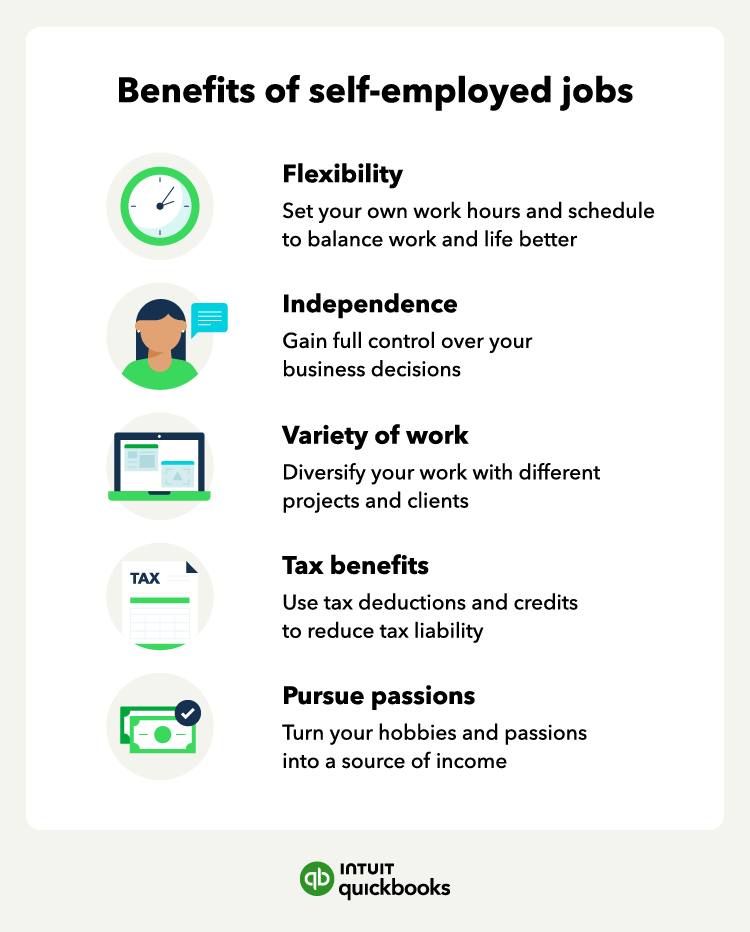

Freelancers are self-employed individuals who work on a project-by-project basis for multiple clients, offering their skills and services.

Freelancing is typical for industries like:

- Writing

- Design

- Programming

- Marketing

- Consulting

Freelancers typically work independently and can choose which projects they take on. They also set their own rates, determine their project timelines, and work from any location.

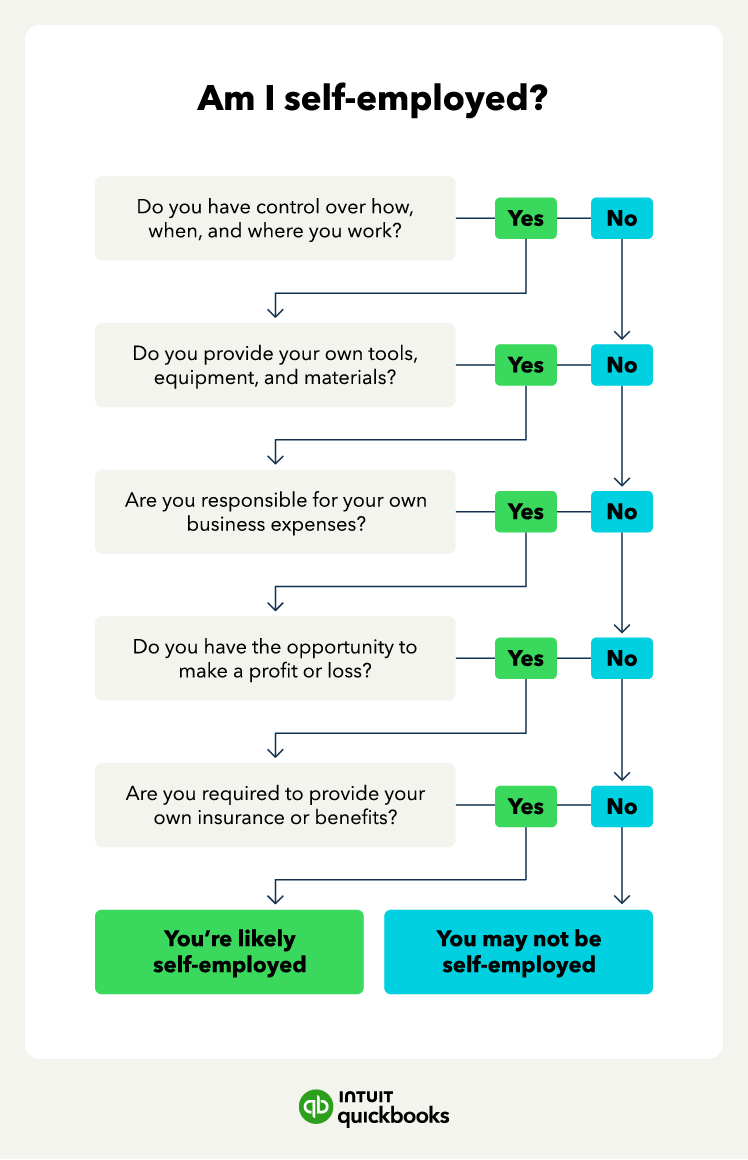

Independent contractor

An independent contractor is similar to a freelancer, typically specializing in a particular field and offering their services to multiple clients. The term independent contractor comes from the idea that the individual provides services on a contract basis.

Like a freelancer, the role of an independent contractor includes executing tasks or projects for a client or organization, using their expertise and skills in exchange for a fee. They have control over their work and handle billing and invoicing clients themselves.

Sole proprietor

A sole proprietor is an individual who solely owns and operates a business. Unlike freelancers and independent contractors, sole proprietors may offer a range of products or services. For example, they can operate retail stores, online stores, or other types of businesses that sell products.

Another distinction is the level of legal liability. With a sole proprietorship, the owner assumes full liability for any legal issues or business debts. This means that the owner's assets are at risk if the business faces any legal actions or financial troubles.